As a seasoned crypto investor with over a decade of experience navigating bull and bear markets, I find myself intrigued by the recent accumulation trends among Bitcoin whales. The rapid increase in their holdings, as highlighted by Axel Adler Jr., suggests a growing confidence among high-net-worth investors.

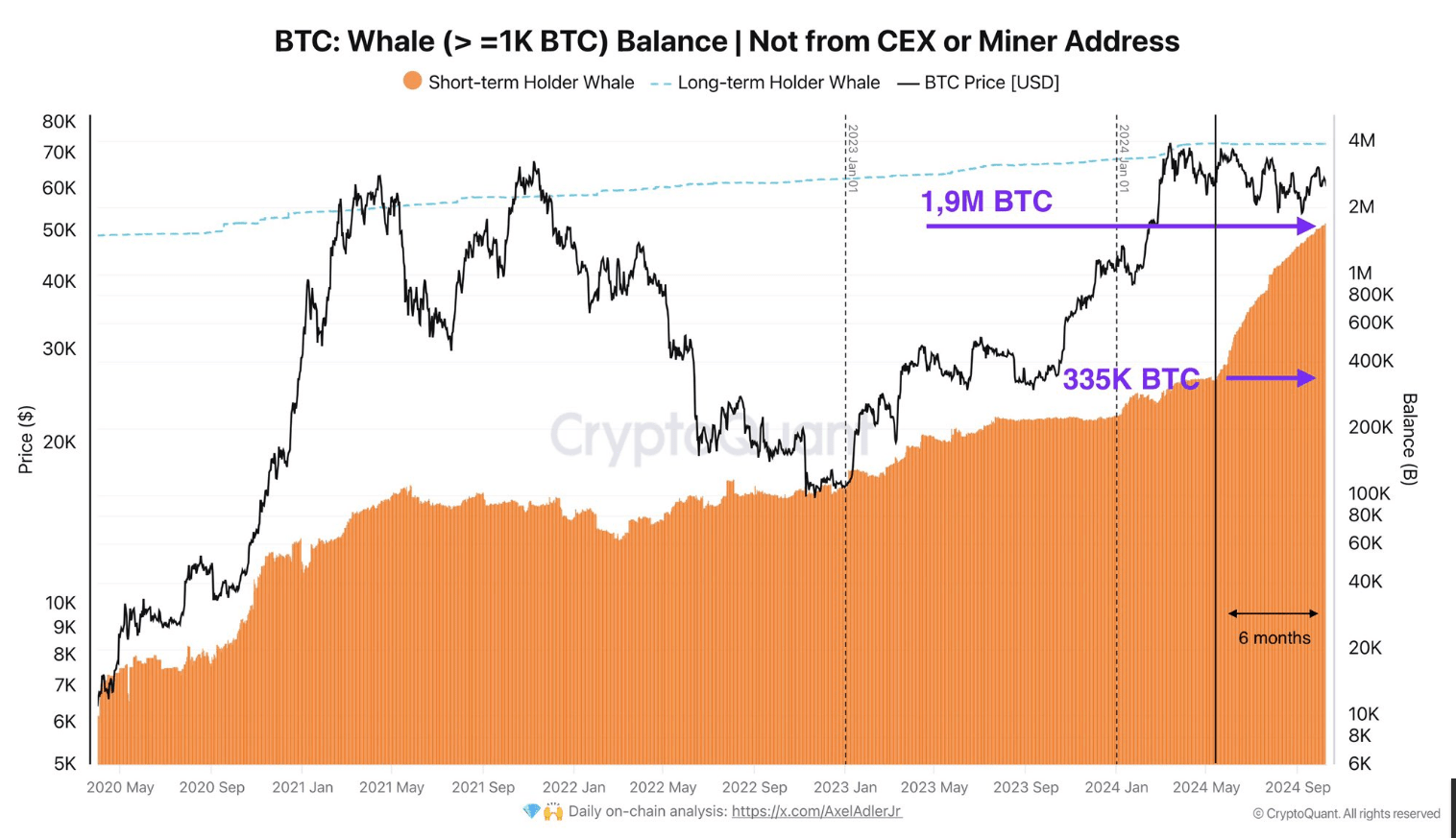

Over the past few months, or more specifically, since May, Bitcoin‘s largest investors, often referred to as “whales,” have amassed approximately $90 billion worth of Bitcoin. This period has been characterized by a relatively stable market situation, where prices have moved within a narrow range. As per the open declaration made by Axel Adler Jr., an analyst from CryptoQuant, those investors who possess more than 1,000 Bitcoins have witnessed a significant increase in their Bitcoin holdings.

Whale Appetite Grows

For the past half year, they amassed roughly 1.5 million Bitcoins, which equates to a staggering capital influx worth around $90 billion when averaged at $60,000 per coin. Notably, these Bitcoins were sold by individuals with less financial strength, who incurred losses during the transaction.

1.5M BTC has been accumulated by whales (with >1K BTC on balance) over the last 6 months.

There’s really nothing to discuss here.

— Axel Adler Jr (@AxelAdlerJr) October 10, 2024

As an analyst, I’ve observed a remarkable increase in the amount of Bitcoin (BTC) held by whale investors. Initially, they controlled approximately 335,000 BTC when the price hovered around $60,000 to $65,000 in early May. Despite the stable pricing during this period, these high-net-worth investors persisted in their accumulation strategy, and now they hold a staggering 1.9 million BTC. This growth suggests a robust short-term confidence among them regarding Bitcoin’s potential performance.

Netflow Metrics Of Large Holders

It appears that even with recent price drops, the pace of buying (accumulation sprees) remains unabated. For instance, Bitcoin dipped beneath $59K for the first time in a month yesterday, triggering significant selling off or liquidations.

Don’t believe that whales accumulated 1.5M BTC and wonder where they got it from?

How about taking a look at the loss-making sales on exchanges?

In the last 24 hours, 24.1K BTC were sold at a loss.

— Axel Adler Jr (@AxelAdlerJr) October 11, 2024

Despite making up only 0.1% of the total Bitcoin in circulation, these major holders gained approximately 629 Bitcoins the day before. Just two days ago, their gain was significantly larger at around 2,480 Bitcoins.

Additionally, data from CryptoQuant suggests that Bitcoin’s stored reserves on exchanges have dropped from approximately 2.576 million coins at the beginning of October to 2.571 million coins now, pointing towards continuous hoarding or accumulation by investors.

Price Prediction And Market Implications

Currently, Bitcoin is valued at approximately $61,690, representing a decrease of about 1.68% over the past week. Meanwhile, the Daily Moving Average (DMI) shows +DI at 18.3 and -DI at 23.3. Although these values are slightly higher, they have been on a downward trend.

In simpler terms, even though there’s a lot of pressure to sell, the strength of that pressure is relatively low right now. The Williams %R, which is currently at -40.74, suggests a neutral position. This could mean that Bitcoin might stay within this range until there’s a significant increase in buying or selling activity.

Veteran analyst Peter Brandt predicts that Bitcoin could peak at a record-breaking $150,000 during this market cycle; however, if it fails to surpass its current price range, a significant drop of up to 75% is possible and the price could plummet dramatically.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Is There a MobLand Episode 11 Release Date & Time?

2024-10-13 04:16