As a seasoned crypto investor with over a decade of experience under my belt, I must say that the current rally in Bitcoin is nothing short of exhilarating. Having weathered numerous market cycles and witnessed the ebb and flow of digital currencies, I can confidently say that this recent surge feels different. The $67,000 mark being breached is a testament to the maturity and resilience of Bitcoin as an asset class.

With the wider cryptocurrency market showing signs of recovery, Bitcoin has taken the lead yet again and surpassed the $67,000 threshold. As of October 16, Bitcoin is trading at approximately $67,150, marking a significant 4% rise over the past day. Notably, this price point is the highest for Bitcoin since late July.

In the past few days, Bitcoin exchange-traded funds (ETFs) experienced their largest one-day influx of funds in more than four months. At the moment I’m writing this, Bitcoin had soared to around $67,820, then settled at approximately $67,000. It seems that interest from investors is growing, suggesting a buildup of momentum for Bitcoin.

Key Factors Driving Bitcoin’s Increase

One significant factor driving the rise in Bitcoin’s value is the reaction of the worldwide market to recent developments in China. With efforts underway to revive its economy, China’s latest economic stimulus plan has sparked numerous queries about its adequacy. As economists express doubts about China’s ability to curb deflation through its actions, some investors have started to shift their focus from Chinese equities towards cryptocurrencies like Bitcoin.

According to Bloomberg, this pattern indicates a growing interest in Bitcoin as a more secure investment option. Moreover, a positive sign of strong market activity is the rise in investments into spot Bitcoin Exchange-Traded Funds (ETFs). After a brief period of withdrawals, these ETFs experienced a significant reversal on October 14, attracting over $253 million in new capital. This trend seems to suggest that there could be less pressure to sell Bitcoin, implying renewed confidence from investors.

Impact Of US Election

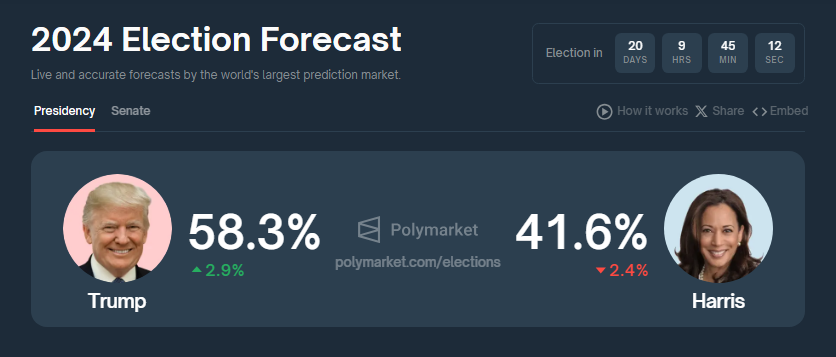

The upcoming U.S. presidential election is contributing to Bitcoin’s rise, as there’s a growing sentiment favoring Republican candidate Donald Trump, who supports cryptocurrencies, over Democratic Vice President Kamala Harris. According to data from Polymarket, the majority of bettors believe that Trump has a 58% chance of winning, significantly outpacing Harris’s chances.

In light of investors considering cryptocurrencies as an alternative to traditional finance, this political climate enhances Bitcoin’s attractiveness. Market feelings towards elections could fuel more speculative crypto investments, thereby potentially boosting Bitcoin’s value.

Liquidations And Market Perception

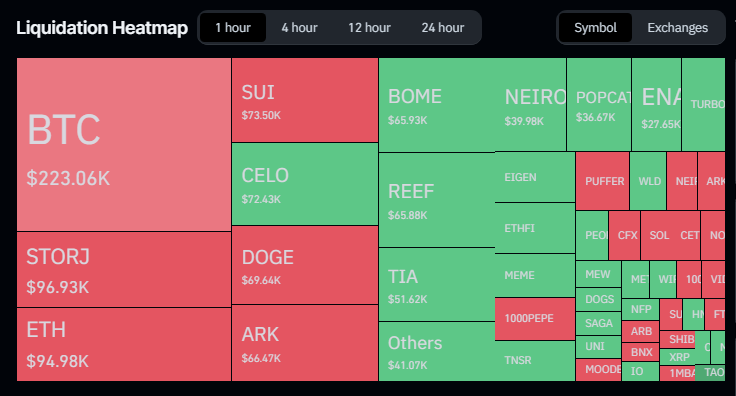

Over the last day, sudden price surges have triggered crypto liquidations worth more than $300 million. The majority of these were short-BTC positions, suggesting that many traders expected Bitcoin’s value to decrease. Because Bitcoin is often considered a risky asset, a substantial rise in the U.S. stock market might have fueled renewed interest in it.

In simpler terms, as stock prices rise and Fed interest rates decrease, this situation tends to boost market liquidity. Come the final quarter of the year, Bitcoin often shows increased strength. This is typically the timeframe where trends linked to these factors start unfolding over the following few weeks.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-10-16 22:16