As a seasoned researcher with over two decades of experience in financial markets, I must admit that the current Bitcoin (BTC) bull run has piqued my interest more than ever before. The meteoric rise of this digital asset, particularly when juxtaposed against traditional market trends, is truly fascinating.

Over the course of the week, Bitcoin (BTC) price has been gradually increasing, moving closer to its peak of $73,700 reached in March this year. This upward trend aligns with the forecasts made by several market analysts, who anticipate substantial growth for the top cryptocurrency before the end of the year.

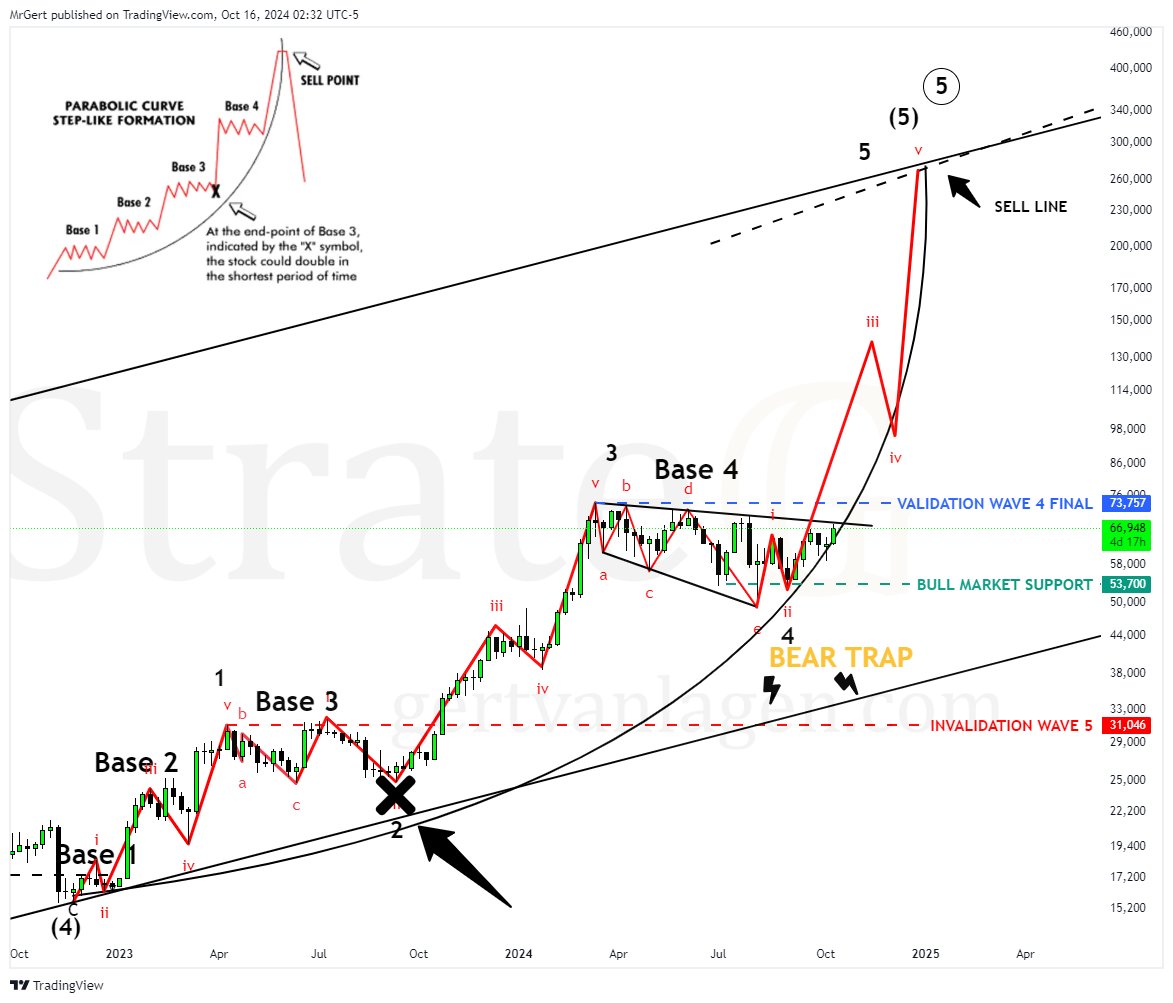

One such expert, crypto analyst Gert van Lagen, recently shared his insights on Bitcoin’s price trajectory via social media platform X (formerly Twitter). He analyzed BTC’s parabolic curve and identified a distinctive step-like formation pattern, which he believes signals a colossal wave 5 rally in the coming months.

Potential ‘Shake-Out Of The Century’

In his examination, van Lagen showcased a Bitcoin graph indicating that the digital currency has effectively overcome numerous obstacles since April 2023. He divided the price fluctuations into three separate stages, highlighting the foundation of the upward trend trajectory fueling the present bullish market movement.

At present, van Lagen points out that Bitcoin’s price fluctuations are primarily focusing on a specific pattern in base 4, suggesting a period of consolidation between the $53,700 and $68,000 price ranges. Notably, the lower boundary at $53,700 is being considered as a support level for this market cycle, signifying bullish momentum.

According to Van Lagen, the verification of Wave 4 is nearly upon us as Bitcoin nears its previous peak record. He anticipates that once Bitcoin surpasses its base 4 and sets a new all-time high, it may spark a significant surge in wave 5, potentially reaching prices around $250,000.

Nevertheless, the analyst cautions about a possible severe drop after the predicted increase in Bitcoin value. He advises that when Bitcoin reaches its expected maximum, there might be a “recession,” causing the price to dip as low as $10,000, and potentially even down to $1,000 if his more extreme forecast comes true. He refers to this potential decrease as “the century’s shake-out,” if his predictions prove accurate.

Over the past month, Bitcoin’s price fluctuations have escalated significantly, leading me, as an analyst, to anticipate a potential scenario. If Bitcoin fails to surmount the resistance at $70,000 – a hurdle it has previously attempted and failed to cross on four occasions – then I believe the $57,500 mark could act as a significant support for the cryptocurrency in the short term.

Historical Patterns Suggest Bitcoin Price Increases Ahead

Showing optimism about Bitcoin’s potential for more growth, Brett Munster from Blockforce Capital stated that the current circumstances seem to be setting up a “powerful combination” or “ideal conditions” that could benefit Bitcoin and other digital currencies following half a year of price stabilization.

Munster emphasized how global liquidity might contribute to this possible increase, noting the rise in funds injected by central banks around the world. It’s worth mentioning that China has taken steps to boost its economy through economic stimulus packages.

Historical trends indicate that an excess of global liquidity over its average tends to correspond with significant price hikes in Bitcoin.

Moreover, enthusiasm within the crypto market is reinforced by the pledge of U.S. Vice President Kamala Harris to establish a regulatory system for digital currencies, addressing ongoing worries from the crypto community about the existing regulatory landscape.

At the time of writing, BTC has been trading at $68,300, up 3.6% in the last 24 hours.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Who Is Al Roker’s Wife? Deborah Roberts’ Job & Relationship History

- One Piece Chapter 1140 Release Date, Time & Where to Read the Manga

- Clare Crawley Subtly Reacts to Matt James & Rachael Kirkconnell Split

2024-10-17 09:04