As an analyst with over two decades of experience in the financial markets and a keen interest in digital assets, I find Matt Hougan’s perspective on Bitcoin’s potential price trajectory to be both intriguing and plausible. His emphasis on the upcoming U.S. elections, the Federal Reserve’s monetary policy, and geopolitical factors aligns well with my understanding of market dynamics.

In a recent memo shared with clients, Bitwise CIO Matt Hougan emphasized several factors that could cause Bitcoin (BTC) to “melt-up” to $80,000 in the last quarter of 2024.

Factors To Propel Bitcoin To $80,000

In his analysis, Hougan identified three crucial factors potentially driving Bitcoin to reach fresh record highs by 2024. Of particular importance is the upcoming U.S. presidential election in November, whose outcome may shape the future direction of Bitcoin’s pricing.

As per Hougan’s perspective, any outcome other than a Democratic victory could potentially favor the leading cryptocurrency in terms of market capitalization.

In the memorandum, Hougan clarified that although the election is often perceived as a two-sided decision (with Donald Trump, the Republican candidate, considered beneficial for the crypto industry and Kamala Harris, the Democratic candidate, viewed as harmful), the situation on the Democratic side is actually more complex. He stated:

As a researcher examining the political landscape of cryptocurrencies, I’ve noticed a diverse range of perspectives within the Democratic Party. On one end, there’s Senator Elizabeth Warren (D-Mass.) who is often associated with an “Anti-Crypto” stance. Conversely, Representative Ritchie Torres (D-N.Y.) has shown strong support for the sector. Regrettably, over the past four years, the faction aligned with Senator Warren has held significant influence over policy and appointments within relevant agencies. This dominance has unfortunately fostered a hostile environment for the crypto industry.

Confidently, Hougan stated that a Republican victory would likely bring about a favorable situation for cryptocurrencies. Nevertheless, he pointed out a recent remark by Democrat Maxine Waters, implying that the Democratic party might eventually embrace digital assets, as she acknowledged their unavoidability.

Afterward, Hougan highlighted the U.S. Federal Reserve’s (Fed) reduction in interest rates. Specifically on September 18, the Fed reduced its key interest rate by 0.50%, causing a surge in cryptocurrencies. Additionally, the People’s Bank of China’s (PBoC) move to inject economic stimulus into their economy further ignited digital assets, fueling their growth.

It’s predicted that the financial market anticipates a further reduction of 50 basis points in interest rates by the Federal Reserve by the end of this year, combined with more fiscal stimulus from China. If these events transpire, the cryptocurrency market might experience a robust surge during Q4 of 2024.

In summary, Hougan suggested that if there are no major unexpected events, Bitcoin could potentially reach $80,000. However, potential setbacks like a large-scale cryptocurrency exchange breach, new legal disputes, or the release of previously restricted coins could disrupt this positive trend.

Key Ingredient For The Rip To $100,000 BTC

Additionally, Hougan mentioned that a surge in pro-cryptocurrency feelings is essential for Bitcoin to potentially hit the high target of $100,000 within the upcoming months.

He brought up the well-known “DeFi summer” of 2020 as an illustration and foresees a broader move across the cryptocurrency market, fueled by increasing adoption of stablecoins, advanced blockchain networks with high transaction speeds, and breakthroughs in passive income strategies.

In a recent statement, the CEO of cryptocurrency mining company CleanSpark, Zach Bradford, expressed his belief that Bitcoin’s value could potentially rise to around $200,000 within the next 18 months if favorable circumstances prevail.

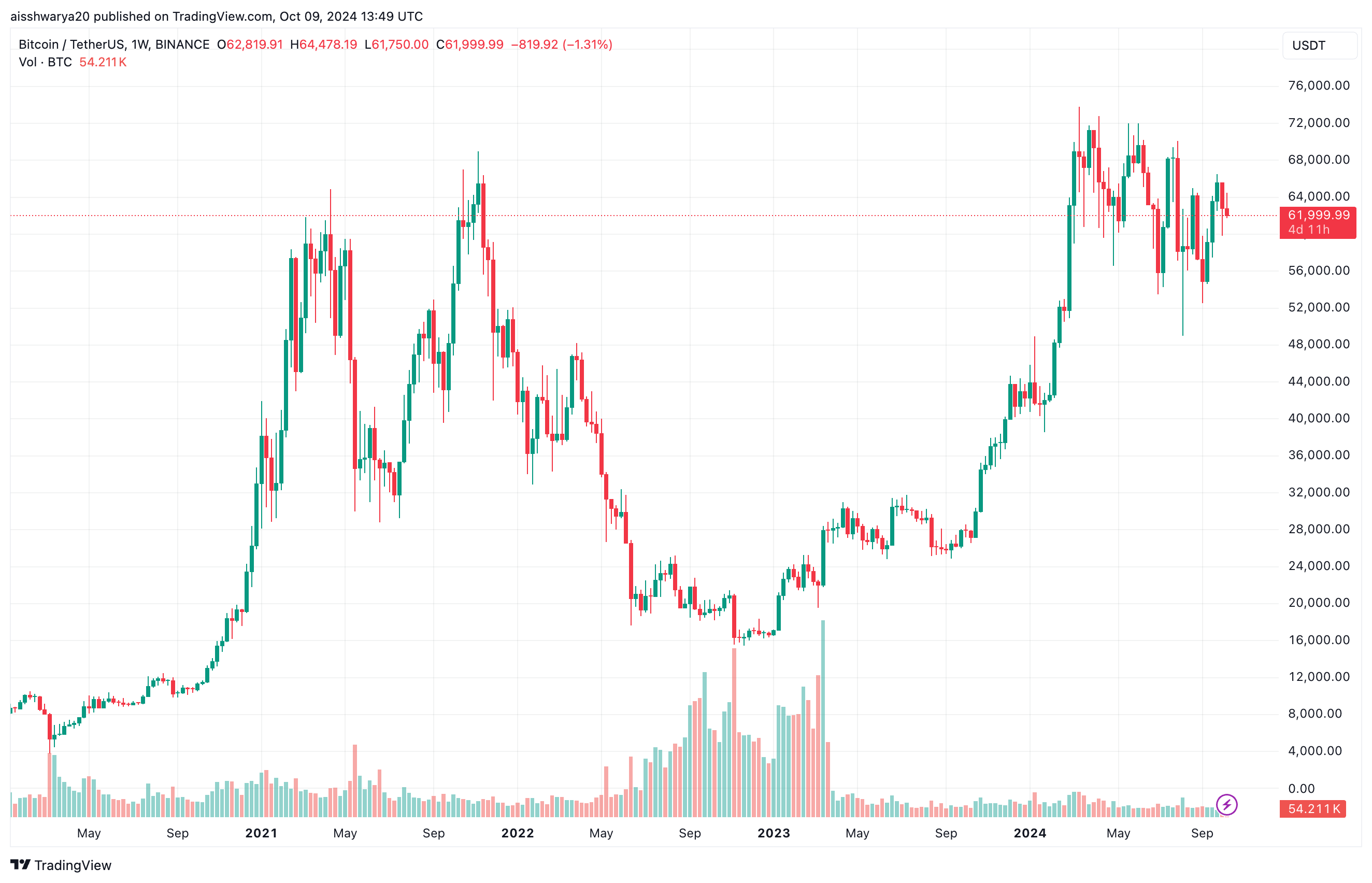

As a researcher examining current market trends, I must emphasize that the ongoing geopolitical tensions in the Middle East could potentially have a negative short-term impact on riskier assets like stocks and cryptocurrencies, including Bitcoin (BTC), which is currently trading at $61,999. In the past 24 hours, BTC has experienced a 1.4% decrease.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-10 13:16