As an analyst with over a decade of experience in the financial markets, I have seen my fair share of market euphoria and panic. The current Bitcoin Fear & Greed Index reading of 73, which places us squarely in the “Greed” region, is a stark reminder of the psychological forces at play in this market.

The data indicates that the Bitcoin market mood is approaching intense optimism since the value of Bitcoin climbed close to $68,000.

Bitcoin Fear & Greed Index Is Currently Inside The Greed Region

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment present among traders in the Bitcoin and wider cryptocurrency markets. This index makes use of the data of the following five factors in order to determine the sentiment: trading volume, volatility, social media sentiment, market cap dominance, and Google Trends. Once found, it represents the market mentality as a score between 0 and 100.

When the metric exceeds 53, it suggests that overall, traders are feeling greedy at this moment. Conversely, if it falls below 47, it indicates a prevailing sense of fear among traders. Values within this range (between 47 and 53) suggest a balanced or neutral outlook in the market.

In addition to the primary emotional areas, there are two exceptional regions known as intense fear and intense enthusiasm. The first, or intense fear, is found at levels below 25, while the second, or intense enthusiasm, appears at levels above 75.

Now, here is what the latest value of the Bitcoin Fear & Greed Index has been like:

From what you can see up there, the indicator reads 73, indicating that presently, investors exhibit a high level of greed – quite a shift compared to the market’s sentiment last week when the index dipped into the ‘fear’ zone.

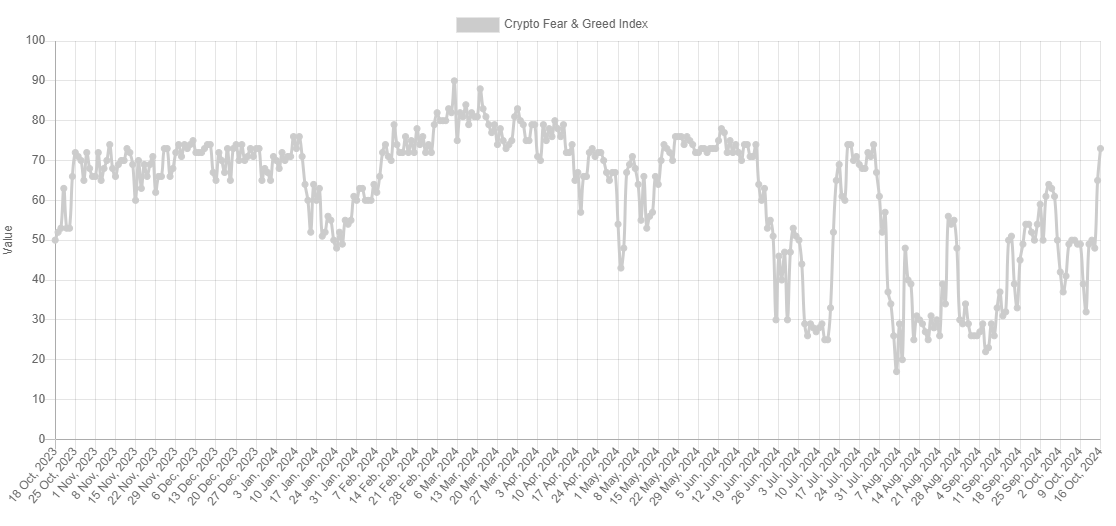

Here’s a simple, clear, and conversational rephrasing: This graph illustrates the fluctuations in the Bitcoin Fear & Greed Index over the last twelve months.

Looking at the graph, it’s clear that the recent surge in positive sentiment, caused by the asset reaching $68,000, has pushed the index to its highest point since late July. In fact, similar high sentiment levels back in July coincided with a peak for the cryptocurrency. This kind of pattern is something that has been observed repeatedly throughout history.

Interestingly, it seems that Bitcoin often goes against the general expectation of the crowd. The likelihood of this counterintuitive movement becomes greater as more traders favor one side over the other.

As an analyst, I’ve observed that in the market extremes, investor sentiment tends to be particularly influential, often leading to the formation of both peaks and troughs when there’s a widespread agreement among investors. Currently, the index value is hovering near the boundary of extreme greed, which suggests that if investor optimism continues to escalate, a potential top could materialize for the asset.

In this situation, it might not be necessary for feelings or opinions to get any better, because historically, events like this have started happening even when the index value was just one unit higher than its current level, as we saw in July.

BTC Price

At the time of writing, Bitcoin is trading at around $68,000, up more than 9% over the last week.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-10-17 02:10