As a seasoned analyst with years of experience navigating the volatile crypto market, I must admit that watching Bitcoin breach the $64,000 mark again is like witnessing a phoenix rising from the ashes. The sudden 7.7% increase has left many short sellers in a state of shock, much like a game of Jenga where the last block keeps getting pulled out unexpectedly.

Recently, Bitcoin‘s price surged past $64,000 once more, marking an approximately 7.7% rise from its lowest point of $59,400 over the last four days. This swift increase has caused a ripple effect throughout the crypto market, as data from Coinglass suggests a spike in liquidations due to the sudden and unforeseen surge. Those who had bet on Bitcoin’s decline found themselves in a difficult position when the cryptocurrency refused to follow their predictions.

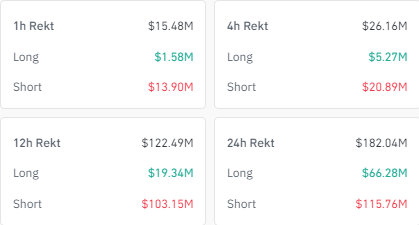

Significantly, data from Coinglass indicates that approximately $182 million in positions have been liquidated on multiple platforms within the last day, primarily comprising short positions.

Bitcoin Price Breaks Above $64,000 Again

On Monday morning, October 14th, Bitcoin surpassed $64,000 following a weekend breakout and a 2.53% increase over the past day. In recent hours, it even peaked at $64,500 – its highest point in October. This significant jump means that Bitcoin has now exceeded its opening price for the month, marking the first time the monthly return has shown a positive gain since the beginning.

Despite the overall upward trend in price, it didn’t work out favorably for everyone. As depicted in the image below, the abrupt increase proved costly for numerous traders who had taken short positions. Those betting on a prolonged decrease (bears) endured significant losses due to Bitcoin’s sustained surge, which triggered a series of liquidations.

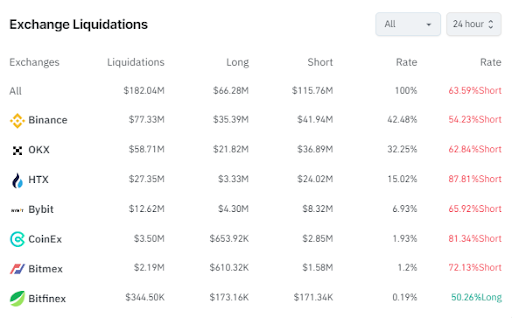

Approximately $115.76 million out of the $182 million in total liquidations on multiple platforms was due to short positions, contrastingly, long positions accounted for around $66.28 million.

In the past 24 hours, Binance has dominated the crypto exchange market by accounting for nearly 42.5% of all liquidations, totaling around $77.33 million. Interestingly, about 54.23% of these liquidated positions on Binance were short positions. OKX comes in second, with a significant amount of $58.71 million in liquidations, and an even higher percentage of 62.84% being short positions.

On HTX, a massive $27.35 million worth of positions were liquidated, with an astounding 87.81% being short positions. Bybit followed closely behind with $12.62 million in liquidations and a high percentage of short positions at 65.92%. Lastly, CoinEx had $3.50 million in liquidated positions, with over 81.34% stemming from short positions.

More Liquidations Ahead?

Bitcoin’s recent uptick brings back the possibility of a declining Uptober sentiment. This interesting rally could set the stage for a surge in the second half of October, similar to what was witnessed in September.

If the current Bitcoin rally persists throughout the month, it’s likely that many short positions will be closed soon, potentially within the next few hours. Those who have been speculating on Bitcoin’s decline (the bears) might feel compelled to exit their trades to limit their losses. This mass exit of short sellers could intensify Bitcoin’s upward trend even more.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-14 17:10