As a seasoned crypto investor with over a decade of experience in this dynamic market, I’ve learned to navigate through the ups and downs with a blend of caution and optimism. SUI‘s recent surge has certainly caught my attention, but as you know, every moonshot must be followed by a momentary fall.

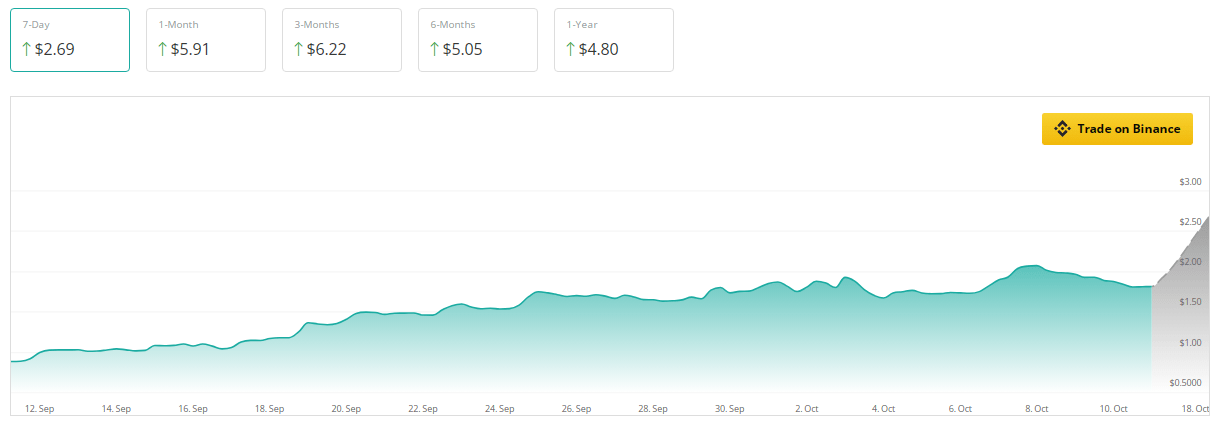

In the last month, the digital currency SUI (SUI) has experienced significant success, tripling its market cap and demonstrating impressive growth. A surge of over 100% in value pushed the token’s market cap above $5 billion. However, as is often true with cryptocurrencies, a temporary downturn is expected when something ascends – a period of decline that SUI may also experience.

The upward trend of the coin appears to be slowing down following several weeks of growing intensity. Investors are now keeping a close eye on how this previously scorching-hot asset will develop next. As per the crypto price forecast site CoinCheckup, SUI is currently being sold 220% cheaper than its predicted value for the coming month, which could indicate an underpricing situation.

Price Slips And Declining Market Activity

At the moment of reporting, SUI was valued at $1.84, marking a 5% decrease from the previous day. According to CoinMarketCap, trading volumes have also dropped by approximately 4%. This drop in activity seems to indicate, for now, a decreasing enthusiasm towards the token.

Over the past week, the technical indicators of SUI don’t appear to be improving significantly. Specifically, a measure called Chaikin Money Flow (CMF), which tracks money flowing into and out of the asset, has been trending downwards. This suggests that investors are withdrawing their funds from SUI, which can often lead to problems with price stability. Additionally, the CMF has dipped below zero, indicating that selling pressure is currently stronger than buying interest.

SUI: Slowing Momentum But Potential Bounce

As an analyst, I observed a sell-off in the token as its Relative Strength Index (RSI) dipped below a crucial threshold, suggesting a slowdown in momentum. However, there’s a silver lining to consider: if the RSI subsequently turns positive, it could potentially signal an opportune moment for investors who believe in SUI‘s long-term potential to buy back in.

If sales continue, experts predict that SUI could reach a test point at $1.70. This isn’t necessarily a bad thing, as solid support levels often attract buyers who see value in lower prices, which can lead to the price rising again. However, for SUI to escape its current slump, it must surpass the resistance at $2 – a significant barrier both fundamentally and technically speaking.

Cooling Interest

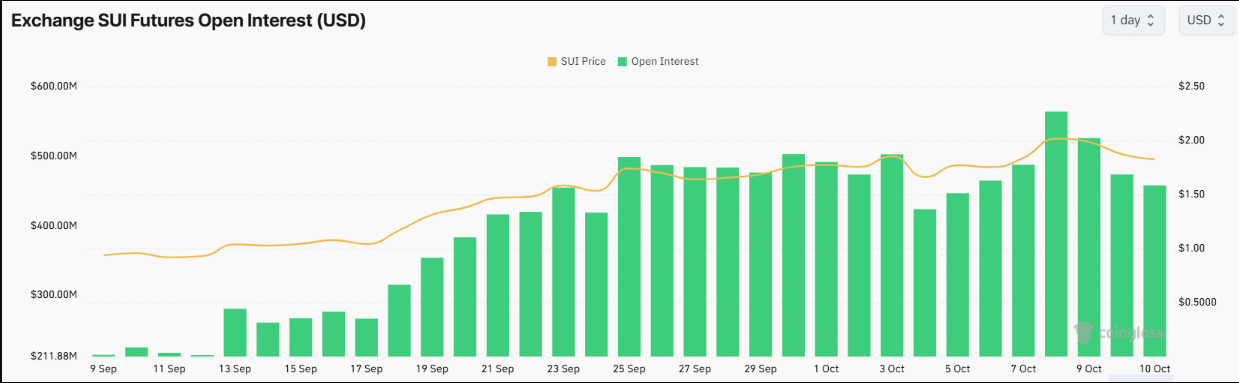

Recently, SUI has experienced a slowdown in its growth, with a drop from a peak of $560 million to $450 million in open interest over the past 24 hours. This decrease by 10% suggests that traders are closing their positions as enthusiasm wanes, potentially contributing to the overall downward pressure on the coin’s price.

As a researcher studying the trading landscape, I’ve noticed that a decrease in open interest might be perceived as an opportunity by some traders. This is because when prices fall, it often signals renewed interest from buyers, especially if they believe the asset (in this case, SUI) is undervalued.

Looking ahead, there’s optimism about SUI‘s potential in the long run. Over the course of the next three months, analysts predict a potential price surge of approximately 240%. Within the year, they foresee a 160% increase. For those with a long-term outlook, SUI’s future seems promising, although the path may be challenging at times.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-10-11 14:46