As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I find myself constantly seeking out analysts like Dan Gambardello whose insights can help navigate through the turbulent seas of Bitcoin price action. His latest video analysis on the potential final major dip in Bitcoin has certainly piqued my interest.

In a recent video analysis titled “Bitcoin‘s Key Signal Suggesting the Last Major Price Drop,” well-known crypto analyst Dan Gambardello (who has over 370,000 subscribers on YouTube) examines the latest trends in Bitcoin to predict what might be the final significant price drop. The market has been gripped by fear following a dip as low as $60,000 on Wednesday, which has sparked concerns about a potential further price plunge.

Why This Could Be The Final Leg Down For Bitcoin

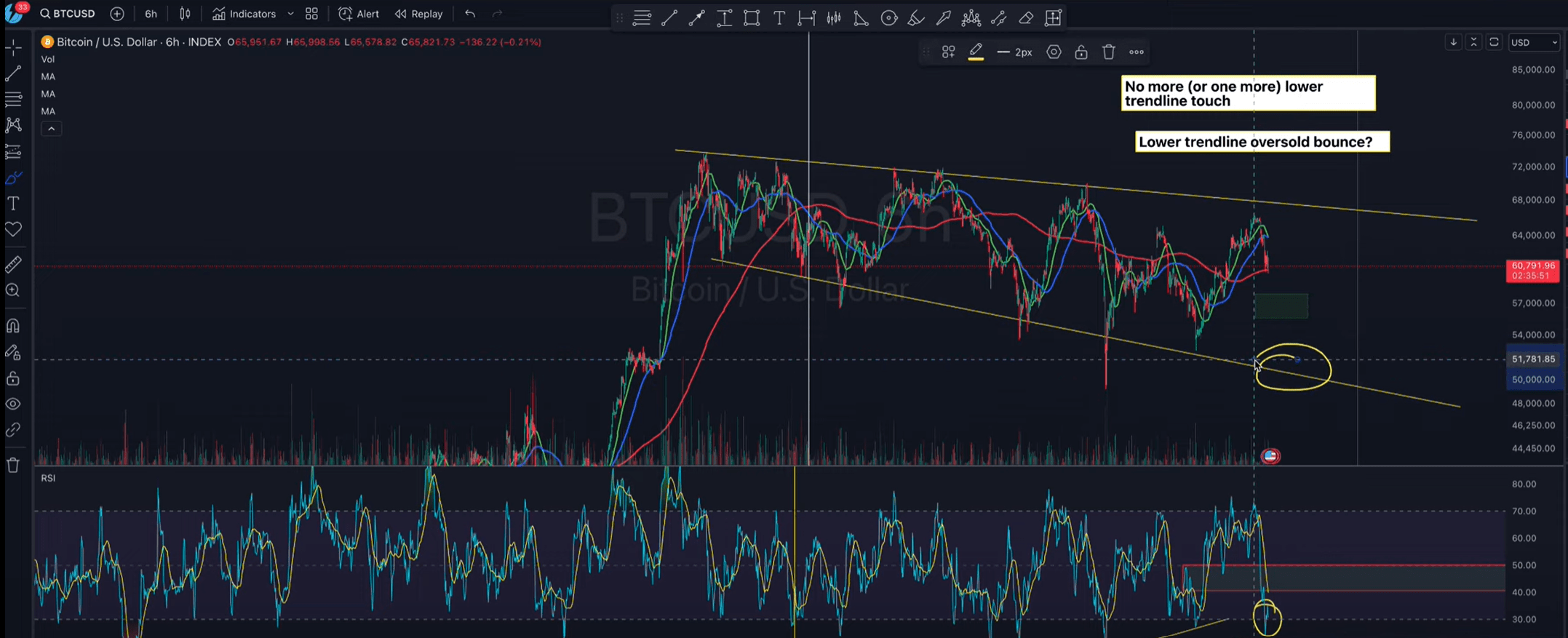

Gambardello highlights the importance of looking at both daily and six-hour Bitcoin charts. At present, Bitcoin is encountering the 50-day moving average on the daily chart, which frequently functions as a gauge for short-term investor feelings.

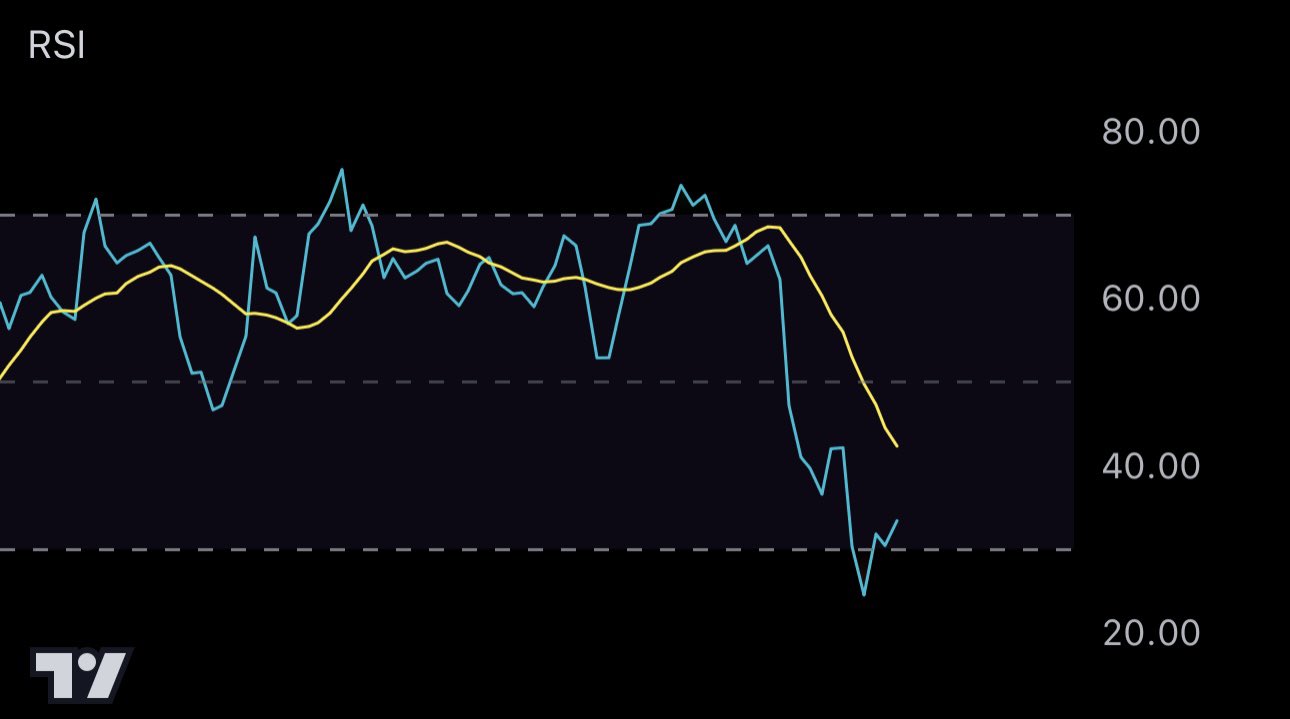

Instead, consider this: The analyst primarily looks at the Relative Strength Index (RSI) on the six-hour chart, a tool that measures the pace and direction of price fluctuations. Remarkably, it’s reached oversold levels. As per Gambardello, when the RSI gets to oversold territory, it’s often seen as a positive sign, suggesting that the current price downturn might be nearing its end.

In simpler terms, Gambardello mentioned that we might be near a turning point. There could be a quick selloff soon, but he anticipates a substantial rebound afterwards. This suggests that while there may be short-term market turbulence due to the Israel-Iran conflict, the underlying strength indicates a robust recovery in the future.

As a crypto investor, I find myself particularly intrigued when the Relative Strength Index (RSI) is significantly oversold for six hours right at the onset of a bull market. It’s also an encouraging sign during the bull phase itself.

According to his examination, this claim is based on how Bitcoin’s market has behaved historically under similar circumstances, emphasizing its tendency to cycle. By comparing current conditions with past data, Gambardello underscores the recurring trends in Bitcoin’s price fluctuations during October. Specifically, he points out that Bitcoin typically starts off by decreasing but then recovers strongly by month-end.

According to Gambardello, October is likely to conclude with a positive trend. This pattern often occurs after a dip, causing some anxiety among investors. However, he suggests that this provides us with additional time. As we’re currently seeing many red candles leading up to October, he predicts that another week, perhaps even two weeks, could lead to a significant increase or breakout, resulting in a favorable end to October.

Delving even further into the examination, Gambardello explores various possibilities regarding Bitcoin’s consistent support level, its lower trend line over the previous six months. He proposes that should Bitcoin revisit this trend line, it could potentially act as a strong foundation, possibly signifying the final significant dip before an extended period of growth moving upward.

Significantly, if the trendline is slightly adjusted, it might lead Bitcoin’s price to drop to approximately $50,000. Yet, Gambardello believes this scenario is less probable because the Relative Strength Index (RSI) for a 6-hour period has reached an oversold state, and Bitcoin is currently rebounding from its 50-day moving average.

Additionally, Gambardello highlights Bitcoin’s historical pattern during halving periods, where they often lead to bull markets, as demonstrated in 2016 and 2020. He posits that this trend may continue in the current year. “Is this a Halving year? We saw what happened in 2020 and 2016 around October. Could history repeat itself?

At press time, Bitcoin traded at $60,899.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-10-03 15:40