As a seasoned analyst with over two decades of experience in financial markets under my belt, I must admit that Kelly Greer’s analysis resonates deeply with me. Her insights into Bitcoin’s potential surge to $118,000 by year-end are not just compelling; they are backed by solid data and a keen understanding of market dynamics.

According to a report published on X, Kelly Greer, Galaxy Digital’s Vice President of Trading, puts forth a persuasive explanation as to why the value of Bitcoin might reach up to $118,000 before year-end. Greer’s perspective is based on an analysis that encompasses past performance trends, current market influences, and broader economic factors across the globe, which she thinks are coming together in a way that strongly supports Bitcoin.

Here’s Why Bitcoin Could Skyrocket To $118,000

Greer initially emphasizes Bitcoin’s robust growth trend during the last three months (Q4) of past years. She noted that, since 2020, Bitcoin’s typical Q4 return to its highest point within the quarter has been around 85%. This calculation takes into account a maximum gain of 230% and a minimum decrease of 12%.

Greer points out that the average return for Bitcoin in the fourth quarter since 2020 (compared to its highest point within the quarter or full quarter’s return) is +85%, with the worst performance being -12% and the best +230%. This strong asymmetry between the potential upside and downside implies that historically, the fourth quarter has been a period of substantial growth for Bitcoin.

If Bitcoin experiences an average growth of 85% in Q4, it’s projected to reach a year-end value of approximately $118,000. However, if Bitcoin surpasses its previous best performance of 230%, the price could potentially soar beyond $200,000 by the end of the year.

Significantly, Greer posits that the current market may not be optimally prepared to seize this opportunity. She links this underinvestment to several crucial aspects. Initially, there’s a sense of unease regarding the upcoming US presidential election set for November 5. Secondly, other investments like gold and China’s A-shares are garnering substantial interest and resources, which might steer funds away from Bitcoin.

Greer believes that the current market distribution isn’t quite right – in the year 2024, some sectors might be underrepresented because of a few factors. One is the risk associated with the November 5 US election, and another is the strong performance of certain assets like gold or China A-shares.

Key Reasons To Be Bullish On BTC

To back up her evaluation of the market’s present situation, Greer refers to her conversations with risk managers and highlights certain market signals. She points out observing “moderate volatility and limited perpetual funding,” which implies that traders are not excessively wagering on large-scale price fluctuations.

Besides considering the market fluctuations, Greer highlights numerous macroeconomic and sector-specific aspects that she considers to be shaping a “generally very favorable” environment for Bitcoin. One notable factor is the implementation of monetary stimulus programs in significant economies like the United States and China (excluding Japan).

Greer additionally points out that BNY Mellon, the largest custodian bank globally, was granted a SAB 121 exemption. This exception enables the bank to provide Bitcoin custody services without the rigorous capital requirements that previously made these services less appealing. Greer characterizes this advancement as “significant and undervalued,” emphasizing that it will “substantially relax financing in our sector.

To expand on Greer’s observation, he notes that ETF investments are showing increasingly positive trends. In recent days, Bitcoin exchange-traded fund (ETF) inflows have significantly picked up pace. Last Friday alone, these inflows reached a staggering $494.8 million, marking the highest daily net inflow of the current quarter and the largest since June 4th.

A promising sign is that Bitcoin miners are forming collaborations with hyperscale companies – major cloud service providers. Such alliances could boost mining productivity and decrease operational expenses.

Greer points out that “excess supply [has mostly] been addressed,” indicating that significant sales which might dampen the price are unlikely in the short run. Furthermore, she predicts that “demands from FTX cash distributions [are approaching], hinting that funds distributed from the FTX platform could be invested in Bitcoin, potentially increasing demand even more.

On the other hand, it’s worth noting that Greer recognizes potential threats that might influence Bitcoin’s path. These risks involve updates on monetary policy from the Federal Reserve and the likelihood of a market correction in equities. Such occurrences could lead to increased volatility or diminished investor interest.

Despite potential risks such as the Fed’s signals, stock market corrections, and other factors, her overall impression is optimistic. She expresses this by saying, “Of course there are risks, but if you look at the big picture, things seem quite positive, and the momentum is just beginning.

Greer refers to Bitcoin as a “self-reinforcing asset.” Essentially, she suggests that the value of Bitcoin is influenced by its own price fluctuations: as the price goes up, it draws more investments, which further boosts the price. This is a continuous loop where the price and investment flows influence each other.

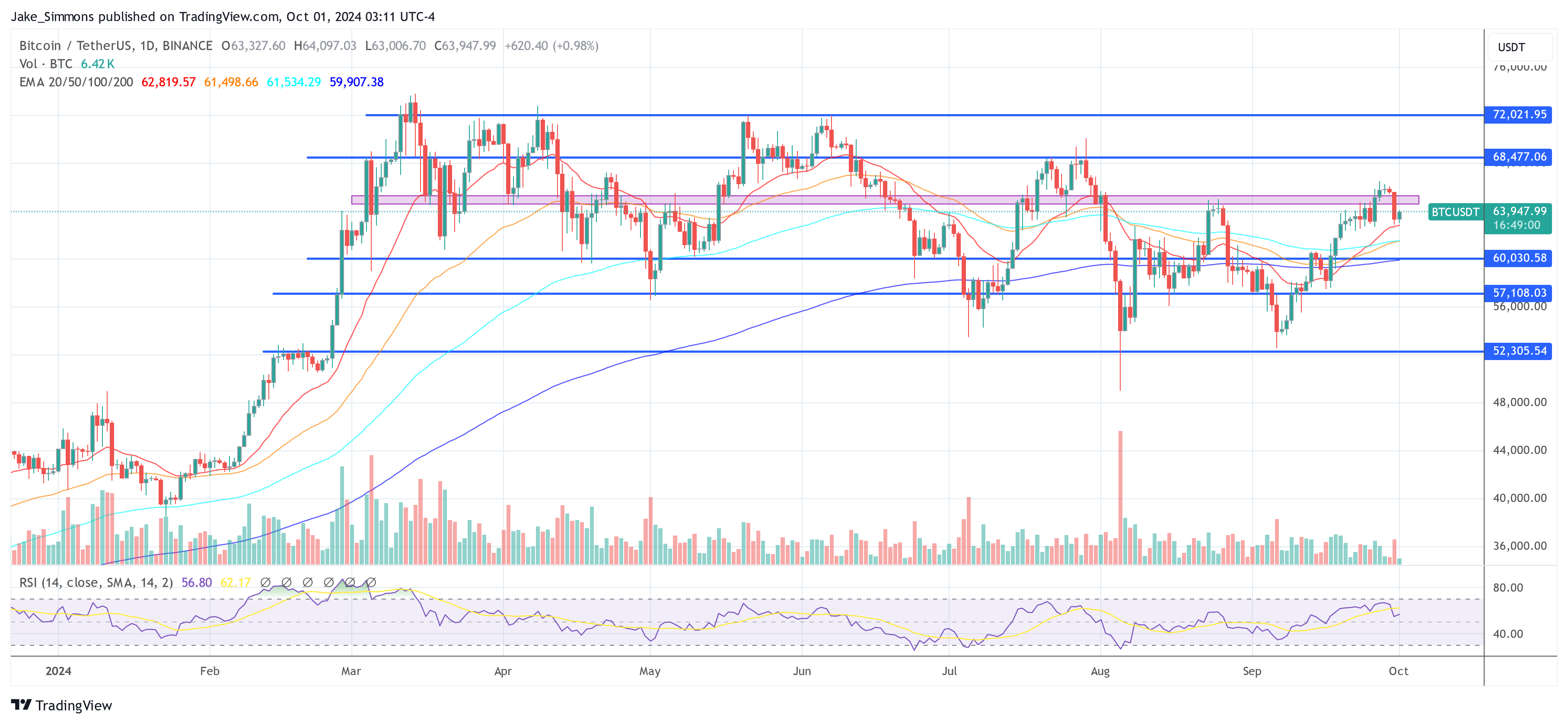

Greer observes that Bitcoin has moved into the fourth quarter following a significant milestone at around $65,000 in price. If the cost were to rise back up to $70,000, she anticipates increased investments as investors are drawn in by the positive trend and remember the robust Q4 performances from past years.

At press time, BTC traded at $63,947.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-01 14:47