As a seasoned economist with decades of experience under my belt, I find myself intrigued by the unfolding events leading up to the 2024 Election Day. Having witnessed numerous administrations come and go, I can’t help but feel a sense of deja vu when it comes to the US dollar’s fate.

Prior to Election Day on November 5, 2024, if Donald Trump becomes the next president, his administration has promised to maintain a robust US dollar by following established economic policies. Scott Bessent, one of Trump’s key economic advisors, recently reassured the Financial Times that this is their intention, alleviating worries about a potential weakening of the dollar under Trump’s leadership.

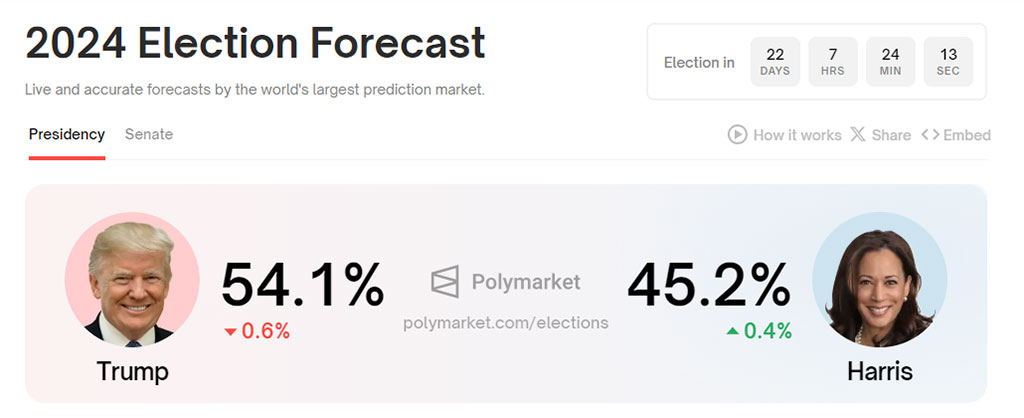

As the election approaches, prediction platforms such as Polymarket indicate Democrat Kamala Harris trailing behind Republican Donald Trump, who supports cryptocurrency. Earlier in the year, Trump and his vice presidential pick, JD Vance, expressed a preference for a less strong dollar to stimulate manufacturing expansion. This stance has caused concern among investors and economists regarding the potential devaluation of the U.S. currency.

Bessent made it clear that Trump isn’t planning on deliberately weakening the U.S. dollar. Instead, he emphasized its role as a “reserve currency,” suggesting that Trump would work towards keeping its value strong. Contrary to common belief, devaluation involves lowering a currency’s worth to boost exports, but Bessent ruled out this tactic for the incoming administration.

Bessent Defends 20% Import Tariffs

It’s whispered that Bessent is a strong candidate for the position of Treasury Secretary in the Trump administration, reflecting his substantial impact on shaping the economic policies within this administration. Moreover, he endorsed Trump’s plan to impose tariffs as high as 20% on all imports, suggesting that these “radical viewpoints” might be modified during negotiations with trading partners.

As an analyst, I expressed that the value of a reserve currency, such as the U.S. dollar, can fluctuate according to market conditions. In my opinion, implementing sound economic policies will inherently strengthen the dollar’s position. Furthermore, while my statements may not directly represent Trump’s official viewpoint, they do imply a commitment to maintaining policies that bolster a robust dollar.

Trump’s latest commendation of Bessent as a “remarkably astute figure in Wall Street” highlights the substantial impact that this economic advisor has on the administration’s monetary policies.

During the interview, Bessent commended Trump for being a businessman who grasps complex economic matters, setting him apart from Kamala Harris whom he deemed economically uneducated, and her partner Tim Walz as even less knowledgeable in economics. These comments highlight the significant political and economic differences between the candidates.

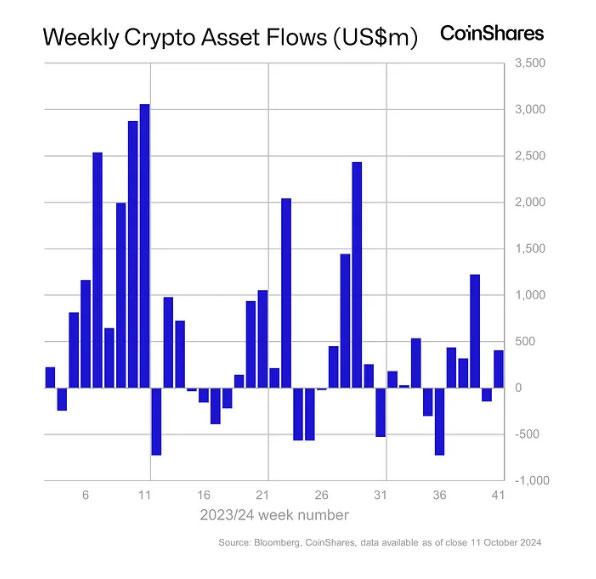

Election Influence on Digital Assets Surge

The surge in political events has led to a significant increase in investments within the digital assets sector. As per the CoinShares weekly report dated October 14, digital asset investment products saw an influx of approximately $407 million. This growth appears to be more influenced by upcoming elections rather than standard monetary policies.

Amid these political shifts, Bitcoin received a significant boost with investments amounting to $419 million. Conversely, investment in short-Bitcoin products saw a withdrawal of $6.3 million. Over the past 17 weeks, multi-asset investment products have consistently seen inflows, albeit modest ones at $1.5 million. On the other hand, Ethereum witnessed outflows totaling US$9.8 million.

Read More

- The First Berserker: Khazan Releases Soundtrack Excerpts

- POPCAT PREDICTION. POPCAT cryptocurrency

- Libre Capital’s Sui Blockchain Move: Money, Magic, and Mayhem! 🚀💰

- Who Is Alex Cooper’s Husband Matthew? Relationship, Age, Job, Kids Explained

- Dead Rails [Alpha] Codes (February 2025) – Are There Any?

- TLC’s The Baldwins Is More Than Just the Rust Controversy

- Mazaka Trailer OUT: Sundeep Kishan, Rao Ramesh’s chemistry shines in upcoming action comedy entertainer

- Blue Lock Chapter 296 Spoilers: Bachira Scores, Barcha Takes the Lead, and a New Strategy Emerges

- Anaganaga OTT release date: When and where you can watch Sumanth starrer family drama online

- What Happened to Daniel Bisogno? Ventaneando Host Passes Away

2024-10-14 16:54