As a seasoned researcher with a knack for deciphering market trends and a keen interest in Bitcoin, I find Ki Young Ju’s analysis both insightful and reassuring. His use of technical price data and the growth rate difference to predict Bitcoin’s bullish outlook is commendable. Having been burned by the crypto market’s volatility more times than I care to remember, I can’t help but appreciate the comfort that comes with a robust, data-driven analysis.

The surge in Bitcoin‘s value during mid-September has started to taper off as we approached the end of the month. Despite finishing September on a positive note, with an upward monthly closing price, Bitcoin has dropped below the significant $65,000 level once more. This move has triggered a shift from greed to neutral sentiment in the fear and greed index, which seems to have caused some hesitation among Bitcoin investors. Yet, CryptoQuant CEO Ki Young Ju is not considering such doubts.

Ki Young Ju believes that Bitcoin is currently experiencing a prolonged period of growth, often referred to as a “bull market.” This is encouraging for Bitcoin investors since the cryptocurrency market typically sees increased activity and potential gains during the final quarter of the year, which has historically been bullish.

Bitcoin Bull Market Not Over

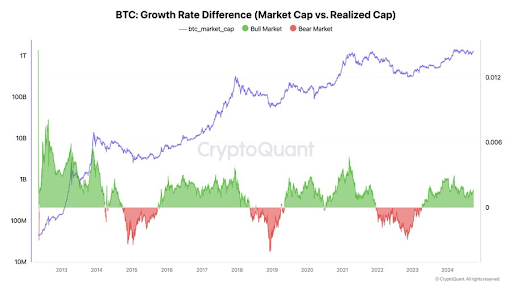

ki Young Ju, CEO of CryptoQuant, is among the passionate Bitcoin investors who remain undeterred by recent price swings. Instead of relying solely on speculation, his perspective is grounded in technical price analysis and data. Ki Young Ju’s optimistic viewpoint on Bitcoin stems from the significant difference in its growth rate, which offers an intriguing perspective on the cryptocurrency. In essence, this growth rate difference calculates the market cap of Bitcoin versus its realized cap to assess its bullish or bearish potential.

The market cap of a cryptocurrency is the total value of all coins in circulation, calculated by multiplying the current price by the total supply. In contrast, the realized cap takes into account the actual value paid for each BTC in circulation based on the price at which each coin last moved. A higher market cap growth rate suggests the spot price of the average coin has increased compared to the last it was moved.

Ki Young Ju recently pointed out on social media platform X that Bitcoin’s market capitalization is expanding at a faster pace than its realized cap, suggesting we’re still in a bullish phase. Interestingly, this pattern, which emerged towards the end of 2023, historically persists for roughly two years, as noted by the analyst in a previous analysis comparing growth rates.

What Does This Mean For BTC?

Based on historical patterns of Bitcoin’s bull cycles, which usually span around two years according to Ki Young Ju’s observations, it is anticipated that this cycle will persist for over a year ahead. Moreover, the current fundamental indicators suggest a consistent upward trajectory for Bitcoin as more investments flow in from institutional sectors.

Discussing institutional investors and Bitcoin Spot ETFs, these financial products saw their largest weekly inflow ($494.27 million) since July 22 come to a close last week. Kicking off the new week, they recorded $61.3 million in net inflows yesterday, indicating promising trends ahead. The increased involvement of institutional investors, particularly through products like Bitcoin Spot ETFs, plays a significant role in Bitcoin’s continuous price rise.

At the time of writing, Bitcoin is trading at $64,080.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- All Elemental Progenitors in Warframe

- How to get all Archon Shards – Warframe

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- What Happened to Kyle Pitts? NFL Injury Update

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-10-01 20:46