As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen Bitcoin go from a curiosity to a global phenomenon that’s hard to ignore. The recent surge past $65,000 has certainly caught my attention, and as I look at the charts and analyze the data, it seems we might be on the verge of an “Uptober” rally.

As a researcher, I’m excited to share that Bitcoin (BTC) has soared above the $65,000 threshold, sparking renewed enthusiasm among traders for a potential “Uptober” upswing. This optimistic rally could potentially prolong Bitcoin’s bullish trend, adding fuel to its dynamic market momentum.

Is The Bitcoin “Uptober” Rally Finally Here?

At around 3 am on October 15th, Bitcoin momentarily hit a high of approximately $66,000, but later dipped to $65,964 as of this writing. In the last day alone, the value of Bitcoin has increased by about 1.4%.

Based on findings from Bitfinex’s report, Bitcoin surpassing the significant $63,000 barrier and backed by positive on-chain statistics, suggests a possibility of additional price increase in the future.

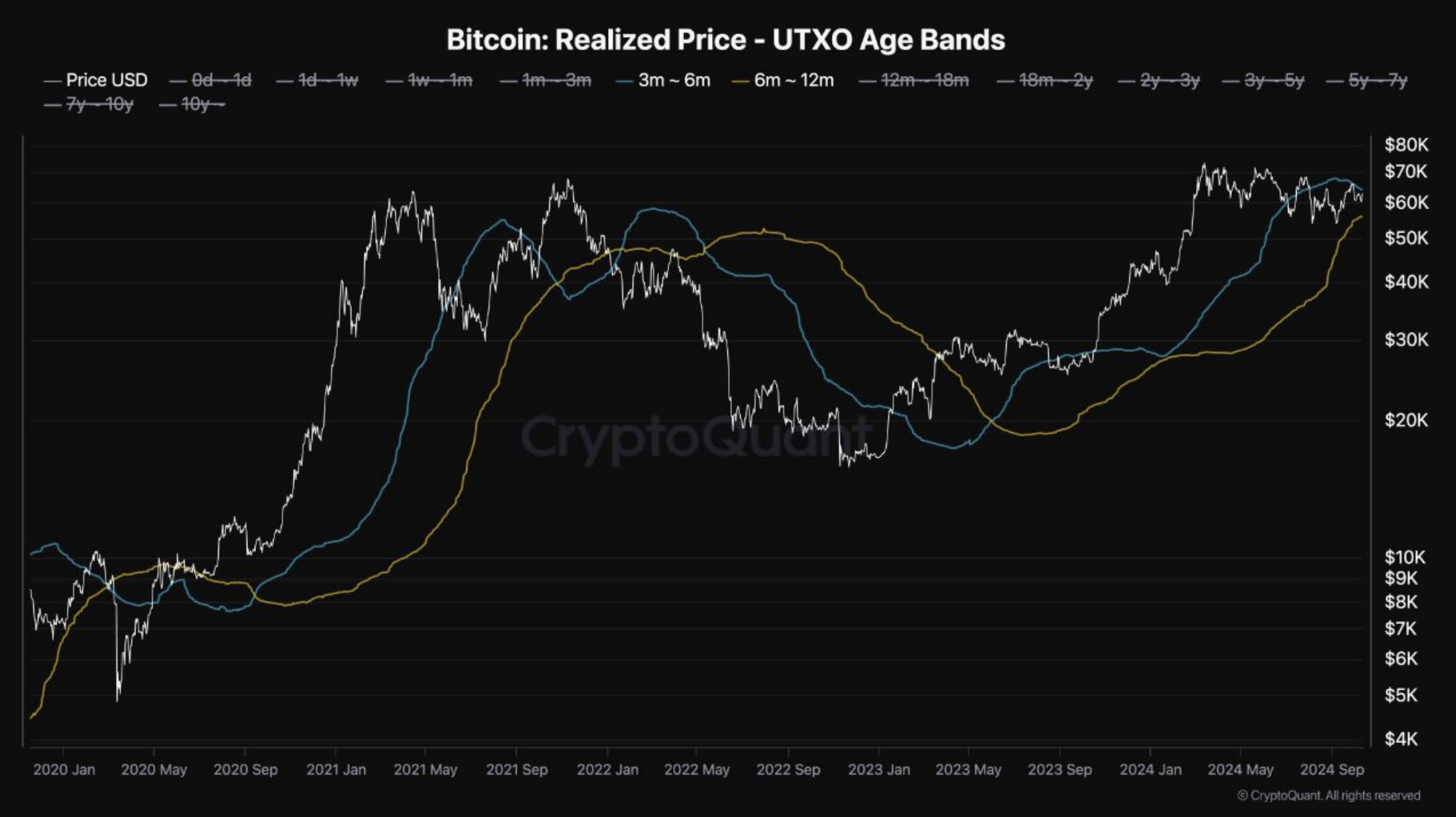

As an analyst, I find that the Bitcoin report highlights the realized price of unspent transaction outputs (UTXOs) based on their age as a crucial on-chain indicator for assessing the Bitcoin market’s behavior.

For those new to Bitcoin, UTXO age bands represent the worth of Bitcoins that have been last activated at different time intervals. In essence, these bands help trace the average cost of purchase for various groups of Bitcoin owners based on how long they’ve held their coins, offering insights into market trends and the profitability of specific groups of investors.

Historically, the prices that short-term (3-6 months) and mid-term (6-12 months) investors have actually paid for a certain asset have served as important points of support or resistance. Currently, the average price for short-term holders is approximately $63,000, while it’s around $55,000 for those holding for mid-terms.

If Bitcoin’s market value is less than the average buy price for these investor groups, it typically suggests a downward trend (bear market). On the other hand, when Bitcoin trades above their average purchase prices, it might signal an upward trend (bull market), indicating potential bullish activity.

After BTC broke through the $63,000 barrier, it might continue to rise. But if it fails to stay above this point, there’s a possibility of a drop towards $55,000.

Market Displays Strong Appetite For Digital Assets

According to the report, the decline in Bitcoin’s price to $58,943 on October 10 was primarily due to a lack of strong buying interest in the market. The report further indicates that most of the selling activity during this period appears to have come from the Coinbase platform.

The document refers to the Coinbase Premium Gap Indicator, or CPGI – a tool that highlights the discrepancy in Bitcoin’s price against the dollar when traded on Coinbase compared to other prominent centralized trading platforms.

As a crypto investor, I noticed a drop of 100 points in the Crypto Fear & Greed Index (CPGI) as Bitcoin’s price dipped below $59,000. Historically, when the CPGI drops below 50 points, Bitcoin has experienced a rebound afterwards. Additionally, the report suggests that this could be a potential sign of an upcoming recovery for Bitcoin.

For about eight months now, Bitcoin’s trading has been mostly confined to a wide band. If a bear market were to start, you’d usually see selling increase when the Coinbase Premium goes below zero. But so far, there hasn’t been much selling, implying that despite the price swings, the market remains fairly steady and not driven by widespread panic-selling. This stability could be a sign of strong underlying factors or a well-balanced market sentiment that might guide future price trends.

This research corresponds with a distinct report issued by crypto company QCP Capital, pointing out that the limited selling off in the cryptocurrency market amidst the geopolitical conflicts between Iran and Israel suggests continued interest in speculative investments.

In related updates, Bitcoin optimists can take comfort in the fact that the closed cryptocurrency platform Mt. Gox has postponed its payback to October 2025, which could lessen the strain on immediate sales.

However, some analysts warn that BTC may face price capitulation due to tightening on-chain liquidity. At the time of writing, Bitcoin trades at $65,964, up 1.4% in the past 24 hours.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- King God Castle Unit Tier List (November 2024)

- Dig to Earth’s CORE Codes (May 2025)

- Odin Valhalla Rising Codes (April 2025)

- General Hospital: Why Is Jonathan Jackson Being Replaced With Guy Wilson?

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

- What Is ‘Mama Dat Burn’ Meme on TikTok? Explained

- Selena Gomez & Benny Blanco Buy $35 Million Beverly Hills Mansion — Report

2024-10-16 11:46