As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. In the case of Ethereum (ETH), the current situation presents an intriguing mix of bullish signals and lingering uncertainty.

At present, Ethereum (ETH) is trading roughly 11% lower than its recent peak of approximately $2,730. Many investors are hopeful for an increase in price over the next few days, fueled by positive on-chain indicators.

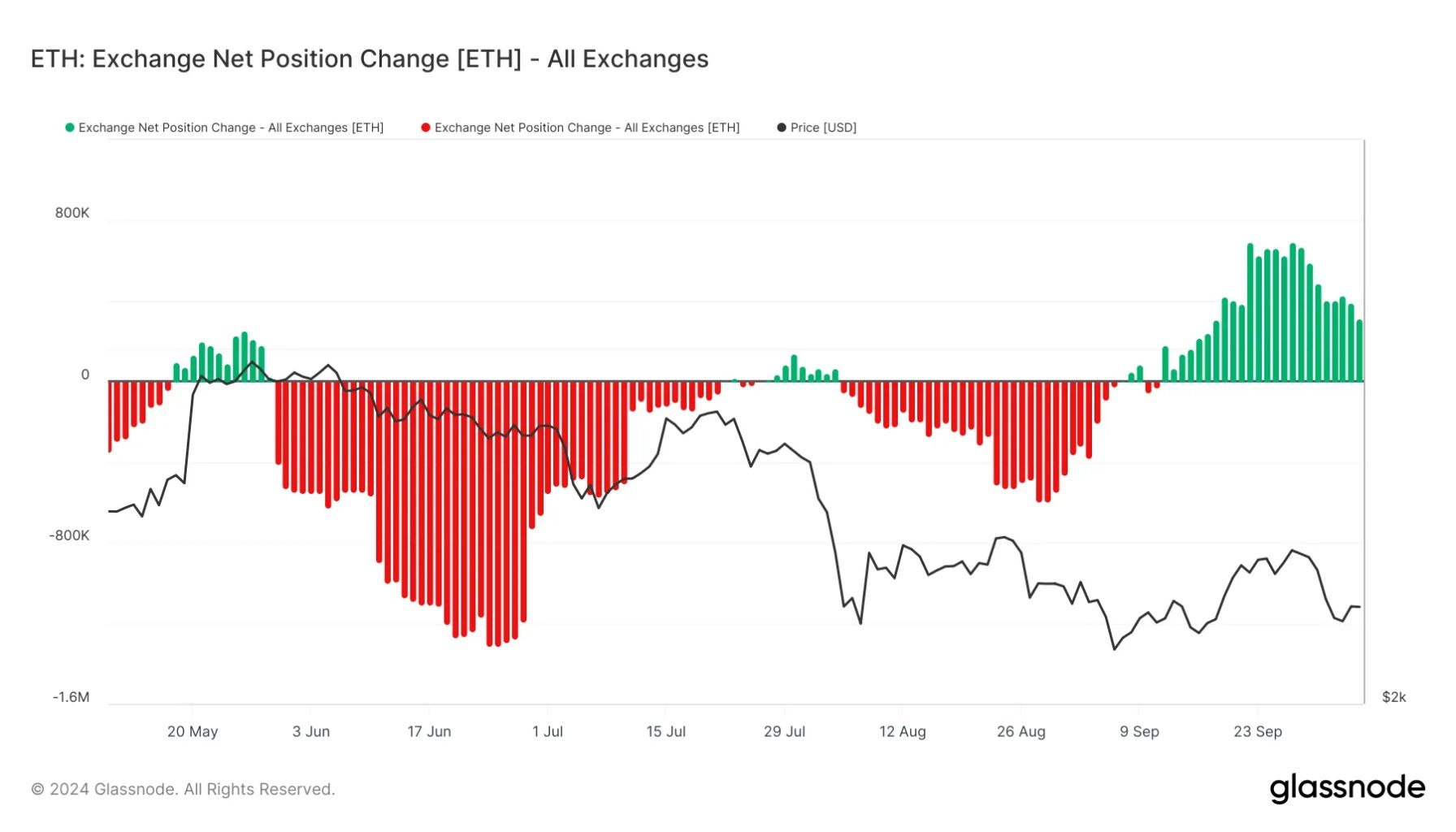

Data from Glassnode shows less Ethereum is being sent to exchanges, which might mean investors are keeping their holdings instead of cashing out. This pattern often signals increased hoarding and could potentially predict a strong market surge ahead.

As the crypto market undergoes change, Ethereum investors stay on high alert, hoping for a bullish surge that might boost prices even further. The drop in inflows into exchanges may indicate that traders are preparing for an uptrend, as they appear to be more focused on holding onto their investments during this critical period.

If Ethereum manages to surpass key resistance points, it could spark renewed optimism and draw more investors. The coming days are crucial for ETH as traders watch closely for indications of a comeback based on price fluctuations and on-chain data. Under favorable circumstances, Ethereum might aim for new peaks, bolstering the overall positive vibe in the crypto market.

Ethereum Exchanges’ Net Position Change Decreases

Right now, Ethereum (ETH) stands at a significant point in its price journey, having dipped by 15% from its recent peak. The overall cryptocurrency market is buzzing with excitement for a substantial surge following the Federal Reserve’s decision to lower interest rates a few weeks back. Yet, despite this positive outlook, prices have found it challenging to rise further, causing some investors to feel uneasy.

It’s promising to note that data from Glassnode indicates a decrease in the urge to sell Ethereum, potentially boosting market confidence and setting the stage for an anticipated ETH recovery. A significant factor to focus on is the Ethereum Exchanges’ Net Position Change measure, which has been decreasing since mid-September. This metric monitors the movement of ETH into and out of exchanges, and its recent decrease indicates a substantial drop in inflows.

A decrease in incoming funds often means there’s less urgency for selling among investors, since fewer individuals are transferring their holdings to exchanges with the intent of selling. This shift suggests a more optimistic outlook in the market, implying that investors might be less likely to offload their investments at current prices.

As the selling pressure eases, I find myself hoping that Ethereum might get a chance to regain its footing and rebound from its latest dip.

Furthermore, growing investor confidence could trigger a rise in Ethereum prices over the next few days. If this trend persists, Ethereum might experience a comeback, paving the way for a bullish surge as market conditions seem to favor it. Traders are keeping a close watch on ETH to determine if it can leverage this positive mood and regain its upward trajectory.

ETH Testing Crucial Supply Levels

Ethereum (ETH) is currently valued at $2,448 following its resistance at the 4-hour 200 exponential moving average (EMA) of $2,516 and difficulty in sustaining upward momentum above the 4-hour 200 moving average (MA) of $2,458. These occurrences suggest a crucial juncture for Ethereum. If ETH can’t regain these important levels over the next few days, it could be in danger of sliding towards the $2,200 region, which might initiate a more substantial correction.

Should Ethereum (ETH) successfully breach and maintain these key thresholds, it might suggest a bullish trend reversal, potentially paving the way for an upward push toward the $2,700 resistance zone. The coming days will be crucial in predicting Ethereum’s direction. I, as an analyst, am closely watching this development.

Keeping a keen eye on these price points is crucial for traders and investors, as reclaiming them could potentially give Ethereum the push it needs to recover and aim for higher value ranges. The current market fluctuations mirror a sense of doubt, so Ethereum must take a strong, clear stance to boost confidence and spark an upward trend.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-10-08 02:10