As a seasoned crypto investor with over a decade of experience in the digital asset market, I’ve witnessed numerous price fluctuations and trends. However, the current surge in Bitcoin’s price and open interest has left me genuinely excited about the future prospects of this revolutionary technology.

Today, the price of Bitcoin has surged to an impressive peak of $66,173. This significant rise suggests that the digital asset may have marked a notable achievement in its development.

A CryptoQuant analyst reports that the amount of Bitcoin’s outstanding derivative contracts, known as open interest, has hit a record peak, according to their latest findings.

This progress indicates increased trading action within the Bitcoin market, pointing towards a positive outlook among investors.

Detailing The Open Interest ATH

As a crypto investor, I recently delved into an enlightening analysis shared on the CryptoQuant QuickTake platform by EgyHash, highlighting the importance of this latest surge in Bitcoin’s open interest.

As a researcher delving into the world of cryptocurrencies, I’ve just noticed an intriguing development: Bitcoin’s open interest has surpassed its previous record, currently standing at $19.8 billion. Furthermore, funding rates have climbed to their highest positive levels since August, suggesting that a significant portion of this increased open interest is leaning towards long positions.

It’s worth mentioning that as open interest rises and funding rates grow, it suggests that traders are optimistic about Bitcoin, indicating their belief in its ongoing price increase.

In simpler terms, EgyHash underscored that the surge in the derivatives market is indicative of a rising tide of investment and heightened interest in digital currencies.

As an analyst, I’ve noticed a steady rise in open interest for Bitcoin, which has also coincided with a substantial price increase. Over the last 24 hours, its value surged by approximately 5.1%, reaching a high of $65,655, and even momentarily exceeding $66,000 during a brief rally.

The surge in price for this item has coincided with a significant jump in Bitcoin’s total market value, now sitting at approximately $1.297 trillion – an increase from $1.175 trillion as recently as last week.

The trading volume for Bitcoin has significantly increased, nearly doubling from around $20 billion on the weekend to more than $40 billion today.

Bitcoin Price Outlook

Multiple crypto experts are expressing their opinions about Bitcoin’s potential direction due to the surge in market activity and price increases. A well-known analyst, Trader Tardigrade, has expressed optimism, indicating that Bitcoin Stochastic has experienced a breakthrough.

Based on my analysis, this current breakout mirrors the pattern from our previous cycle. As such, I believe we’re witnessing the local bottom that marks the onset of a monumental Parabolic Rally for Bitcoin. My recommendation would be to invest in Bitcoin, aiming for a potential target of $500k.

In simpler terms, the current trend in Bitcoin ($BTC) appears similar to its past cycles. The breakout point suggests we’ve reached a local minimum, marking the start of an enormous surge potentially leading to $500k per Bitcoin.

— Trader Tardigrade (@TATrader_Alan) October 14, 2024

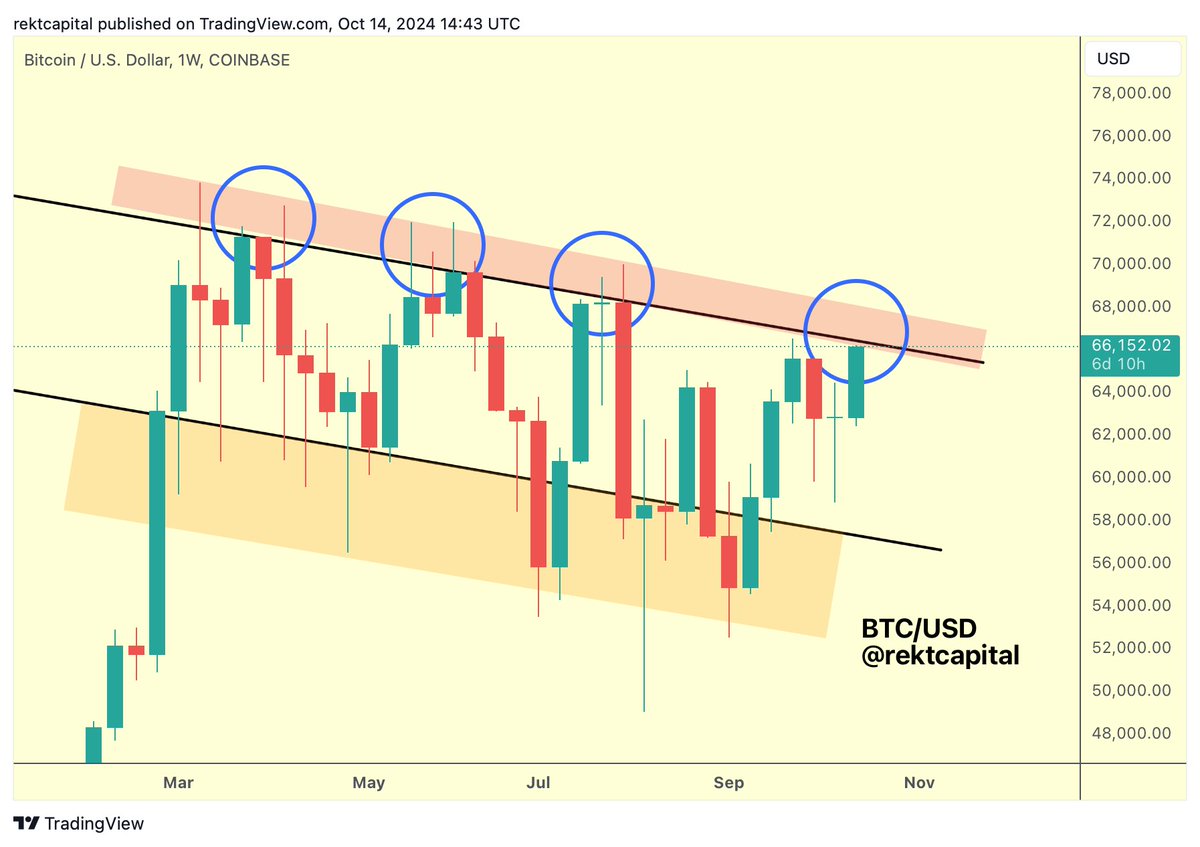

Although some traders remain hopeful, various analysts advise proceeding with caution. Similarly renowned in the cryptocurrency sector, RektCaptal advocates for Bitcoin to achieve a weekly closing point above its present downward trendline, which would validate a prolonged surge.

He noted, “Bitcoin needs to Weekly Close above the black Downtrending Channel Top to finally break out from this Channel.”

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-15 09:40