As a seasoned analyst with over a decade of experience in the crypto market, I have witnessed the ebb and flow of bull runs and bear markets. The current rise in Bitcoin dominance has me scratching my head, reminiscing about the days when altcoins ruled supreme.

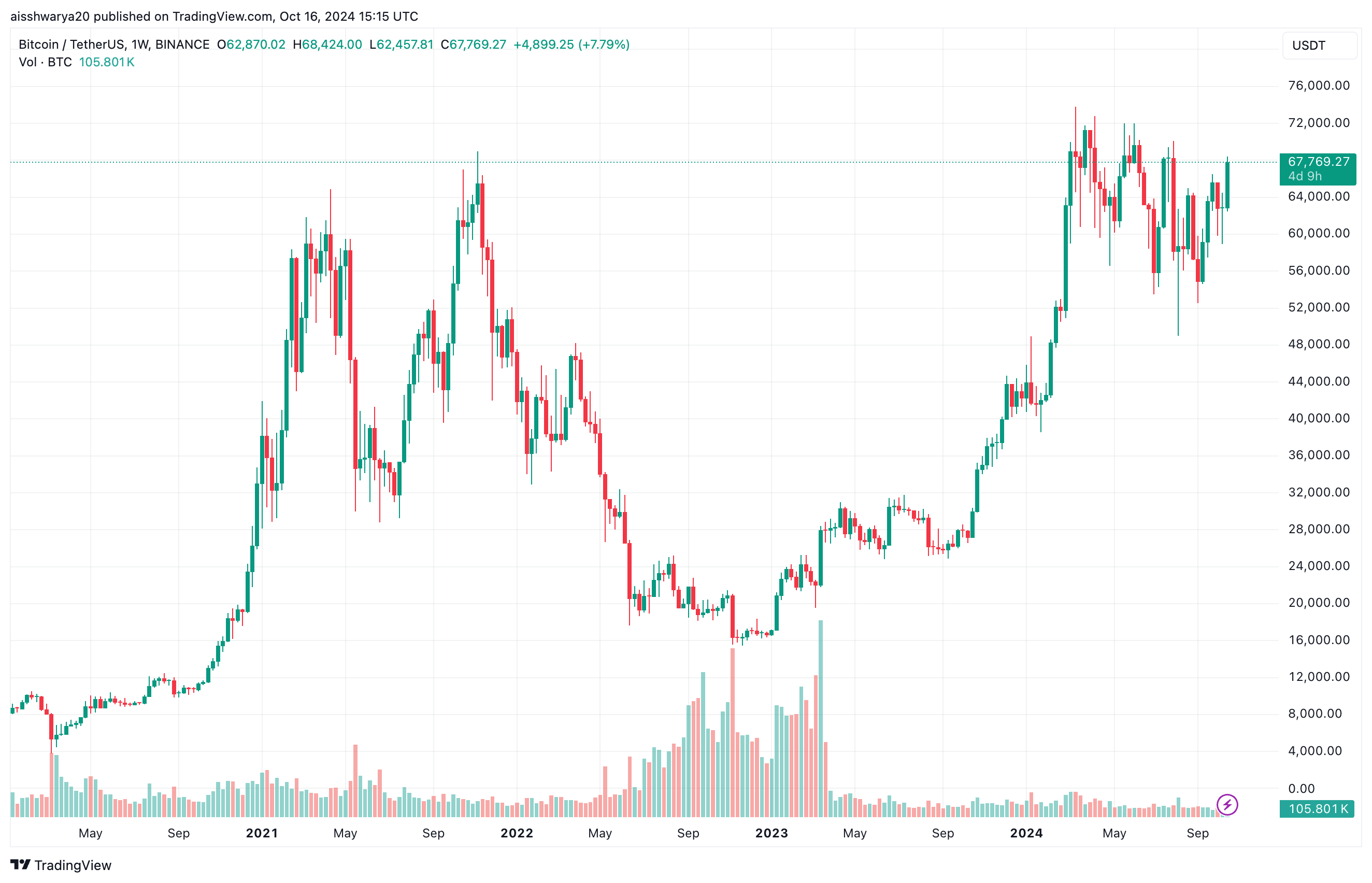

Approaching the $70,000 mark, Bitcoin‘s influence within the broader cryptocurrency sector has peaked at a record high of 58.9%.

Bitcoin Dominance Rises, Are Altcoins In Trouble?

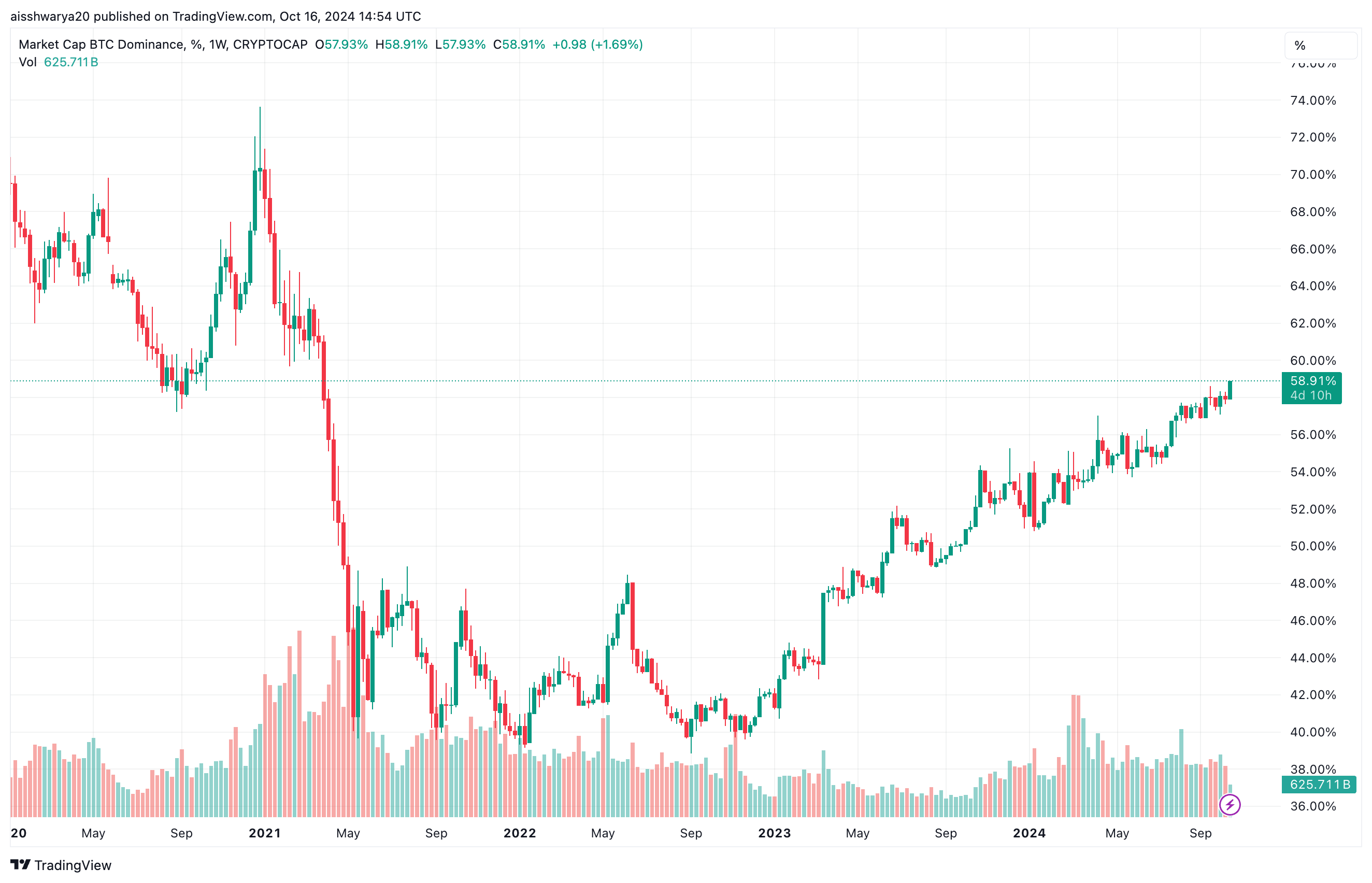

Bitcoin dominance (BTC.D), a metric that measures the proportion of the total cryptocurrency market cap commanded by the leading digital asset, has hit a new cycle high of 58.9%. The last time the crypto market witnessed this level of BTC.D was in April 2021.

Following the minor dip after Iran’s actions against Israel this month, Bitcoin has climbed approximately 10% over the last seven days and is currently valued at around $67,769 as I write this.

Simultaneously, the overall value of the cryptocurrency market has escalated from $2.26 trillion on October 8, to $2.41 trillion on October 16, as per data from CoinGecko. This significant increase in the total crypto market cap is primarily driven by the rising price of Bitcoin.

In the beginning of October, BTC.D stood roughly at 57.1%. However, it has since increased by approximately 1.8%, demonstrating Bitcoin’s robust performance compared to other cryptocurrencies like Ethereum (ETH), Solana (SOL), Binance Coin (BNB), and more.

The high degree of Bitcoin Dominance (BTC.D) at present has raised questions about the possibility of the eagerly awaited “altcoin season,” which is known for significant price surges in altcoins and a drop in BTC dominance. Interestingly, BTC.D reached 70% during the bull market following COVID-19 in 2020-21, but fell to 40% by mid-2021.

As a crypto investor, I experienced a significant dip in late 2022 when BTC.D plummeted to approximately 39%, largely due to the halting of operations at FTX following allegations of fraud against its management. However, since then, BTC.D has been steadily climbing, as evidenced by the chart below.

ETH/BTC Ratio Must Rebound For A Potential Altseason

As Bitcoin Dominance Index (BTC.D) increases, it’s crucial to examine the relationship between Ethereum and Bitcoin, specifically the Ethereum-to-Bitcoin trading pair, often referred to as the ETH/BTC ratio. This ratio measures Ethereum’s performance relative to Bitcoin.

Currently, the Ethereum-to-Bitcoin exchange rate is at 0.0385, similar to its value in April 2021. As depicted in the chart below, Ethereum has not set a new high against Bitcoin since at least November 2022, suggesting that its price performance versus Bitcoin has been relatively weak over the last two years.

A robust showing by Ethereum compared to Bitcoin typically signals the approach of an “altcoin season,” yet at present, there’s no discernible indication of a significant shift in trends.

Additionally, the combined worth held in Decentralized Finance (DeFi) systems on various blockchains decreased from approximately $110 billion in June 2024 down to $88 billion, suggesting that crypto investors may be experiencing reduced interest in altcoins.

Nevertheless, certain cryptocurrency experts and analytical tools indicate that an “altcoin season” (a period where altcoins outperform bitcoin) might be approaching.

This month, I observed an interesting development in the altcoin market: the total market cap crossed above its 200-day exponential moving average (EMA). This significant resistance level is often seen as a sign of robust altcoin growth over the past few days, hinting at potential positive performance in the near future.

In a similar vein, Steno Research has indicated that Ethereum (ETH) is poised for a resurgence due to the US Federal Reserve’s interest rate reductions. At the moment of this writing, Bitcoin (BTC) stands at $67,769, marking a 2.5% increase over the past day.

Read More

2024-10-17 10:16