As a seasoned crypto investor with over a decade of experience in this volatile yet exhilarating market, I find myself in agreement with the recent trend of investors opting for self-custody solutions rather than relying on centralized exchanges. The allure of direct ownership and the sense of control it provides has been a game-changer for many, including myself.

It seems that crypto investors are preferring to manage their own cryptocurrencies, rather than using trading platforms. This shift in preference has led to a decrease in the reserves of Bitcoin and Ethereum held by centralized exchanges, reaching an all-time low.

Staying Away From Cryptocurrency Trading

Lately, it’s been observed that both experienced traders and crypto enthusiasts are opting to keep their digital currencies instead of selling them through Bitcoin or Ethereum trading platforms.

Individuals opted more frequently for personal control over their assets through individual wallets, boosting the need for such self-management options. This shift, however, resulted in a decrease in the availability of Bitcoin and Ethereum on centralized trading platforms due to less liquidity.

Strengthening Bitcoin And Ethereum Values

As more traders choose to hold their Bitcoin and Ethereum directly (self-custody solutions), there’s an observed trend of these digital assets appreciating in worth over time. This shift in preference away from centralized cryptocurrency trading platforms contributes to a perception of scarcity, thereby driving up the value of these assets.

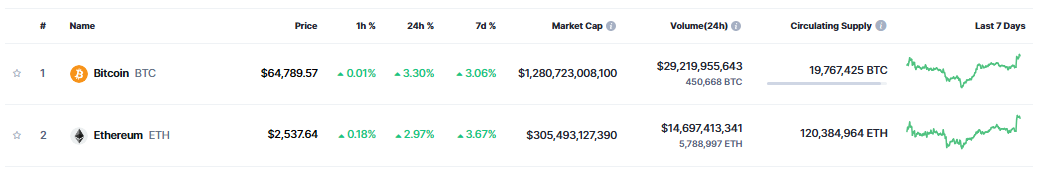

As I write, the current value of Bitcoin stands at approximately $64,842. Since surpassing its all-time high of around $73,000 in March this year, its price has fluctuated, staying within a range of roughly $66,000 to $49,000. Simultaneously, according to Coinmarketcap, the value of Ethereum is at $2,464.

Bitcoin, Ethereum Reserves Drop

Bitcoin (BTC) and Ethereum (ETH) experienced a significant drop on centrally controlled reserves, reaching record lows early this month. On October 13, CryptoQuant’s chart indicated that centralized BTC exchanges held a historic minimum of approximately 2.67 million bitcoins.

On June 8, 2022, the maximum value of Bitcoin reached 3,361,854, but since then it has experienced a steep drop. Recently, it reached its lowest point early in the current month.

When it comes to Bitcoin holdings (or reserves), spot exchanges collectively have approximately 1.1 million Bitcoins, while derivative exchanges have slightly more at around 1.39 million. Among all crypto exchanges, Binance holds the most with over half a million Bitcoins (563,000 to be exact), making it the largest by trading volume. Kraken is the second-largest with about 112,300 Bitcoins in reserves.

Contrarily, Coinbase Advanced maintains approximately 830,530 Bitcoins in its reserves, while Coinbase Prime has just 3,000. Similarly, major centralized exchanges dealing with Ethereum are grappling with a comparable problem, as their reserves have been steadily decreasing and have hit an all-time low of around 18.7 million.

As reported by CryptoQuant, a significant proportion of Ethereum is stored in derivative exchanges, amounting to approximately 10.3 million units. Meanwhile, around 8.4 million Ethereum is held in the reserves of spot exchanges.

As a data analyst, I’ve observed an interesting trend with Ethereum: Its all-time high reserve was 2,310,823, which was reached on September 6, 2022. Since then, the Ethereum reserves held in central exchanges have been consistently decreasing.

Speaking about their Ethereum holdings, Coinbase boasts a substantial reserve of approximately 4.5 million Ethereum, trailed closely by Binance with around 3.6 million Ethereum. Kraken also maintains a sizeable Ethereum reserve totaling about 1.3 million.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-10-14 18:40