As a seasoned crypto investor with a keen eye for DeFi projects, I must admit that Aave’s performance has been nothing short of impressive. Over the years, I’ve seen my fair share of DeFi protocols rise and fall, but Aave has consistently stood tall amidst the turbulent crypto market cycles.

In simpler terms, Aave, a popular decentralized loan service, consistently ranks as one of the biggest players in the field known as DeFi (Decentralized Finance), measured by the amount of money locked within it. Remarkably, even through the ups and downs of the cryptocurrency market’s price fluctuations, Aave has functioned smoothly without any technical issues.

Aave User Address Grew By 675% In One Week

From the start of the year, Aave has been a recurring topic in news articles, primarily focusing on its price trends and increasing Total Value Locked (TVL). Yet, when considering other key performance indicators, it’s clear that the lending platform is operating robustly.

As reported by Santiment, Aave on the Optimism platform is rapidly expanding as the fastest-growing protocol they’re tracking, with a minimum TVL (Total Value Locked) of $500 million. Furthermore, the number of Aave wallets on Optimism increased by an impressive 675%, which is nearly double the growth rate of KuCoin tokens (KCS).

Currently, Aave is surpassing Maker, Chainlink on Optimism, and Raydium in terms of performance within their respective domains: lending/borrowing, oracle solutions, and decentralized exchanges. Interestingly, both Chainlink on Optimism and Raydium have experienced a significant increase of approximately 100% over the past week.

It’s significant that Aave on Optimism has grown more rapidly than Raydium, the leading DEX (Decentralized Exchange) on Solana. Normally, any meme coin launched on Pumpfun that accumulates at least 69 SOL will automatically be listed on Raydium. This indicates a notable achievement for Aave on Optimism.

Although only a small percentage graduate and are listed on Raydium, tens of thousands of meme coins launch on the meme coin launchpad on Solana.

According to Santiment’s current assessment, it appears that the price of AAVE could potentially profit from its ongoing growth. They noted that in the past, an increase in utility has often shown a robust relationship with sustained growth, leading to significant long-term returns.

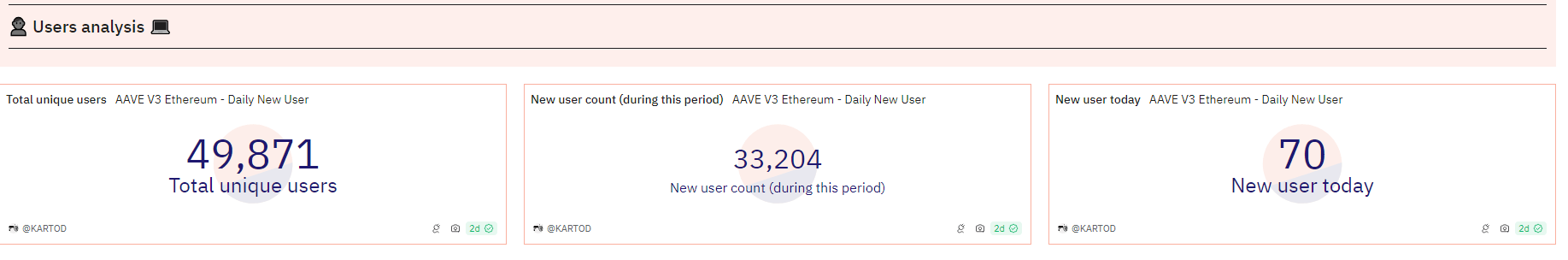

As reported by Dune, approximately 49,800 distinct individuals utilize Aave v3 on Ethereum every day. In the past two days, an additional 70 users have joined the platform. Despite a predicted growth in overall user numbers, the number of newly registered users has remained consistent.

Will Prices Rise To Fresh 2024 Highs?

AAVE is trading above $150, trending at around 2024 highs. Although the token is in an uptrend, prices have moved sideways over the past four weeks. Technically, a close above $180 could drive demand, lifting prices to new 2024 highs in the coming days.

As a researcher, I’ve been examining potential contributing factors, and one interesting finding is the resurgence of DeFi and project-specific elements. For instance, as of October 17th, approximately 56% of the total supply of cbBTC – Coinbase’s Bitcoin stablecoin – has been locked within Aave. This indicates a significant engagement with these decentralized finance platforms and projects.

The protocol is considering introducing a new Rewards Program for cbBTC. Borrowers who pledge cbBTC as collateral for USDC loans can expect increased incentives if they transfer their debt from USDT to USDC. Furthermore, users switching from wBTC to cbBTC as collateral will receive extra collateral benefits.

Read More

2024-10-19 01:16