As a seasoned market analyst with over two decades of experience under my belt, I’ve seen countless market fluctuations and trends that would put a roller coaster to shame. However, nothing quite compares to the unpredictable dance of Bitcoin.

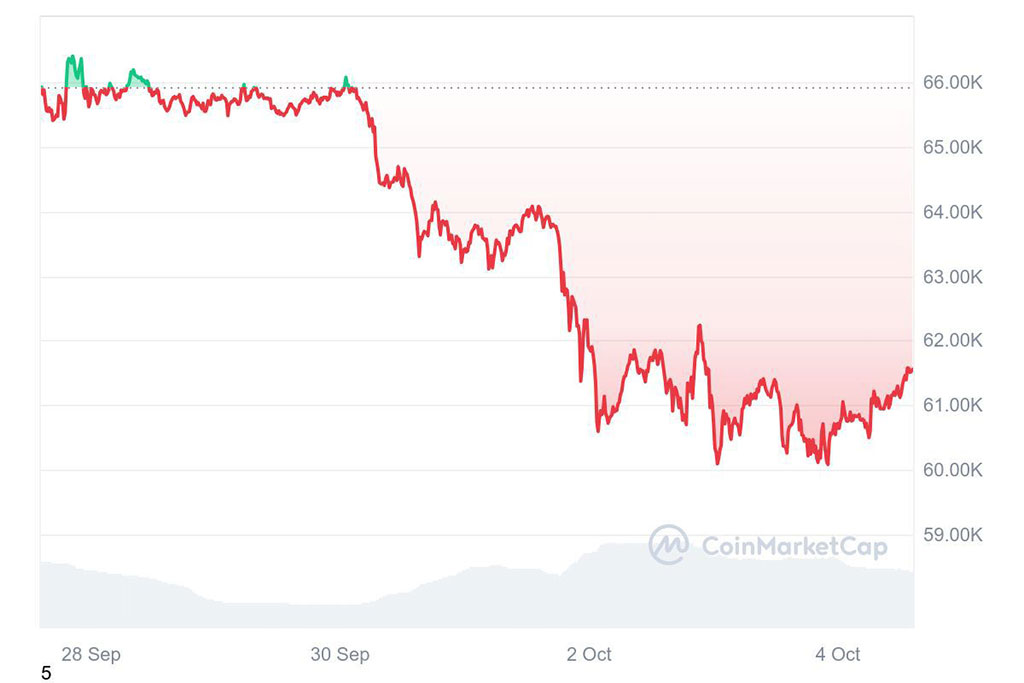

Bitcoin (BTC) currently stands at $61,283, marking a 6% decrease since September 30, 2024. Quinn Thompson, Chief Investment Officer at Lekker Capital, considers this dip as an excellent time to buy, viewing the current price as a strategic opportunity for investors to amass more Bitcoin. He bases this on shifts in the broader economic environment.

Photo: CoinMarketCap

On October 3rd, Thompson publicly presented his insights regarding X (previously known as Twitter). Within this analysis, he showcased a graph illustrating Bitcoin’s price fluctuations from March 5th, 2024 – when BTC attained a high of $73,700. This graph emphasized Bitcoin’s price instability and its recent decline, causing Thompson to draw parallels with historical market patterns.

As a researcher, I typically focus on long-term perspectives, but the recent 180-degree change in the broader market landscape presents an opportunity that seems too compelling to pass up. This area, similar to three previous instances, appears to be a prime candidate for bidding, given the clear invalidation of earlier patterns.

— Quinn Thompson (@qthomp) October 3, 2024

Previously, Bitcoin has dropped below its 200-day moving average on three separate occasions, which is a significant indicator for traders evaluating an asset’s medium-term resilience. Interestingly, in the present context, Bitcoin bounced back shortly after hitting this level. Thompson suggests that this swift recovery might be indicative of a substantial change in the overall economic environment, implying that Bitcoin’s price may surge upwards once more in the near future.

Geopolitical Tensions Fuel Bitcoin Bitcoin Sell-off

Thompson showed optimism towards the market, implying that despite temporary volatility, it remains a good time to invest. He highlighted geopolitical conflicts, especially Iran’s military actions against Israel in the Middle East, as events causing turbulence in global markets. Additionally, he referred to broader economic uncertainties, which have resulted in a decrease in risky assets such as Bitcoin.

Concerns about the robustness of the U.S economy and the unpredictable results of the November elections have sparked market turbulence, causing investors to lose confidence. This change has diminished the excitement typically associated with “Uptober”, a nickname for October’s generally strong performance in the crypto world. With markets pulling back, references to “Uptober” on social media have decreased.

Thompson’s perspective echoes that of analysts like Maksim Balashevich from Santiment. While they both observe a decrease in optimism, they suggest this could potentially pave the way for a temporary improvement. However, Balashevich adds a word of caution, indicating it remains uncertain whether the broader downward trend in Bitcoin has truly come to an end. This demonstrates the divided outlook among investors regarding Bitcoin’s future trajectory.

🎃 References to “Uptober” have noticeably decreased, suggesting that traders are less enthusiastic about October being an inherent cash generator for cryptocurrencies. This pessimism could potentially lead to a temporary market recovery. 📈

— Santiment (@santimentfeed) October 3, 2024

Bitcoin Dips Hint at October Surge

Historically, October has demonstrated robust growth in the cryptocurrency market, with an average increase of more than 20% over the past 11 years (as per CoinGlass). The majority of these gains usually happen during the latter half of the month. However, at the start of October 2023, Bitcoin saw a dip of 7%, reaching $26,650. Yet, within just two weeks, it skyrocketed almost 30%, concluding the month at $34,500. This trend has prompted traders to anticipate another significant rise this October.

At present, Bitcoin’s 6% drop followed by indications of recovery gives rise to a guarded optimism among investors. Notably, Quinn Thompson, a prominent figure, advocates purchasing during these dips, a stance supported by past trends. It is crucial for investors to evaluate this advice, taking into account both potential risks and benefits in the current market scenario.

In the rapidly developing world of cryptocurrencies, significant global occurrences, economic indicators, and technical studies are shaping investment tactics. The upcoming period could hold the key to whether Bitcoin will replicate its usual October growth spurt or blaze a new trail in this dynamic financial landscape.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-04 13:20