As a seasoned crypto investor with a few battle scars from past market cycles etched into my trading portfolio, I find myself intrigued by the recent surge in Bitcoin’s UTXO Supply in Loss. Over the years, I’ve learned that when the tide turns, even the most hardened sailors can find themselves swimming against the current.

The quantity of Bitcoin currently at a loss, as indicated by on-chain data, has nearly reached 20%, following the recent downturn in its market price.

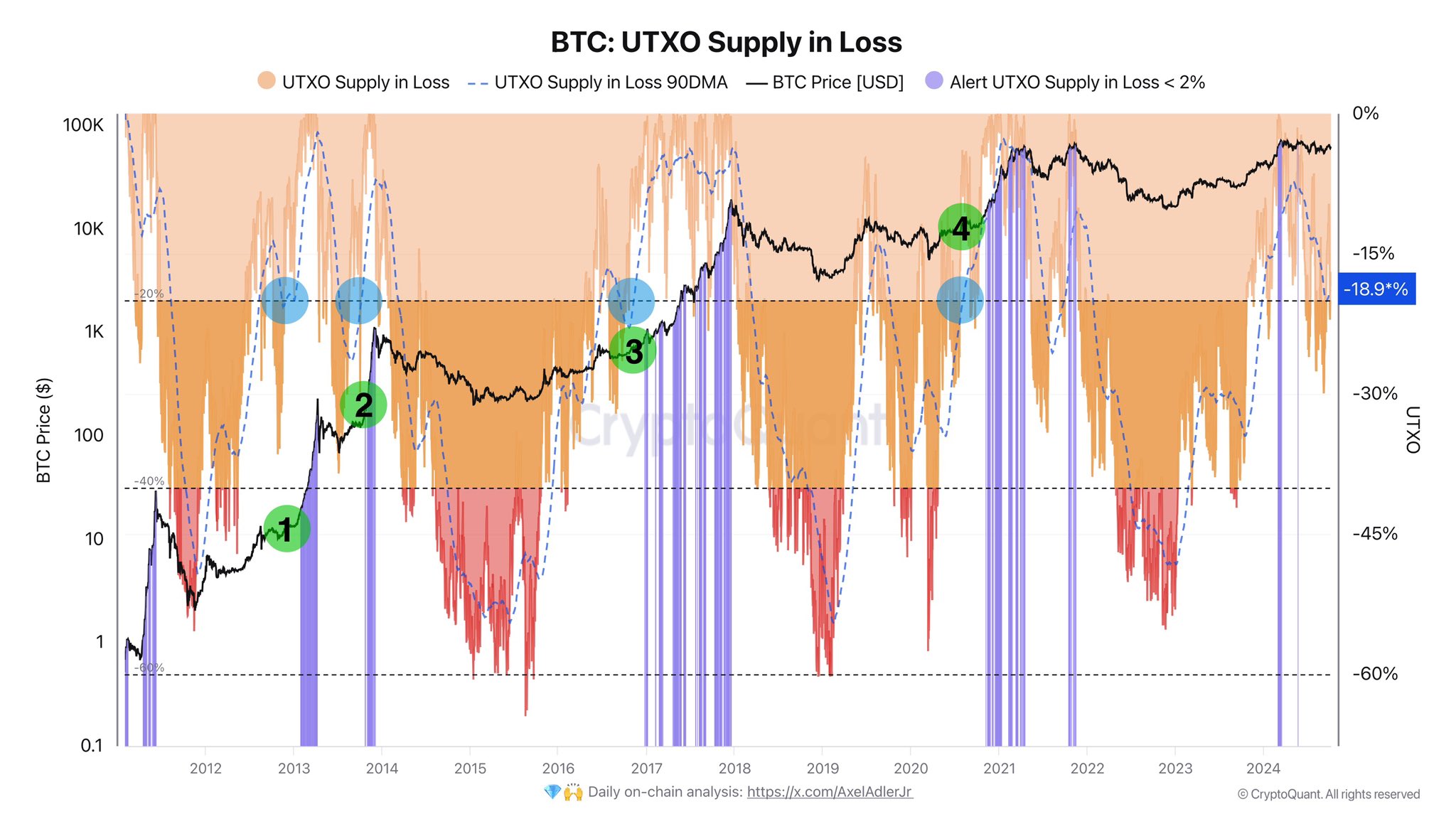

Bitcoin UTXO Supply In Loss Has Seen A Sharp Increase Recently

In a recent article on X by CryptoQuant’s author Axel Adler Jr, he discussed the current pattern observed in the Bitcoin Unspent Transaction Output (UTXO) Loss Ratio. The “UTXO Loss Ratio” refers to the proportion of all existing UTXOs (or just the Bitcoins themselves) that are being held at a net loss in value.

This tool operates by examining the transaction history on the blockchain for each active UTXO (Unspent Transaction Output). By looking at when these tokens were last transferred, we can determine the last price point they were traded, which is considered their cost basis since it’s the last time they changed hands.

When this cost basis for any UTXO is greater than the current spot price of the cryptocurrency, then that particular UTXO can be assumed to be underwater right now. The UTXO Supply in Loss adds up all UTXOs satisfying this condition to find what percentage of the total supply that they make up for. Like this metric, there also exists the UTXO Supply in Profit, which naturally keeps track of the UTXOs of the opposite type.

As an analyst, I’d like to present a visual representation I’ve prepared, which illustrates the historical trend of the Bitcoin Unspent Transaction Output (UTXO) supply in loss. This chart offers insights into the distribution of Bitcoins that have not been spent and may indicate potential selling pressure or hodling behavior within the market.

Observing the graph before me, it’s clear that the Bitcoin UTXO Supply in Loss dropped dramatically to the bottom (remember, this chart reads from zero downward due to its negative scale) when the cryptocurrency reached its all-time high (ATH) earlier this March. This is expected because when Bitcoin sets a new record, every investor realizes profits, so it’s only logical that the UTXO Supply in Loss would decrease to zero. However, as Bitcoin has experienced bearish trends over the past few months, we’ve seen an uptick in this metric’s value again.

In simpler terms, the 90-day moving average (MA) of the displayed indicator is nearing the 20% mark. As shown on the chart, the author of CryptoQuant has previously highlighted instances where this metric approached a comparable level.

Axel points out that in past instances, similar circumstances have occasionally led to a price increase. So, there’s a possibility that Bitcoin could experience another price surge under the current conditions too.

The decrease in the number of investors who are in profit might signal a reduction in potential sell-offs, which can be interpreted as bullish for Bitcoin, since when the UTXO Supply in Loss increases, it suggests that fewer investors are likely to offload their Bitcoins, leading to less selling pressure.

BTC Price

Yesterday, Bitcoin displayed a rebound above the $64,000 mark, but it seems that it couldn’t sustain this growth and has fallen back to $62,500 currently.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-10-09 08:11