As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the recent surge in long positions for ETHUSDT on Binance. Having navigated through numerous market cycles, I’ve learned that the crypto world often defies conventional wisdom and traditional market indicators.

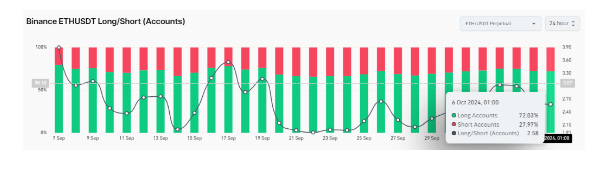

It’s worth noting that about 7 out of 10 ETHUSDT traders on Binance are currently holding long positions, according to data from the trading analytics platform CoinGlass. This bullish sentiment stands out since it follows a week where Ethereum was generally moving lower.

As a researcher analyzing market trends, it appears that the general sentiment among traders is optimistic towards Ethereum’s future price recovery within the upcoming week, as indicated by a predominant bias towards long positions. However, it’s worth noting that approximately one-quarter of Binance traders continue to maintain short positions on ETHUSDT, suggesting some degree of caution or skepticism in the market.

ETHUSDT Long Positions Soar: What’s Behind It?

Based on information from CoinGlass, it appears that most ETHUSDT traders are favoring a rise in Ethereum’s price over the next few weeks. It’s important to note that this trend is predominantly influenced by the actions of traders involved in the ETHUSDT perpetual contracts.

It appears that more traders are choosing to open long Ethereum (ETH) positions on Binance compared to those opening short positions, with a difference of about 2.58 times, suggesting a strong optimistic attitude towards ETH among certain trading groups.

Currently, it’s not fully understood why most Binance perpetual traders are choosing to buy Ethereum (go long on ETHUSDT), other than a broad positive outlook for the cryptocurrency’s future growth. This is because these positions do not have expiration dates, meaning they can be held indefinitely. In the last 24 hours, about 72.03% of such positions opened are long ETHUSDT trades.

Currently, approximately a quarter (27.97%) of Ethereum (ETH) and Tether (USDT) traders are adopting a cautious stance by opening short positions. This could indicate that they’re unsure about Ethereum’s long-term price growth. Conversely, over half (58.15%) of Bitcoin (BTC) and Tether (USDT) traders are buying (going long), while nearly a third (41.85%) have opened short positions within the last 24 hours.

While Binance may seem bullish on Ethereum, the overall crypto market sentiment seems less optimistic. Data from multiple exchanges suggests that traders are taking a more neutral approach towards Ethereum, with an almost even distribution between buyers and sellers. In fact, over the past 24 hours, the Exchange ETH Long/Short Ratio indicates that 49.05% of market participants are buyers, while 50.95% are sellers.

What’s Next For Ethereum Price?

On Binance, long positions indicate a bullish attitude towards an increase, but spot traders’ neutral sentiments hint at a more reserved viewpoint. As I write this, Ethereum is being traded at $2,420. Data from Coinmarketcap shows that the cryptocurrency has decreased by 8.38% over the last 24 hours.

From my analysis perspective, Ethereum appears to be testing a critical bottom trendline, teetering on the edge of potentially breaking downward. If the bulls fail to maintain this line, we could witness a slide of approximately 10.7%, potentially pushing Ethereum towards $2,150. However, should there be a rebound at this trendline, we might see Ethereum surging back up and challenging its resistance at around $2,700 as October unfolds.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

2024-10-06 17:46