As a seasoned crypto investor with a knack for navigating through market turbulence, I find myself in a familiar position amidst the current Bitcoin volatility. The Israel-Iran conflict and the impending US elections have undeniably added fuel to the fire, but the resilience of Bitcoin never ceases to amaze me.

This past week has been quite challenging for my Bitcoin investments, especially considering the increased volatility triggered by the ongoing Israel-Iran conflict. As we stand on October 4th, approximately $1.07 billion worth of Bitcoin options are set to expire, with a put-call ratio of 0.75 and a maximum potential impact at around $63,000. This situation has left me, and many other crypto investors worldwide, bracing ourselves for the upcoming market movement.

As the U.S. election is only six weeks away, there’s a high probability that Bitcoin might experience some fluctuation due to the tight race between Donald Trump and Kamala Harris. A widely used platform, Greeks.live, has indicated that all significant maturity implied volatilities (IVs) are presently at average rates compared to last year. Moreover, these IVs are expected to stay robust during the upcoming U.S. elections. The subsequent two weeks could offer a beneficial period for setting up positions before the fourth quarter.

Crypto analyst Ali Martinez observed an upward trend in the number of trades where people are buying more Bitcoins than selling them on the OKX platform. This rise, as per Martinez, suggests a significant surge in aggressive purchasing behavior, which might hint at a possible increase in Bitcoin’s value in the coming days.

On the OKX platform, there was an increase in the Bitcoin Buy/Sell Ratio, suggesting a significant rise in strong buying activity. This is often a signal of potential positive price movement in the near future.

— Ali (@ali_charts) October 4, 2024

After experiencing a drop of over 6% in its weekly performance, Bitcoin investors are holding back, watching closely for definitive signs before jumping into the next price movement. Quinn Thompson, head investment officer at Lekker Capital, advises taking advantage of this situation by purchasing Bitcoin during these temporary dips.

He added that the current price of around $61,000 is a no-brainer while adding that the “macro backdrop” of the BTC price action has changed significantly in comparison to the past drops.

BTC Price Surge Ahead as Demand Remains Strong

According to the on-chain analysis platform, Cryptoquant, there’s a significant chance that the short-term Bitcoin (BTC) price could rise, potentially easing the current selling pressure.

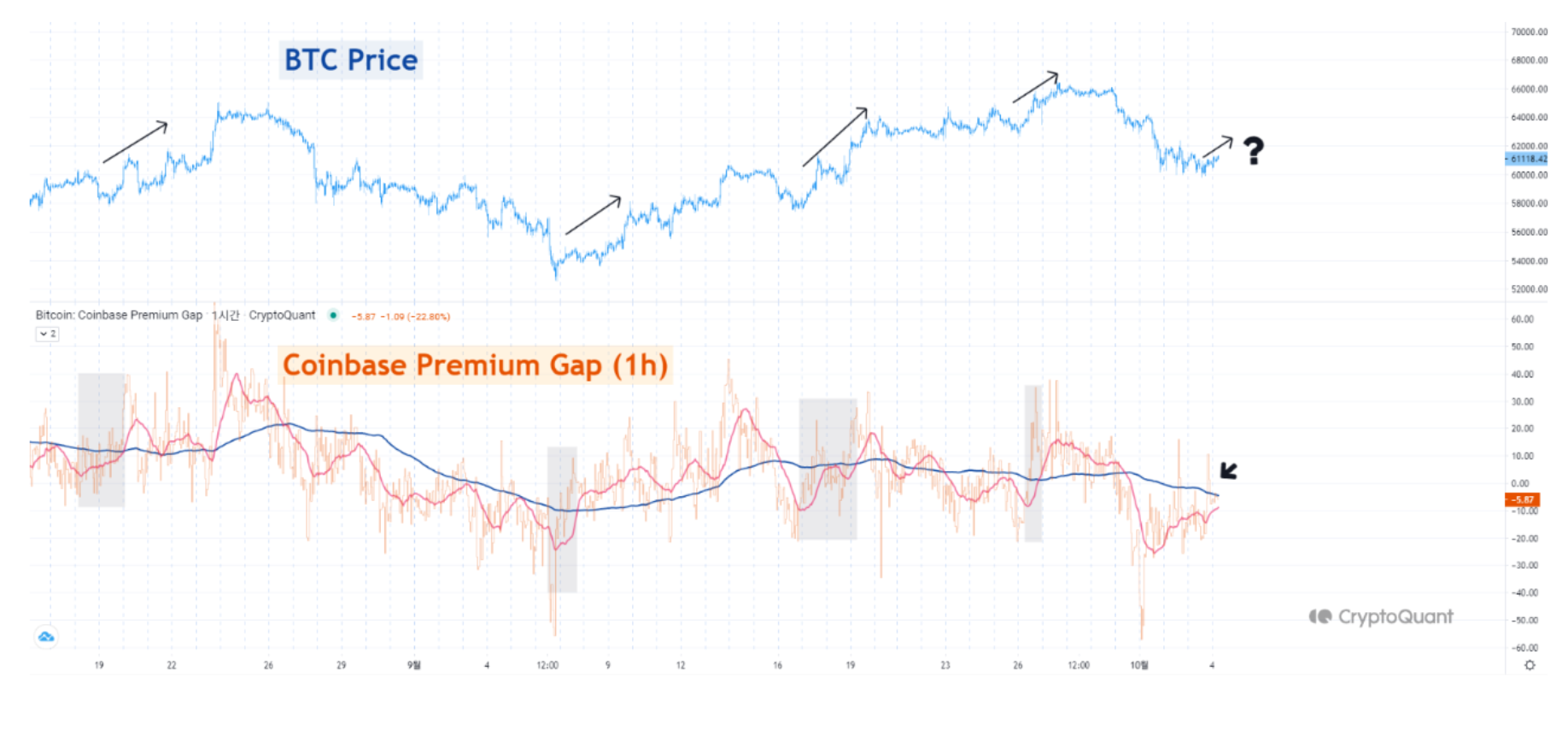

In a less visible aspect, there’s a robust demand persisting, as demonstrated by the popular Coinbase premium indicator. This indicator measures the price gap between the BTC/USD pair on Coinbase, the leading U.S. exchange, and the corresponding BTC/USDT pair on Binance.

Based on insights from CryptoQuant’s contributor Yonsei_dent, the sizes of moving averages in relation to the Bitcoin premium seem to correlate closely with particular Bitcoin price movements. In his own words:

To examine short-term trends, we studied the Coinbase Premium Index using a 1-hour interval. We used the 24-hour (daily) and 168-hour (weekly) moving averages to provide a broader perspective. Historically, when the daily moving average crosses above the weekly moving average with considerable momentum, we’ve noticed substantial price changes following this event.

Courtesy: CryptoQuant

Such a golden cross scenario occurred even during the last month thereby pushing up the BTC price to $66,000.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-04 16:06