As a seasoned analyst with over two decades of experience in the crypto market, I have witnessed numerous bear and bull markets. The current downturn has undoubtedly been challenging for many altcoins, including Injective (INJ), which has seen a 20% plunge since last week. However, I remain optimistic about INJ’s long-term prospects.

Amidst a market downturn due to pessimistic feelings (bearish sentiment), altcoins like Injective are being heavily impacted, causing losses for their holders. Injective, one of these affected altcoins, has experienced significant drops, with its token’s price decreasing by 20% since last week, signaling a robust bearish trend in the Injective market (INJ).

Regardless of the current market’s lackluster performance, the platform persists in solidifying its position as a top-tier Layer 1 solution. Although the recent losses for investors and traders are undeniably painful, ongoing advancements such as these have the potential to bolster investor trust in Injective and its token, helping to steady the shaken confidence within the community.

Network Metrics Show Stable Growth

October saw Injective’s network off to a fantastic start, as they revealed that the platform had handled an impressive 1 billion total transactions. This figure demonstrates the network’s ability to accommodate a rising user base, which has grown in tandem with the transactions.

1 BILLION TOTAL TRANSACTIONS ON INJECTIVE

This is just the beginning. Nothing can stop the rise of ninjas.

— Injective (@injective) October 2, 2024

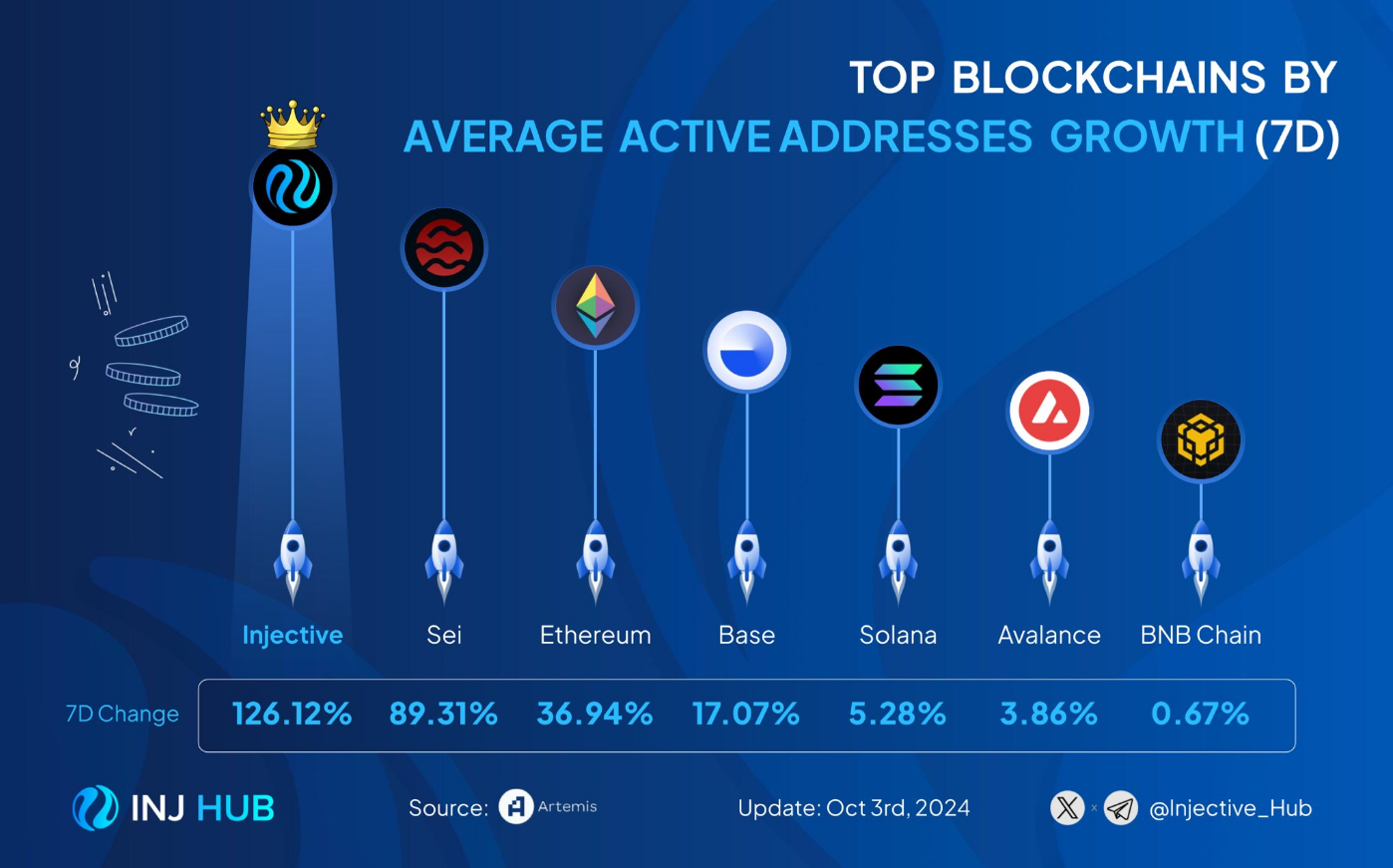

Injective Hub, an X account dedicated to showing the latest developments on the platform, recently shared that Injective experienced a huge growth spurt in active addresses. According to the post, the platform encountered an astonishing 126% average active address growth, ranking Injective to be top 1 in the metric outpacing the likes of Sei, Ethereum, Base, and Solana.

Top Blockchains by Average Active Addresses Growth (7D)

No need for words, just don’t fade this, nINJas! #Injective $INJ

— INJ Hub (@Injective_Hub) October 3, 2024

This month, there’s an exciting development: Injective is forming a partnership with Caldera, an Ethereum roll-up platform, which means they’ll be part of Metalayer. This partnership opens up a multi-chain operability for Metalayer users, thanks to the interoperability layer provided by Metalayer – a feature that allows various blockchains to work seamlessly together. Essentially, this collaboration will introduce Injective to a whole new user base on Metalayer, making it accessible to more people and paving the way for a fresh wave of interoperability among the involved blockchains.

Injective Poised For Higher Levels

Currently, INJ is being traded on an upward trend, with the bulls aiming to surpass the immediate resistance at $19.94. If successful, this could be a promising signal that investors and traders have been anticipating over the next few days.

According to the relative strength index, it appears our hypothesis could be valid. At present, the token is approaching a potential reversal zone that might influence its ongoing bullish trend. Over the last few days, INJ has faced some turbulence, but the market’s robustness combined with significant on-chain advancements should have a positive impact on the token’s value in the forthcoming weeks.

The strong link between INJ and Bitcoin, as well as the broader market, is crucial for understanding INJ’s future trends. If the leading cryptocurrencies show a downward trend in the near future, it’s likely that INJ will decrease towards around $17.71. On the other hand, should the market recover its bullish sentiment over the next few days, INJ should find support and stabilize at approximately $18.57.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-10-05 06:40