As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen countless coins rise and fall, and BONK is no exception. The recent selling pressure on BONK has been a familiar sight in this volatile market. While it was poised for a significant 92% rally upon breaking through the resistance level at $0.00002400, the missed opportunity due to a shift in investor sentiment has pushed the price down by 12.5%.

Recently, the meme coin BONK has experienced a notable surge in selling activity, contributing to a decline as the broader market corrects. This downward trend occurred after a significant breakout point, which, if held, could have potentially triggered a massive 92% upward rally. Unfortunately, a sudden change in investor sentiment prevented BONK from capitalizing on this opportunity, leading to a 12.5% drop in its price, currently standing at $0.0000214. The 24-hour trading volume has reached $741.72 million, and the coin’s market cap is estimated at $1.52 billion, with a 24-hour volatility of 4.0%.

From early September onwards, based on the Chaikin Money Flow (CMF) indicator, there has been a steady rise in capital investment in the Solana meme coin BONK. This surge in investment is considered a strong bullish signal, indicating that investors are optimistic about a potential price increase for BONK in the near future.

As BONK got closer to surpassing the significant barrier at $0.00002400, the Chaikin Money Flow (CMF) indicator began to slope downwards instead.

As a crypto investor, I’ve noticed a shift in the broader market sentiment towards bearishness, leading me to observe other investors withdrawing their funds. This withdrawal of capital has caused the price of BONK to falter, losing its momentum and ultimately breaking through the critical resistance level.

Photo: TradingView / BeInCrypto

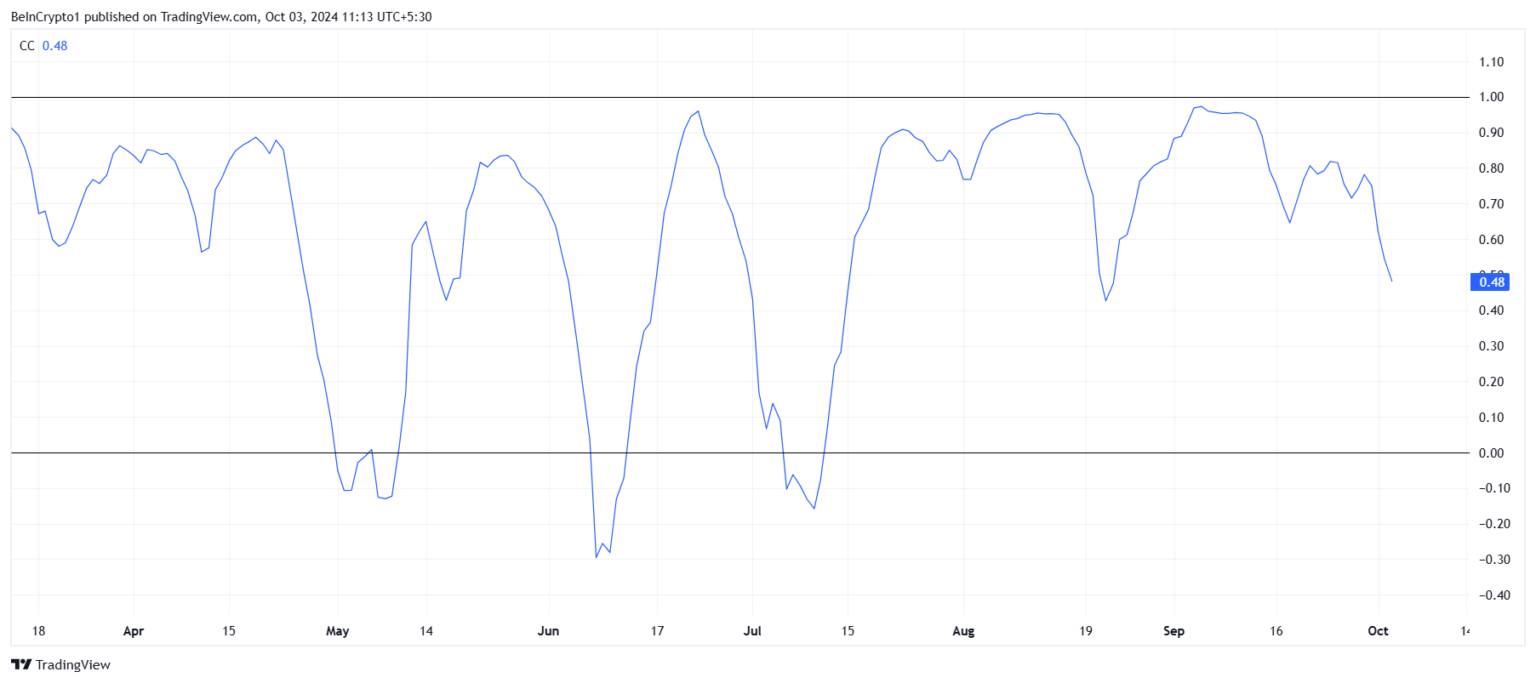

Moreover, the overall market outlook for BONK indicates significant hurdles ahead. In the past few weeks, BONK’s connection with Bitcoin (BTC) has weakened, currently at 0.48. This low correlation serves as a warning sign, suggesting that BONK isn’t capitalizing on Bitcoin’s price surge. Many altcoins that have a stronger association with BTC have already seen growth in September.

BONK’s relationship with Bitcoin is not strong, which means it doesn’t have the widespread backing needed to sustain a rally. As this bond weakens, BONK might find it challenging to generate its own upward trend since it tends to follow Bitcoin’s price fluctuations rather than setting its own course.

Photo: TradingView

BONK Price Action Ahead

Previously, the value of BONK had been moving inside a pattern called a descending wedge, which suggested an impending breakout. This potential breakout could have propelled BONK’s price up by approximately 92%, reaching its maximum historic level at $0.00004800. Unfortunately, the breakout did not materialize as expected, thus moderating optimistic predictions.

If BONK can’t maintain its position at approximately $0.00002153, it might move into a period of stability above roughly $0.00001732, delaying any potential price increase. For the coin to try another push upward, more convincing bullish indications will be required.

Photo: TradingView

If the overall trend of the cryptocurrency market changes direction, the price of BONK may experience a change in its momentum as well. At present, for BONK to achieve this, it must first surpass $0.00002748, transforming this level into support. This move could help the Solana meme coin escape its current bearish phase and initiate an uptrend that could lead it back toward its previous highs.

Alongside BONK and PEPE, the broader meme coin market is experiencing a significant sell-off. PEPE’s price currently stands at $0.0000 with a 24-hour volatility of 5.4% and a market cap of $3.80 billion. Similarly, WIF is also plummeting by a similar magnitude with a current price of $2.15, 24-hour volatility of 6.6%, market cap of $2.14 billion, and a 24-hour volume of $1.18 billion. The impact of the Fed rate cut and liquidity infusion has yet to fully manifest, and it remains to be seen when the altseason will truly commence.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-03 14:12