As a seasoned researcher with over a decade of experience in the cryptocurrency market, I find the current state of Ethereum (ETH) intriguing. The 4.50% daily gain and 1.35% weekly profit are promising, but they don’t tell the whole story.

Yesterday, Ethereum (ETH) saw a positive trend in its price, increasing by approximately 4.50%, as per data from CoinMarketCap. This rise has pushed its weekly earnings up to about 1.35%. The past trading week has been rather volatile. Nevertheless, some market signs suggest that Ethereum’s bullish breakout is still quite a distance away.

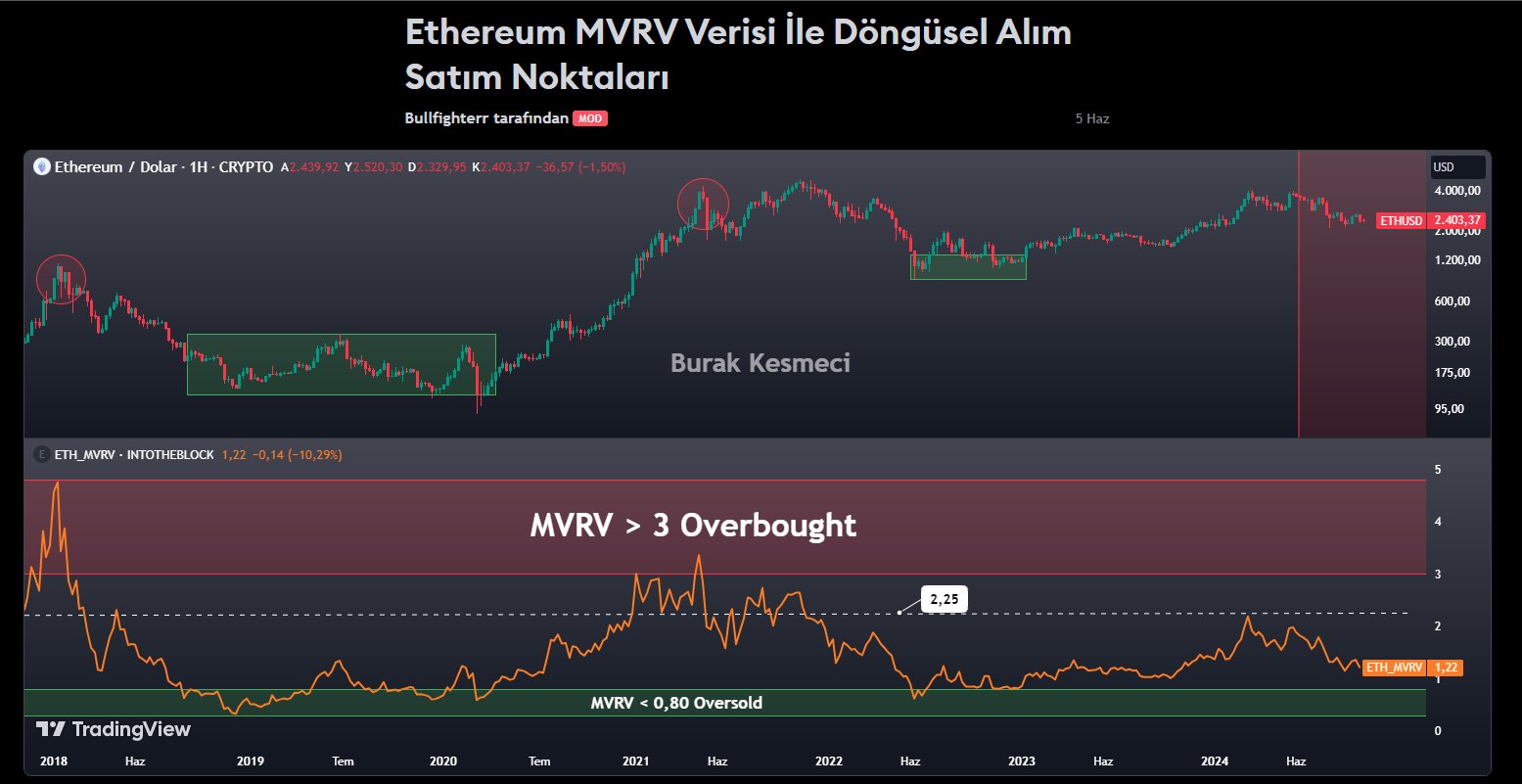

Ethereum MVRV Far From Critical Bullish Level, Analyst Says

In an X post on Friday, crypto analyst Burak Kesmeci shared an insight on the cyclical relationship between Ethereum’s price and its Market Value to Realized Value (MVRV) ratio, which he states can be used to identify buy and sell signals.

As per Kesmeci’s findings, key MVRV (Market Value to Realized Value) points of 3.00 and 0.80 during the recent bull and bear phases in the ETH market have proven significant in predicting price trends.

In simpler terms, when the Money-Value-to-Realized-Value (MVRV) of Ethereum exceeds 3.00, it often suggests that Ethereum is overbought and might be due for a price drop, giving investors a reason to sell with caution. Conversely, if the MVRV value goes below 0.80, historical data indicate that Ethereum could be considered relatively inexpensive or undervalued, potentially offering long-term investors an opportunity for aggressive buying.

In a closer examination, Kesmeci identifies 2.25 as a crucial MVRV threshold during an uptrend for Ethereum. According to the analyst, substantial price increases have typically occurred when Ethereum surpassed this MVRV value in the previous two market bull runs.

As Kesmeci indicates, Ethereum’s MVRM ratio (MVRV) is currently at 1.22 after dropping from 1.95 in the previous 120 days. If the MVRV continues to fall below 0.80, it could potentially signal a good buying opportunity as mentioned before. However, investors should wait for the MVRV value to increase significantly and surpass 2.25 before expecting a strong price surge or substantial rally.

Key Ethereum Support Zone Revealed

Recently, financial analyst Ali Martinez has pinpointed a significant support point for Ethereum. Based on data from IntoTheBlock, approximately 2.4 million wallet holders bought around $52.6 million worth of ETH at the price level of $2,300. If the price drops below this area, it could potentially spark a wave of panic selling in the market, leading to additional price decreases.

Currently, Ether (ETH) is being traded at approximately $2,458, representing a 4.51% increase over the last 24 hours. Yet, the overall sentiment among investors towards this altcoin is predominantly negative, or bearish. This negativity is evident in the 13.21% drop in its daily trading volume, which stands at around $13.45 billion. Ethereum, with a market capitalization of about $293.36 billion, holds the number two position among cryptocurrencies, trailing only Bitcoin.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-12 22:16