As a seasoned researcher with over a decade of experience in financial markets, I’ve witnessed my fair share of market euphoria and subsequent corrections. The current Bitcoin rally is undeniably captivating, yet I remain cautiously optimistic.

As a crypto investor, I’m thrilled to find myself in a position where Bitcoin is holding robustly above the $67,000 mark, having recently touched a local peak of approximately $68,300. This surge in price has ignited a wave of enthusiasm among us investors. The bullish momentum seems to be gaining traction, propelled by market movements and bolstered by crucial data indicators that suggest a possible prolongation of the upward trend.

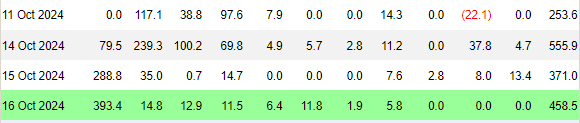

Dan, a leading expert on cryptocurrencies, recently disclosed significant findings indicating that Bitcoin ETFs have consistently increased their holdings over the past four consecutive days. This increase in institutional investment is a promising indicator for the market, as it may potentially drive Bitcoin closer to unprecedented record highs.

Over the coming days, Bitcoin’s future course could be decisively influenced. Many speculators and shareholders are watching closely for a possible breakthrough to unprecedented heights. As Bitcoin approaches these historic peaks, every subsequent price fluctuation becomes increasingly significant, as they may significantly impact the market trend.

Bitcoin Demand Rising

The entire market is abuzz with anticipation and instability, with Bitcoin taking the front seat by setting a consistent upward trajectory since early September.

Experts and financial backers believe some of this rise is due to the Federal Reserve’s recent reductions in interest rates, yet it’s important to note that there are other substantial elements impacting Bitcoin’s price fluctuations as well.

According to renowned cryptocurrency expert Daan’s latest findings, there has been a significant increase in investments into Bitcoin Exchange-Traded Funds (ETFs) during the last seven days.

Over the past four trading days, a staggering $1.639 billion has flowed into Bitcoin ETFs, making this week one of our most fruitful since these funds were first introduced. This influx of institutional investment suggests that traditional financiers are growing increasingly optimistic about Bitcoin’s future prospects, thereby fueling demand and propelling prices higher.

Although there’s a lot of positive sentiment nowadays, market analysts are still exercising caution. In the past, times marked by excessive enthusiasm and market exuberance have frequently led to price corrections or periods of stability.

Bitcoin often signals a pause in its upward trajectory when public enthusiasm reaches a peak, potentially indicating a temporary lull before the next significant price surge. Traders are keenly observing for hints of a possible decline or if Bitcoin will persist in its ascent towards unprecedented record highs over the coming weeks.

Key Levels To Watch

The current Bitcoin value stands at approximately $67,000 following a minor dip of 2% from its latest peak of $68,388. Despite this temporary decline, the price remains robust above its previous record high of $66,500, indicating a robust consolidation phase that might pave the way for another potential increase.

To keep the positive trend going, Bitcoin needs to stay above $66,500. Should this hold true, we might see the price heading towards fresh record-breaking levels in the near future.

If Bitcoin can’t maintain its position above this significant point, it might instead experience a strong pullback to its daily 200-day moving average (MA). Notably, the 200-day MA has often proven to be a robust support during bullish periods, serving as a base for additional growth.

If the cost dips beneath the 200-day Moving Average, it might lead to a more substantial decline toward $60,000. At this point, strong demand is expected, which could present another chance to purchase before the market rises again.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-18 01:16