As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find the recent developments surrounding Dogecoin intriguing. Having been through several bull and bear markets, I can tell you that the 72% increase in new DOGE addresses over the past week is not something to be dismissed lightly.

Recently, Dogecoin (DOGE) has gained significant attention due to positive on-chain indicators suggesting a possible bullish trend ahead. On October 1st, a well-known crypto analyst, known as Ali on X, shared some intriguing insights about Dogecoin. According to his tweet, the Dogecoin network has experienced substantial growth over the past week, with an impressive 72% rise in new DOGE wallets.

He went further to say that on Monday alone, 19,630 new DOGE addresses were created. This surge in the number of new addresses suggests that more people are getting involved with Dogecoin. The rising interest in this meme coin could have been motivated by the growing positive sentiment in the general crypto market. There have been various thoughts about an upcoming bull rally, with many top analysts suggesting that October could actually be an “Uptober” for cryptos.

There’s a substantial surge happening within the Dogecoin network! In the last seven days, we’ve seen a 72% spike in newly created Dogecoin wallets. Yesterday itself witnessed an impressive addition of 19,630 new Dogecoin wallets!

— Ali (@ali_charts) October 1, 2024

Given Dogecoin’s history of performing favorably during market surges, investors might be strategically arranging their positions to capitalize on potential future gains if the forecast indeed materializes.

Between September 7th and 28th, Dogecoin experienced a nearly 50% increase in value. This surge drew in more users as they started jumping on the bandwagon, or FOMO (Fear of Missing Out), into the Dogecoin ecosystem. At the moment of writing this, the price has gone down by almost 20%.

According to Santiment, a company specializing in on-chain analysis, this recent drop in DOGE price might not reflect the overall feelings within the Dogecoin community since whale activity continues to be quite active. The decline appears to have been caused by some whales cashing out their profits, but the increasing statistics suggest that the celebration could still continue.

🐶 Dogecoin has dropped by approximately 18% from its peak reached over the weekend. However, on-chain actions suggest that large investors, or “whales,” might still be holding onto some bullish energy for the leading meme cryptocurrency. Despite cashing out before the peak, their activity within Dogecoin’s network remains quite robust.

— Santiment (@santimentfeed) October 2, 2024

Technical Analysis Supports Impending Rally

As a crypto investor, I delved back into Dogecoin’s history, seeking patterns that might hint at an upcoming rally for DOGE. In my analysis, I utilized the Moving Average Convergence Divergence (MACD) indicator, a tool known for its ability to predict market trends. Notably, the last two instances where DOGE experienced a MACD bullish crossover on the weekly chart, we saw price surges of approximately 90% and 180%. Currently, my chart shows that the MACD line is inching closer to the Signal Line, suggesting that a potential crossover could ignite a significant price movement.

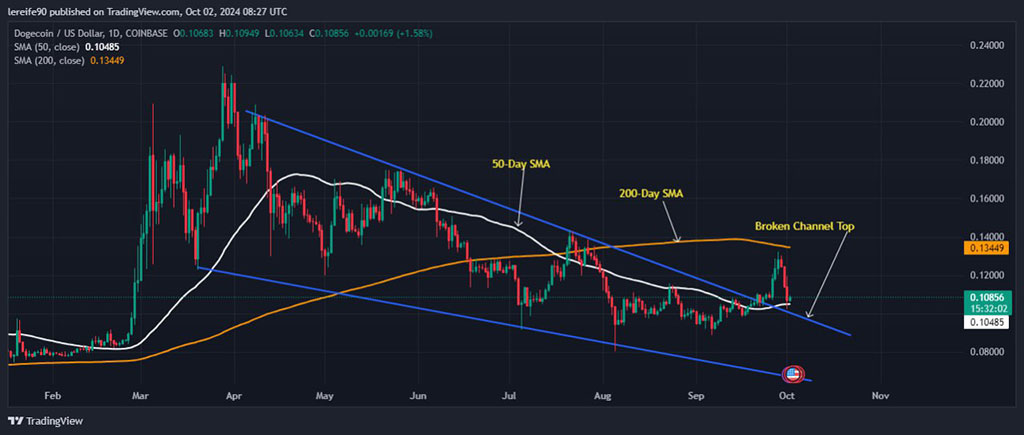

An in-depth look at Dogecoin reveals it was confined within a falling trendline from March up until mid-September, before eventually breaking free. Once it broke out bullishly, the price experienced minimal or no pullback and started surging, but as traders cashed in their profits, it began to dip – this downtrend is currently serving as a test. If Dogecoin successfully revisits this former resistance level, it would act as a support floor. In such a case, we might witness a significant surge from that point onwards.

Photo: TradingView

At this moment, the Daily Relative Strength Index stands at 58. This implies that there’s potential for the price to increase further if the bullish trend persists, as it hasn’t yet reached levels that suggest the market is overbought.

By examining the Short-Term Moving Averages, it appears that the 50-day moving average is currently acting as a foundation for the price, suggesting a potential rise might be imminent. However, the Long-Term 200-day moving average is positioned above the current price and may act as an obstacle in the near future, potentially hindering further increases.

The increasing on-chain indicator suggests optimism, yet technical analysis presents a somewhat ambiguous outlook. This indicates that the price needs to surmount significant barriers (akin to the 200-day Simple Moving Average) and hold crucial support levels (represented by the top of the broken downward trendline), in order to trigger a convincing upswing.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-02 11:37