As a seasoned financial analyst with over two decades of experience, I find Nate Geraci’s prediction intriguing and plausible. While the Gold ETF market has been a staple for centuries, it’s fascinating to see how quickly Bitcoin ETFs are gaining momentum. In my career, I’ve seen bull markets come and go, but the exponential growth of these Bitcoin ETFs is like nothing I’ve ever witnessed before.

Nate Geraci, who serves as both a market analyst and the president of the ETF Store, predicts that U.S.-based Bitcoin ETFs will surpass Gold ETFs in terms of total inflows (cumulative net flows). This projection is based on the remarkable performance of these Bitcoin ETFs recently, which have amassed more than $2 billion in weekly inflows over the past few days.

Spot Bitcoin ETFs To Surpass Gold ETF In 2 Years, Analyst Says

This past week, Bitcoin ETFs caused quite a stir in global financial markets, attracting a substantial investment inflow of approximately $2.13 billion, as reported by SoSoValue. This significant surge happened as Bitcoin experienced an increase of 9.23%, nearing a crucial resistance level at around $70,000.

In the midst of the current market excitement, I find myself aligned with Nate Geraci’s prediction that spot Bitcoin ETFs will accumulate more total net inflows than Gold ETFs in the upcoming two years. This forecast seems quite plausible given the extraordinary growth trajectory these Bitcoin ETFs have demonstrated since their debut on January 11, showing an exponential rise.

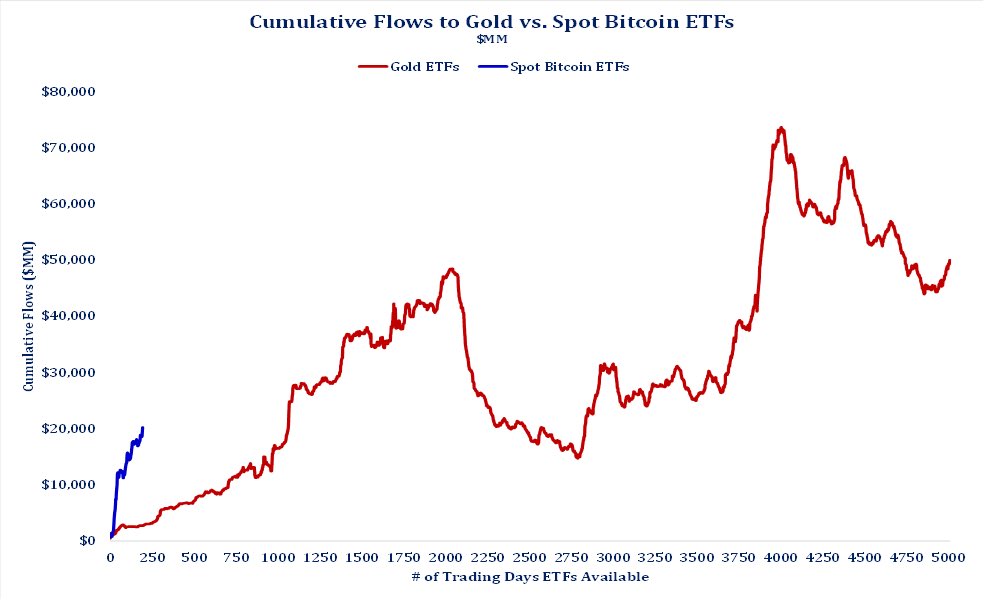

For context, the Gold ETFs currently boast of combined net inflows of around $55 billion in comparison to $20.66 billion aggregate net inflows in the spot Bitcoin ETFs market. However, the Bitcoin ETFs have been trading for barely a year compared to the Gold ETFs which have been around for over 20 years.

Additionally, Eric Balchunas from Bloomberg has pointed out that Bitcoin Spot ETFs have accumulated more than $65 billion in combined net assets, a feat that took the Gold ETF market around five years to reach. This figure accounts for over 25% of the total assets managed by all Gold ETFs globally.

Moreover, Geraci’s theory gains more credibility due to the limited number of 11 Bitcoin ETFs in circulation compared to nearly 5000 Gold ETFs on a global scale. This could potentially mean that these Bitcoin ETFs are well-positioned to surpass their Gold counterparts, given the anticipated crypto market surge and the current high adoption rate of digital assets.

Bitcoin Set For Price Recorrection Amidst Market Surge

Meanwhile, in the latest update, cryptocurrency expert Ali Martinez predicts a potential “temporary drop” for Bitcoin due to its recent surge in value. Previously, Bitcoin saw an increase of more than 8%, rising from approximately $63,000 to just shy of $69,000.

Right now, the Bitcoin market is experiencing an uptrend, but analyst Martinez points out that the TD sequential shows a sell signal on the 4-hour chart, and this is further supported by a bearish divergence on the Relative Strength Index (RSI). If Bitcoin’s price were to drop, it would likely catch investors’ attention at the $60,000 level, which serves as its next potential support zone. However, if selling pressure intensifies, Bitcoin could potentially fall even lower to around $55,000.

At the time of writing, Bitcoin continues to trade at $68,428 with a 0.98% gain in the last day.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-19 14:10