As a seasoned researcher with a penchant for deciphering cryptocurrency market trends, I find myself intrigued by the current state of Bitcoin (BTC). The recent surge above $63,000, while short-lived, could be a promising sign for a potential short-term bullish run. The key price level to watch is indeed $62,700, as highlighted by the insightful CryptoQuant analyst, Yonsei_dent. This level represents the average price at which many short-holders acquired Bitcoin, and a move above it could spark buying activity from these players.

Based on info from CoinMarketCap, Bitcoin (BTC) increased by 4.08% over the past 24 hours and momentarily traded above $63,000. This upward trend follows a dip where BTC was trading below $59,000 on Thursday. At present, the market is optimistic, but specific factors must be in place for a genuine bullish surge to occur.

Bitcoin On The Brink Of Short-Term Bullish Run

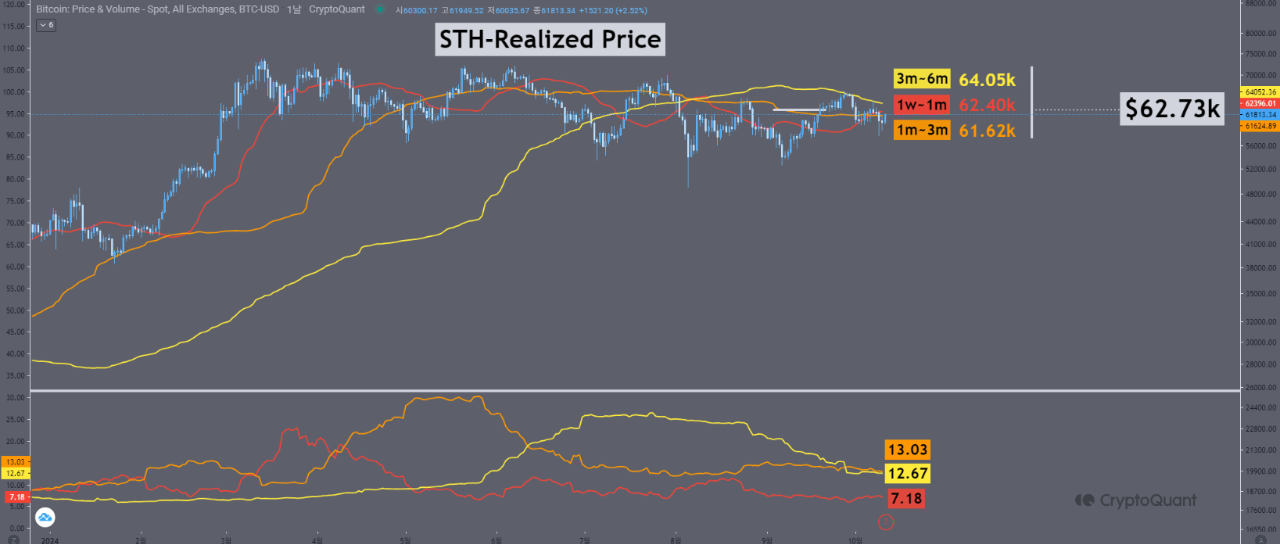

After Bitcoin’s price reached approximately $62,000 last Friday, an analyst from CryptoQuant under the username Yonsei_dent offered a crucial prediction about the asset’s possible price fluctuations.

In a recent Quickake post, Yonsei_dent points out that $62,700 is a crucial price point for short-term investors. This figure signifies the average cost at which numerous short-term Bitcoin holders purchased their coins, a level that has remained consistent over the past three months, as indicated by the analyst’s analysis.

Therefore, this level of $63,000 for BTC is crucial, as any movement beyond it could indicate a change in market direction and potentially stimulate buying among short-term investors. However, Yonsei_dent points out that Bitcoin must break through this threshold to generate a strong bullish trend over the next few weeks.

Following the price analysis, Bitcoin has momentarily surpassed $63,000, but subsequently dipped back to approximately $62,300. This swift surge may be attributed to a decrease in substantial trading activity, which is crucial for a convincing short-term bullish breakout as suggested by Yonsei_dent.

As a crypto investor, I’m observing that Bitcoin’s current trading volume stands at approximately $30.75 billion, showing a modest 2.94% growth over the past 24 hours. If Bitcoin manages to push its price back above the $63,000 mark, accompanied by heightened trading activity, it could potentially surge towards its next significant resistance level around $67,000.

Bitcoin Approaches Critical November

Contrary to widespread opinions, Bitcoin has had a rather bumpy ride in October. However, there’s optimism that it might still have a strong month, often referred to as “Uptober”. But looking ahead to November, there are signs that it could provide the necessary bullish momentum for the Bitcoin market. For instance, investors anticipate the Federal Reserve to reduce interest rates by 0.25%, which would increase liquidity for volatile assets like Bitcoin.

Additionally, it’s worth noting that the upcoming US elections are having a substantial impact on the crypto market as digital asset regulation is becoming a prominent topic in political discussions. There’s optimism among analysts that if Donald Trump, who is perceived as pro-crypto, wins against Vice President Kamala Harris, it could potentially trigger the long-awaited Bitcoin price surge.

At the time of writing, Bitcoin trades at $62,697 reflecting a 1.07% gain in the last week.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

2024-10-12 18:04