As a seasoned crypto investor with a decade of experience under my belt, I can’t help but find myself intrigued by the recent developments surrounding Ethereum. The quiet accumulation of ETH by whales is indeed a positive sign, suggesting confidence in the asset’s long-term potential. However, it’s important to remember that the crypto market is as unpredictable as a rollercoaster ride at an amusement park – you never know when it might take a sudden dip!

It appears that while Bitcoin‘s price rebound is stealing the spotlight, Ethereum – the crypto I’m invested in as the second-largest by market cap – has been quietly making strides under the radar.

As reported by IntoTheBlock’s latest findings, significant Ethereum investors, commonly referred to as ‘whales’, have shown increased activity in buying Ethereum during the last month.

The Quiet Accumulation Of ETH From Whales

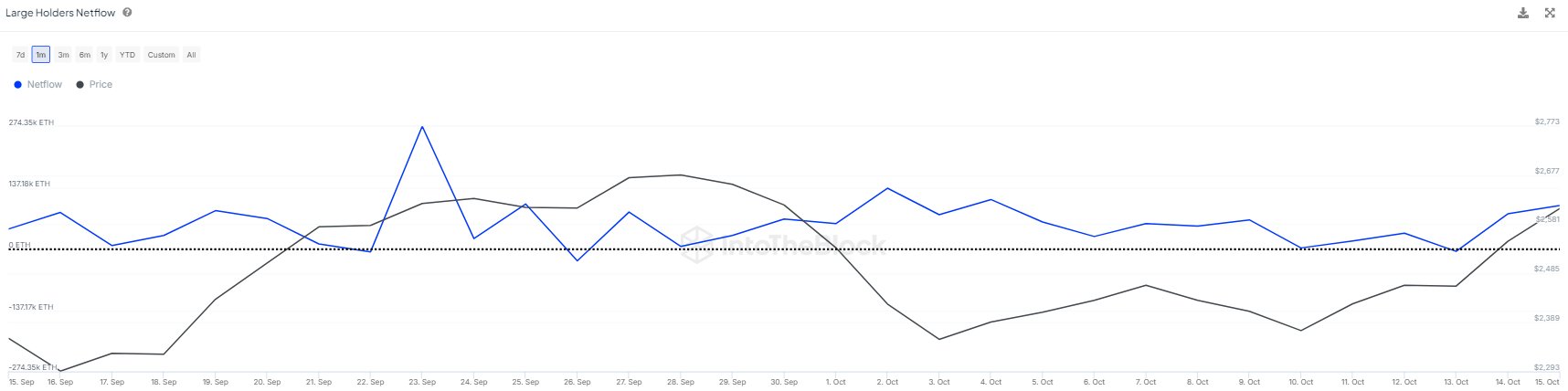

According to IntoTheBlock’s X account report, there has been a significant rise in the net flow of large Ethereum holders over the last 30 days. More precisely, wallets classified as ‘whales,’ which control more than 0.1% of Ethereum’s overall supply, have consistently seen outflows, implying they are stockpiling or “accumulating” Ethereum.

Over the past month, I’ve observed that there were only three instances of net outflows. This suggests that most of the significant investors were primarily accumulating positions rather than reducing them during this period.

During this timeframe, a total of approximately 1.7 million Ethereum (ETH) were amassed, with around 175,000 ETH being bought within just the past two days. According to IntoTheBlock, such significant accumulation by large holders usually signifies faith in the asset’s long-term prospects.

For the last month, significant Ethereum (ETH) whale wallets have consistently been buying, with just three instances of net withdrawals being observed.

As a researcher, I examine the behavior of significant players in the market by monitoring the Large Holder Netflow Indicator. This tool alerts me when wallets that own over 0.1% of the total supply decide to either purchase or offload their holdings.

In total, these wallets have…

— IntoTheBlock (@intotheblock) October 16, 2024

Ethereum Price Performance And Outlook

It seems that large investors are showing their optimism by increasing their holdings, and this positive sentiment is starting to show in Ethereum’s price movement. Over the last week, Ethereum has experienced a growth of approximately 5.9%, pushing its value back above the $2,600 threshold.

Over the past day, there’s been a modest 1.3% rise in the asset’s value, pushing its present trading price up to $2,616. As for Ethereum, its daily trading volume has noticeably surged over the past week. It was just under $14 billion last Wednesday, but today it stands above $18 billion.

Amid this price performance, crypto analyst CrediBULL shared his latest outlook on Ethereum. In a post on X, the analyst expressed concerns over Ethereum’s relative weakness against Bitcoin.

CrediBULL noted that while Ethereum showed some initial signs of strength, it failed to clear local highs during the most recent rally. This underperformance has led the analyst to believe that Ethereum may continue to struggle against Bitcoin in the short term.

I haven’t made any recent changes to my ETH holdings. It has been demonstrating noticeable vulnerability compared to Bitcoin, as have most altcoins in the past period.

It appears that, contrary to my expectations, there won’t be a brief period of superior performance followed by a fall below 2k at this moment.

ETH…

— CrediBULL Crypto (@CredibleCrypto) October 15, 2024

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

2024-10-17 12:05