As a seasoned crypto investor with a decade of experience under my belt, I must say that the recent Bitcoin price analysis by Ali Martinez and other analysts has given me pause for thought. The crucial support level at $60,365 is indeed an important one to watch, as a break below it could potentially trigger a further decline to $57,420.

As a crypto investor, I’m keeping a close eye on the market after analyst Ali Martinez has warned that the Bitcoin crash might not have run its full course, even though we’ve seen a relief rally pushing it up to around $61,000. Martinez emphasizes the significance of the $60,365 price level, suggesting that if we fall below this point, a potential drop as low as $57,000 could be on the horizon.

Bitcoin Needs To Hold Above This Price Level To Avoid Crash

According to Martinez in his recent post, the price of $60,365 is an important benchmark for Bitcoin. If it drops below this point, he predicts that the leading cryptocurrency could slide down to $57,420. Conversely, if it manages to stay above this level, he suggests a potential recovery towards $63,300. In essence, the direction Bitcoin takes will be influenced by the significant support at $60,000.

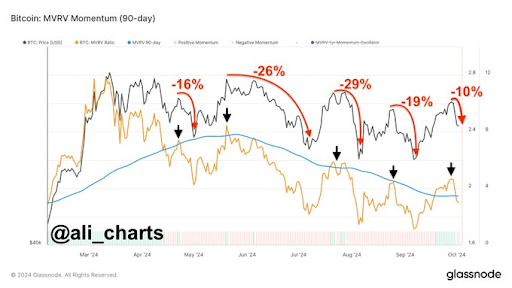

In another examination, Martinez proposed that Bitcoin might experience greater downward trends in the near future compared to a recovery. He disclosed that since May, every adjustment of the Market Value to Realized Value (MVRV) ratio from its 90-day average has historically resulted in a substantial drop for Bitcoin.

According to the analyst’s assessment, the recent price decrease of 10% was initiated by the latest rejection. This observation implies that Bitcoin might experience further price drops. Analyst Justin Bennett further speculates that the value could dip down to approximately $57,000. He also mentioned that it would be beneficial if there’s a break that allows short positions at $63,200 to be liquidated.

As I delve into my ongoing analysis, I find myself referring to the highly anticipated U.S. Job Report due out on October 4th. This analyst predicts a surge of volatility in the markets, particularly given the inflation data accompanying the report. Should the job report show weakness, it might trigger a Bitcoin plunge reminiscent of the one witnessed in August, driving the leading cryptocurrency down to $54,000. Moreover, the inflation figures are crucial as they will shed light on whether investors can anticipate more interest rate reductions from the Federal Reserve this year.

Experienced Bitcoin trader Peter Brandt appears to hold a bearish stance currently. He’s pointed out a ‘Three Blind Mice’ pattern emerging on the Bitcoin graph, suggesting that the cryptocurrency might experience a downward shift after its upward trend in October, hinting at a potential bearish reversal.

Why A Price Crash Could Be Good

According to Santiment’s analysis, a potential drop in Bitcoin’s price could pave the way for further growth. This is because there appears to be a decrease in public enthusiasm towards cryptocurrency following Bitcoin’s recent 9% decline from its peak of $66,400 on September 27.

Santiment contends that it’s uplifting since financial markets often go against the general public’s expectations. Given this pattern, there’s a possibility for an unexpected surge in the Bitcoin price, as sentiment among market players seems to be increasingly negative towards its future course.

According to Ali Martinez, Bitcoin is presently experiencing a phase of calm confidence and could use a cooling-off period before resuming its upward trend.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-10-04 15:40