As a seasoned researcher with years of experience in tracking crypto market trends, I must admit that Cardano’s current situation leaves me cautiously optimistic but also slightly concerned. The recent surge following the Federal Reserve’s interest rate cuts was indeed exciting, but the lack of sustainable demand and the rising selling pressure are red flags that I can’t ignore.

Over the past fortnight, Cardano has experienced a significant 26% increase in value, largely due to the Federal Reserve’s decision to reduce interest rates, which has sparked renewed enthusiasm throughout the cryptocurrency sector.

Experts and financial backers are doubting the long-term strength of the current market spike. Even though there was an initial increase, Cardano’s price couldn’t maintain above a crucial barrier, suggesting possible vulnerability in its upward trajectory.

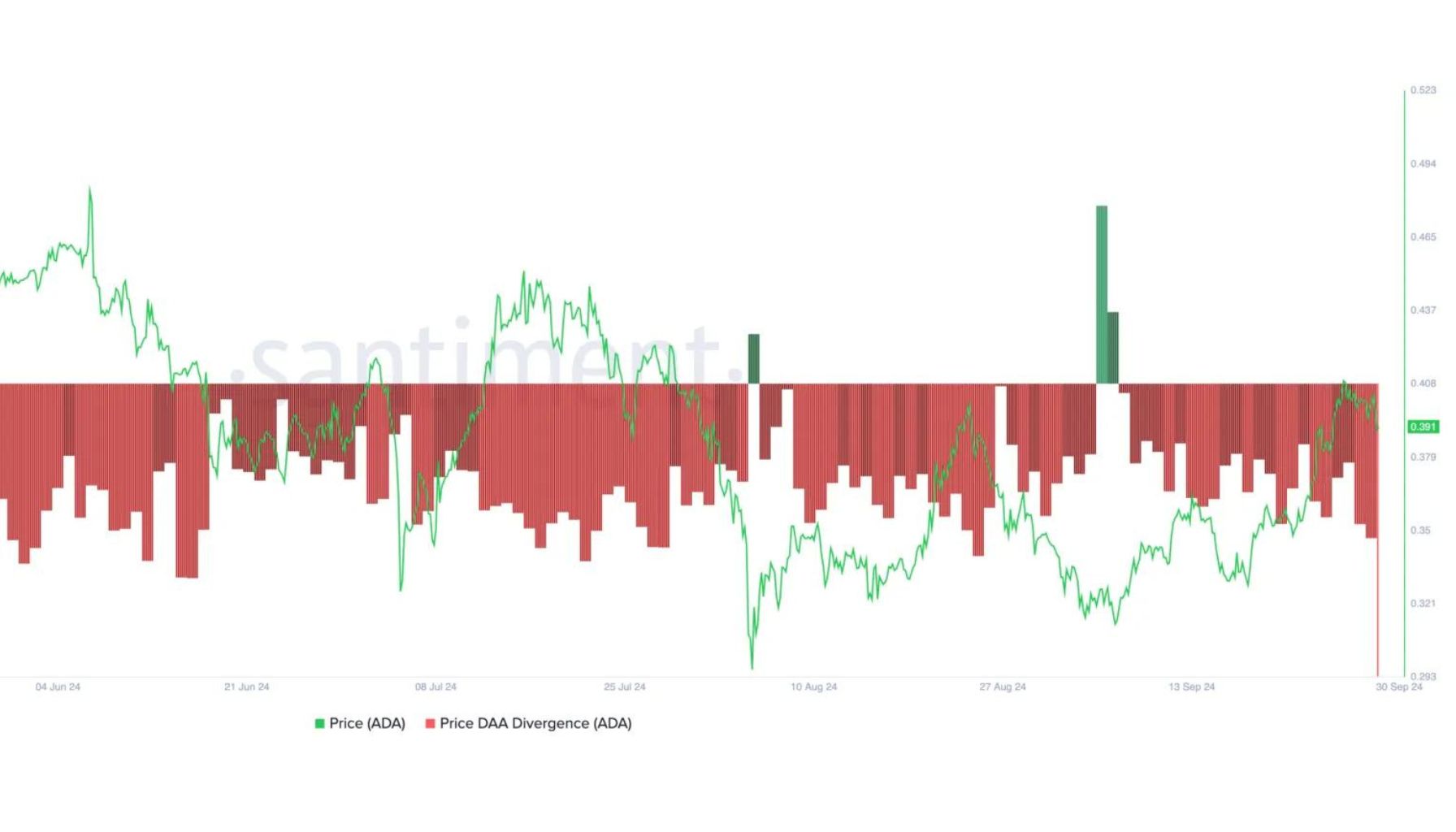

According to on-chain analysis by Santiment, there’s been a decrease in interest for ADA, which is causing investors to exercise more caution. Lower network activity and reduced buying pressure are leading some to question whether the current upward trend can be maintained.

In anticipation of more news, investors are keeping a close eye on any indications suggesting whether ADA‘s trend will reverse or keep rising. They recognize that ADA’s upcoming action might establish its trajectory for the coming weeks.

Cardano Indicator Shows Concerning Data

As a crypto investor, I’ve noticed some concerning signs for Cardano. On-chain analysis by Santiment suggests an escalating sell-off and dwindling interest in the coin, which could potentially lead to a 30% plunge back to its yearly low of approximately $0.27. This is something to keep a close eye on.

The indications for ADA‘s price have grown more distinct, as its daily active-address (DAA) divergence currently stands at -43.3%. This particular metric measures the relationship between an asset’s price fluctuations and adjustments in its daily active addresses, and it has consistently shown negative values since September 7, suggesting a concerning pattern for Cardano.

As a crypto investor, I’ve noticed that the negative DAA divergence implies that the surge in ADA this month, spurred on by the Federal Reserve’s interest rate reductions, might be more due to general market enthusiasm rather than a genuine increase in demand for ADA. This absence of organic growth in interest could potentially lead to a sharp correction imminently.

If the demand for Cardano doesn’t continue, its price might suddenly decrease significantly as traders choose to cash out their earnings, which could lead to a further decline in prices.

If ADA doesn’t manage to surpass its current resistance point approximately at $0.41, analysts predict a more significant downturn, which could drive the price down to its yearly low of $0.27. With decreasing interest from buyers and escalating selling pressure, Cardano’s short-term perspective appears unclear, and traders are preparing for additional risks of a price drop.

ADA Price Action: Testing A Crucial Supply Level

Currently, ADA is being traded at $0.38, having dropped by approximately 10% from its daily 200 exponential moving average (EMA) of $0.41. This EMA level has now emerged as a significant resistance point, since the price reached a new local peak in this region.

For the upcoming weeks, ADA needs to retake the $0.41 mark and surpass the next significant barrier at $0.45 to show a bullish pattern. Overcoming these thresholds would suggest a resurgence of power, placing the advantage in the hands of the bulls and potentially causing prices to rise further.

If Cardano (ADA) doesn’t manage to rise beyond crucial thresholds, it might encounter more downward pressure in the market. Not being able to regain $0.41 and exceed $0.45 could lead to increased selling activity, possibly causing a 30% decline. In this situation, there’s a possibility that Cardano may revisit its lowest price point of the year, approximately $0.27.

Due to the unpredictable market conditions and decreasing interest from buyers, traders are closely monitoring ADA‘s price fluctuations. The coming days may provide crucial insights into whether we might see an upward trend (bullish breakout) or if the downward trend will continue further (deeper correction).

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-10-02 02:10