As a seasoned crypto investor with over half a decade of navigating the tumultuous waters of this digital market, I find Astronomer’s analysis to be not only insightful but also reassuring. Having weathered several altcoin seasons and bear markets, I can attest that the current struggles of altcoins are far from indicative of their potential for growth.

In a recent post on X, crypto expert Astronomer (@astronomer_zero) explores a question that has been on the minds of many in the cryptocurrency community lately: “Could there no longer be another ‘altcoin season’?” Given that Bitcoin‘s dominance (BTC.D) is increasing and altcoins are finding it difficult to match its performance, Astronomer presents a well-supported viewpoint that challenges the commonly held beliefs suggesting that the era of ‘altcoin seasons’ might have come to an end.

To start off, an astronomer addresses the challenges that individuals holding altcoins currently encounter within this market landscape. “Altcoins remain relatively undervalued while Bitcoin Dominance Index is soaring, and it’s true, those invested in ETH and other altcoins are finding it tough,” he highlights.

There’s a rising skepticism among investors that Bitcoin’s dominance might decrease again, causing uncertainty about another altcoin market surge. As Astronomer puts it, people are saying things like “The BTC ETF has transformed everything,” “Boomers won’t buy altcoins, so they won’t increase,” and “BTC is at an all-time high, but alts have not moved.” These statements are simple to understand and seem plausible because they align well with the current market trends.

However, he cautions against accepting these narratives at face value. “They give you a sense of comfort and a reason to not hold any alts, which is typically rough during accumulation stages, especially if the BTC chart ‘looks’ a lot better,” he adds.

For better understanding, let me share an alternate explanation of what’s known as an “altcoin season”: This is a period when the majority of cryptocurrency liquidity shifts from Bitcoin (BTC) to other assets such as Ethereum (ETH) and various alternative coins. During this time, the ratio of Bitcoin’s price against the rest of the market (BTC.D) decreases, while most altcoins experience a rise in value.

The Case For An Impending Altcoin Season

Astronomer lays out a series of facts to support his argument that an altcoin season is still on the horizon:

#1 Historical Precedence

As a seasoned crypto investor, I’ve noticed an intriguing pattern – every four-year rotation, we experience what I call the ‘big altcoin season.’ This cycle unfolds like clockwork, and it’s not just something you’ll find on historical charts; it’s etched in the collective memory of us who have navigated past cycles. An astronomer warns against a mindset that says “this time is different,” as such an approach often puts investors at a disadvantage. Instead, he encourages us to remember that history tends to repeat itself – “history rhymes/repeats,” he stresses.

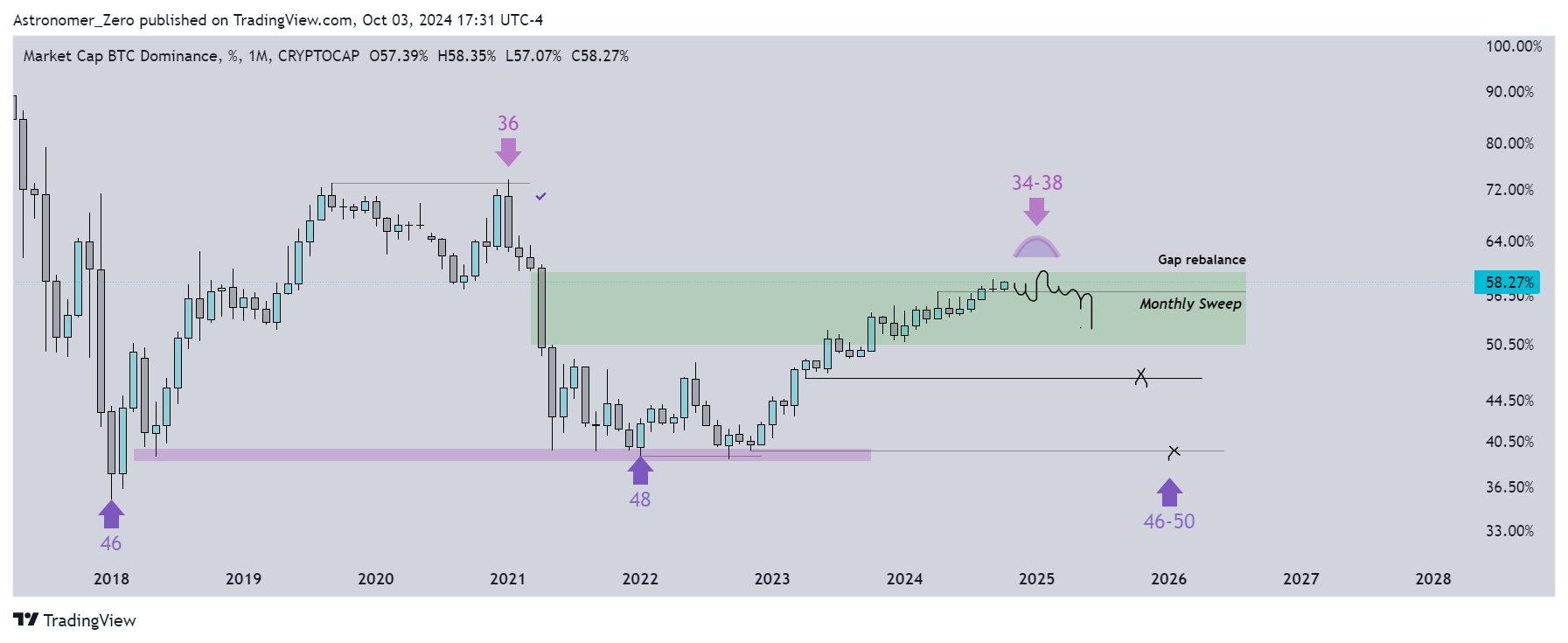

The BTC.D chart appears to be following its 4-year cycle, as suggested by an expert. He had forecasted that a peak in Bitcoin’s dominance would happen around months 34 to 38 of this cycle. Currently, we are in month 33 of the 4-year cycle, indicating a shift in trends could occur in just a short time. The analyst warns that continuing to believe Bitcoin’s dominance will persist without checking is essentially going against established cyclical tendencies.

As an analyst, I’ve observed a pattern that I refer to as the ‘first Grand Altcoin rotation.’ Typically, this event occurs towards the end of the third year in each cycle. Interestingly, it seems we’re witnessing this pattern unfold yet again, just as clockwork.

He uses the 2018-2022 period as a key illustration. “During this phase, LINK stands out as it was among the most robust altcoins within the top 100, delivering a massive 100x increase in just three years, while ETH (and other altcoins driven by Bitcoin’s liquidity) managed only a modest 3x return,” he points out. However, during the last year of that cycle, things changed: “ETH saw a 10x growth, and LINK followed with approximately another 3x increase.

Regarding the idea that the introduction of a Bitcoin ETF has significantly reshaped market behavior, Astronomer remains unconvinced. He expresses his viewpoint by stating, “The idea that a BTC ETF can halt alt season is greatly exaggerated.” He emphasizes that since their debut, ETF funds have amassed approximately $40 billion, whereas Bitcoin’s centralized exchange trading volume averages around $20 billion per day. “ETF inflows are minimal,” he explains, “which is why I rarely discuss them as I prefer to focus on the significant factors.

An astronomer emphasizes economic factors on a large scale that might boost the value of alternative cryptocurrencies. He states, ‘Interest rates are falling, and the amount of money in circulation in the U.S. is growing rapidly, with China now joining the trend. All we’re really waiting for now is Quantitative Easing (QE), which usually happens after an increase in M2 (with a delay).'” He goes on to say, “Historically, such monetary situations have been beneficial for altcoins.” Essentially, he adds, “When the monetary policy favors us, altcoins often perform well.

According to Astronomer, just because Bitcoin hits a new all-time high doesn’t automatically mean an altcoin season has started. Instead, he suggests that we should look at the passage of time and recurring trends as more important indicators than hitting specific price milestones. In simpler terms, he thinks that focusing on the timing and patterns of events is more relevant than just looking at when certain prices are reached.

At press time, Bitcoin traded at $61,129.

Read More

- Odin Valhalla Rising Codes (April 2025)

- POPCAT PREDICTION. POPCAT cryptocurrency

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- King God Castle Unit Tier List (November 2024)

- The Cleaning Lady Season 4 Episode 7 Release Date, Time, Where to Watch

- Jr NTR and Prashanth Neel’s upcoming project tentatively titled NTRNEEL’s shoot set to begin on Feb 20? REPORT

- All Active Brawl Stars Reward Codes (May 2025)

- Final Destination Bloodlines Box Office Beats Projections With Franchise Best Opening

- Green County map – DayZ

- Jurassic World Rebirth Trailer’s Titanosaur Dinosaur Explained

2024-10-04 17:11