As a seasoned crypto investor with a penchant for digging deeper into the technical aspects of digital currencies, I find the current state of TRON (TRX) quite intriguing. The recent token burn and the subsequent increase in daily active addresses indicate a strategic move by the TRON team to stimulate growth.

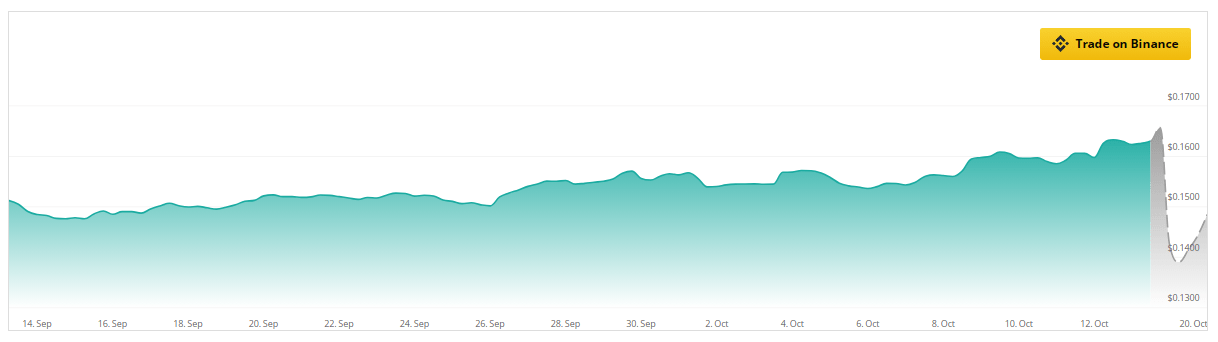

Recently, the cryptocurrency TRON (TRX) has drawn notice by destroying more than 10 million tokens, showing their commitment to a deflationary strategy aimed at boosting its worth. At present, TRX is being traded around $0.1605, suggesting a slight rise.

Experts are bullish about TRON’s future, predicting a 57% price hike within the next three months and an impressive 208% surge over a six-month period, as per CoinCheckup data. This positive outlook suggests that TRX could be on track for a significant growth trend in the cryptocurrency sector.

A Robust Technical Foundation

The technical signs for TRX are moving towards a favorable outlook. The graph shows a slight upward trajectory, and the Relative Strength Index (RSI) currently stands at 57.58. This figure suggests that TRX may be approaching an overbought region, but there’s still room for further increases.

The Stochastic oscillator, presently at 66.63, supports a bullish outlook as it shows strength without suggesting immediate fatigue. Taken together, these signs indicate that TRX could continue its rising trajectory in the near term, making it an enticing prospect for investors.

Increasing Enthusiasm For TRON

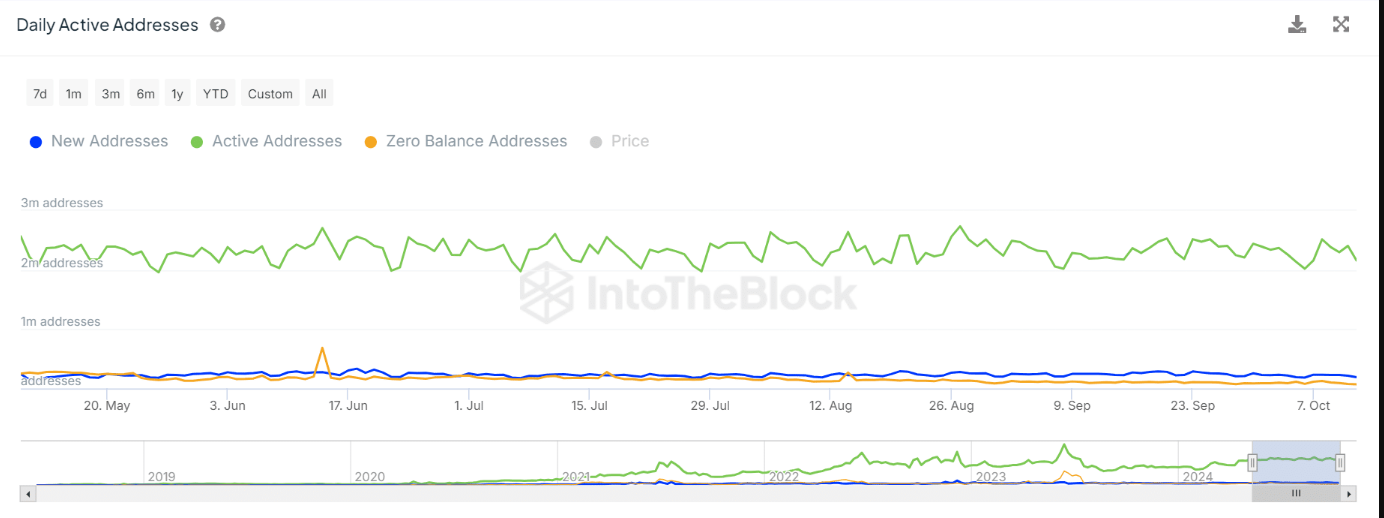

In addition to the process of token destruction (token burn), Tron has experienced an upswing in the number of daily active addresses, according to data from IntoTheBlock. This growth indicates a rising curiosity among investors. While the overall trend appears steady, this slight increase implies that more individuals are joining the market.

As more people join in, it could boost the token’s rising trend, especially when combined with the present deflationary tactics. Since TRON is working on reducing the number of tokens in circulation, these factors might create a solid basis for higher costs.

Market Sentiment And Trading Conduct

Even though the data indicates a positive trend, traders are maintaining a high level of caution. The Long/Short Ratio demonstrates that there are more short positions (54%) than long ones (46%). This cautious approach by traders suggests they are adopting a ‘watchful stance’ as they anticipate potential fluctuations in the price movement of TRX.

In simple terms, when the Total Return Exchange (TRX) OI-Weighted Funding Rate is around zero, it indicates that the number of long positions (buyers who expect prices to rise) equals the number of short positions (sellers who expect prices to fall). This equilibrium suggests a neutral market stance. However, keep in mind that this situation might be favorable for TRX’s market sentiment, but short-term price fluctuations could still occur.

The ongoing destruction of tokens by TRON, coupled with the rising number of active addresses, could fuel the positive trajectory TRX requires to achieve robust growth rates over the coming months.

The technical analysis indicates a strong upward movement and promising price predictions, suggesting that TRX is likely to experience significant growth in the near future.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-14 14:10