As a seasoned analyst with over two decades of experience in traditional financial markets and a keen interest in the digital asset space, I find myself intrigued by Jeff Park’s insights into the potential impact of Bitcoin ETF options on market dynamics. His life experiences in navigating complex financial instruments and understanding risk management strategies seem to have played a significant role in his ability to grasp the nuances of this emerging market.

The potential fluctuation in Bitcoin‘s price could increase dramatically, potentially rising or falling, based on the recent approval of spot Bitcoin ETF options, as suggested by Jeff Park, head of Alpha Strategies at Bitwise Investments. In a discussion with Anthony Pompliano, Park elaborated on how these new options differ from existing cryptocurrency derivatives and why they might have a substantial effect on the dynamics within the Bitcoin market.

Why Bitcoin ETF Options Are A Game Changer

In his interview, Park explained a detailed argument about Bitcoin’s volatility, stating that it doesn’t only show past performance but rather represents the range of possible outcomes, including their severity. He highlighted that the arrival of Bitcoin ETF options could significantly alter the way traders engage with Bitcoin, possibly intensifying both its price increases and decreases. According to him, this instability is rooted in the distinctive traits of options as financial tools.

Bitcoin option markets aren’t exactly novel—entities such as Deribit and LedgerX have been offering similar products overseas. However, ETF options introduce a regulated market monitored by American authorities like the CFTC and SEC. As per Park, this is significant because “the offshore market hasn’t fully addressed counterparty risk, which crypto has yet to solve.” He pointed out that the clearing procedures offered by the Options Clearing Corporation (OCC) provide additional safety for these transactions, a feature institutional investors have long requested.

Essentially, Park underscored the unique benefit of cross-collateralization, a feature not found in platforms that specialize solely in cryptocurrency. In simpler terms, cross-collateralization enables traders to leverage non-correlated assets like gold ETFs as security for Bitcoin transactions. This added flexibility boosts market liquidity and efficiency. Park pointed out that this option is unavailable on platforms such as Deribit or any platform solely dedicated to cryptocurrency, labeling it a significant leap forward for the Bitcoin derivatives market.

Park predicts that these new options could amplify the fluctuations in Bitcoin’s price. He said, “A healthy market requires organic buyers and sellers to establish natural demand and supply.” But it’s the dealer’s strategy for hedging their positions, particularly when they are ‘short gamma,’ a situation where their hedging actions can boost price volatility, that truly makes a difference.

Put simply, Park explained that traders who hold a position with a high sensitivity to Bitcoin’s price fluctuations (referred to as being “short gamma”) must increase their Bitcoin purchases when prices rise and sell when prices fall. This back-and-forth action contributes significantly to the cryptocurrency’s volatility. Furthermore, he noted that traditionally, Bitcoin options trading has been more about speculation rather than strategies like covered calls, which usually help reduce price swings.

One significant aspect highlighted by Park is the significant expansion opportunity for the Bitcoin futures market. Typically, the value of derivatives markets in traditional sectors such as stocks can be up to ten times greater than the actual market (spot market). However, when it comes to Bitcoin, the current size of the open interest in derivatives only makes up around 3% of its spot market worth, based on Park’s data. “The launch of ETF options could potentially magnify Bitcoin’s derivatives market by as much as 300 times,” Park anticipates.

This influx could significantly boost available funds, but it might also escalate volatility because of the increased quantity of speculative transactions and the structural leverage derived from options. In simpler terms, Park said, “This huge amount is expected to bring new money and liquidity into this market, which may in turn lead to higher volatility.

“In the global economy, derivatives markets are far larger than the spot markets,” he added, pointing to the fact that in traditional asset classes like equities and commodities, derivatives play a critical role in risk management and speculation. “Bitcoin is moving toward a similar structure, and that’s where we’ll see the most significant price movements and liquidity,” Park concluded.

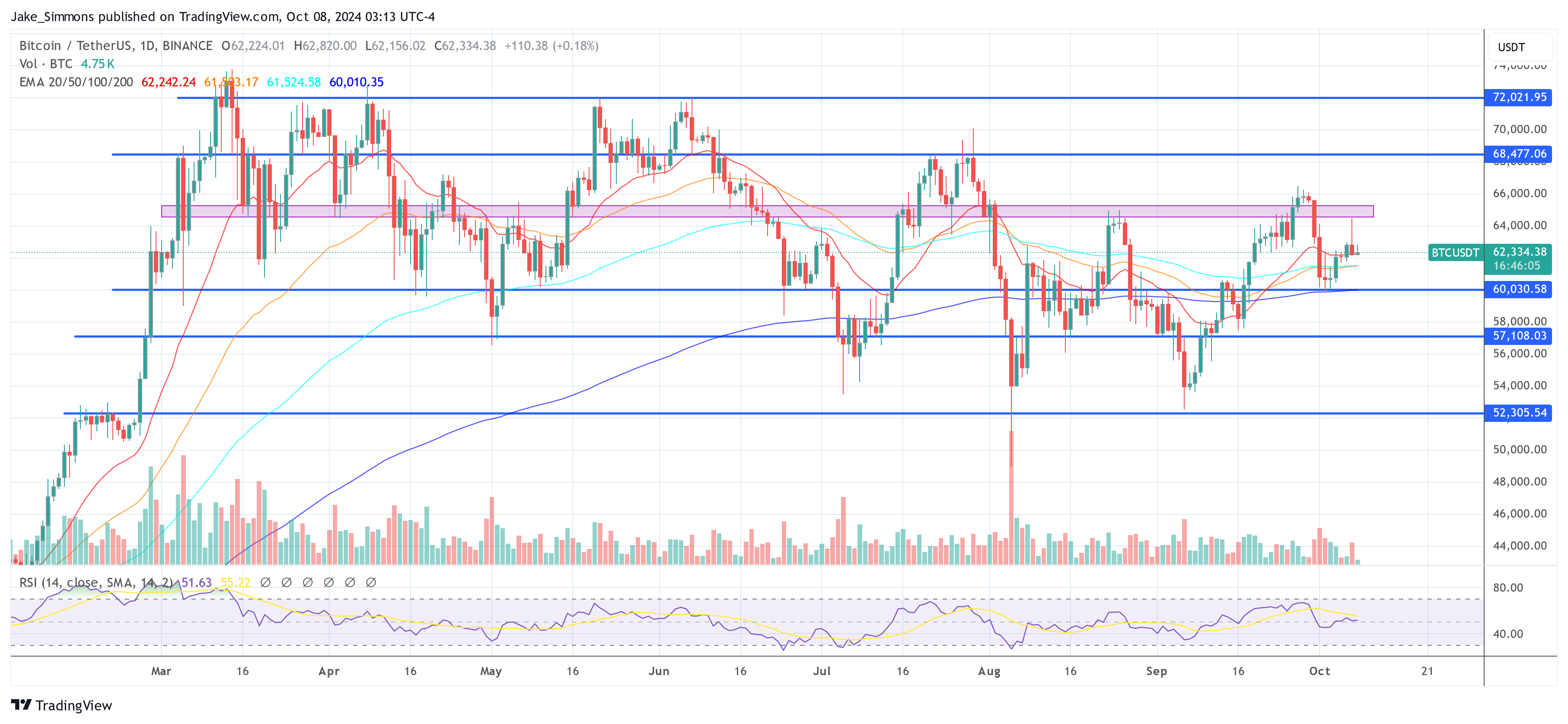

At press time, BTC traded at $62,334.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-10-08 17:10