As a seasoned crypto investor with over a decade of experience in this volatile market, I find Astronomer’s analysis compelling and well-grounded. His reliance on historical data, particularly the cyclical nature of Bitcoin price, resonates with my own observations. I remember vividly the green September of 2017 that set off an unprecedented bull run, a memory etched deep in every crypto enthusiast’s mind.

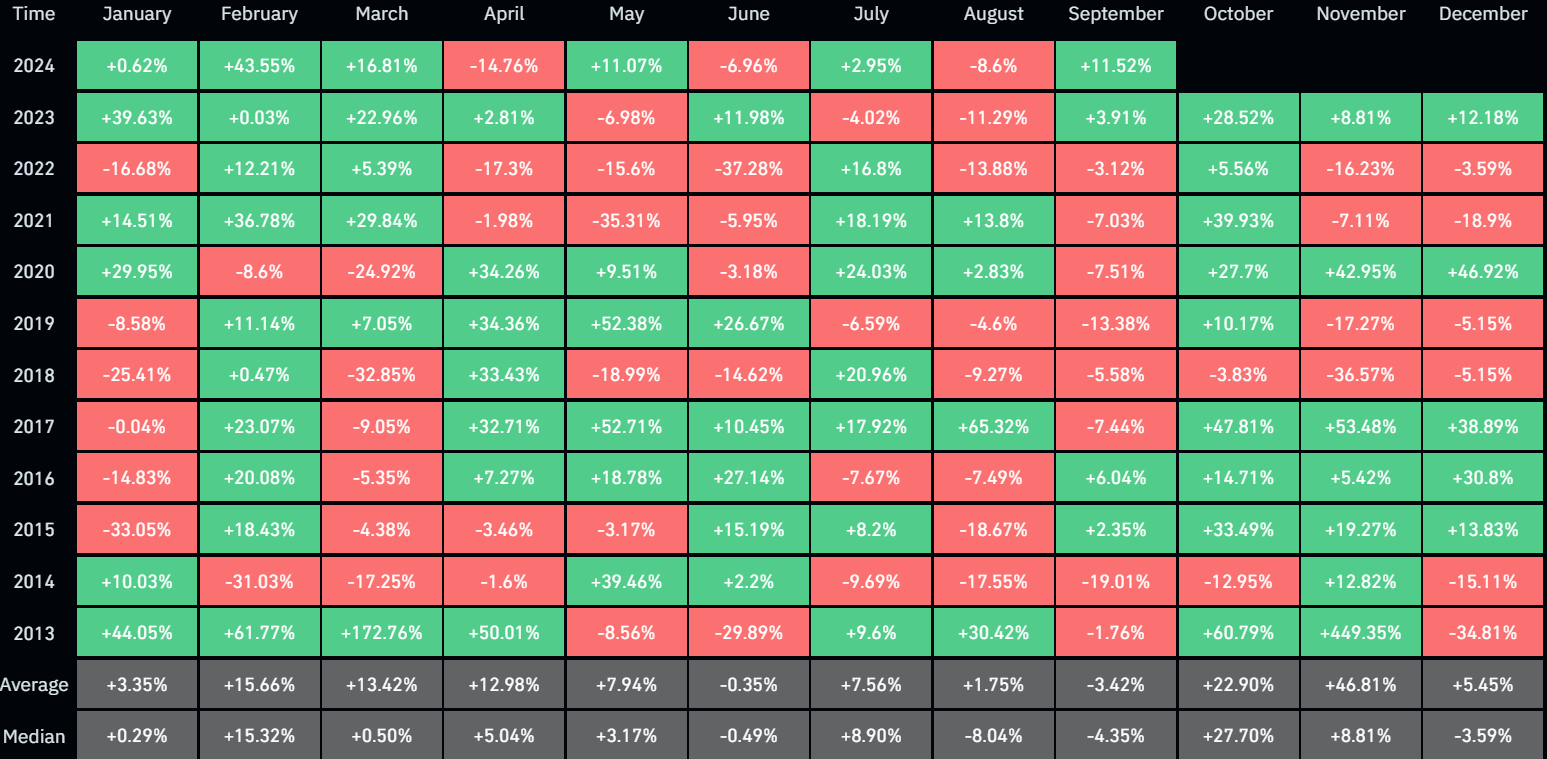

As a researcher immersed in the crypto sphere, I find myself optimistically forecasting a robust uptrend for Bitcoin during the last quarter of 2024. Drawing upon historical data as my guide, I’ve used analytical tool X to construct an argument that supports an 82% likelihood of an exceptionally bullish trajectory, mirroring the impressive performance Bitcoin displayed in September.

The crypto expert begins his analysis by highlighting Bitcoin’s unexpectedly strong growth in September. “As we approach the end of September, it appears that the market is poised to post exceptionally positive gains, potentially setting a record for the greenest September since 2024,” he notes, reinforcing our long-held breakout theory.

As a crypto investor, I’ve observed an intriguing disparity between the general market sentiment and the actual investment positions. While many of us share the optimistic ‘bull thesis’, it’s crucial to remember that data is unwavering. Upon closer examination, despite the numerous bullish posts circulating, a large portion of investors are yet to fully commit, have prematurely cashed out, or eagerly await dips, viewing them as opportunities rather than setbacks.

He provides more insight about this feeling, discussing it privately: “This insight isn’t solely based on public statements or tweets, but also from the numerous paid groups used to perform these analyses. I can’t disclose names or specifics, but many of these groups indeed made profits early, are seeking new opportunities, or are short-selling. It appears that the market is being manipulated in some way.

82% Chance Bitcoin Will Be Bullish

whenever Bitcoin has had an upward trend in September, it has consistently been followed by three more months of positive trends (October, November, and December). This pattern has held true every time since the inception of Bitcoin, a total of three instances so far. This suggests a strong seasonal tendency or cycle.

Despite his tendency to get angry easily, he’s also quick to acknowledge flaws in his approach, particularly when it comes to his methodology. He openly admits that using a small data sample, in this case, just three points, could lead to an incorrect conclusion, a type of error known as the low data fallacy. However, he adds, due to the binary nature of bullish and bearish markets, there’s an exclusivity to the data: if September doesn’t turn green, history shows that Q4 is unlikely to be green for 6 out of every 8 months.

As a crypto investor, I’ve been refining my perspective and here it is: ‘By incorporating the concept of exclusivity and presenting a broader, more accessible interpretation using additional data points, I can say: “Historically, when September is positive (not negative), it has set the tone for a bullish Q4 about 9 out of 11 times. So, if Bitcoin closes above $59k in September, there’s an 82% probability that Q4 will be bullish.”‘

The prediction stirred dialogue within the community. A user @pieceofsheet99 commented skeptically, suggesting the potential for an unexpected downturn: “If September turned out to be green to everyone’s surprise, October can also turn out to be red to everyone’s surprise as well.” Astronomer responded, reaffirming his reliance on historical trends, “Indeed, but that’s not what we have seen typically. So, I personally, as always, stick to the data.”

The astronomer’s findings suggest a hopeful yet strategic outlook, underscoring the significance of adapting to market trends and long-term patterns instead of relying on impulsive guesswork. To put it simply, the question is not about amassing wealth for retirement or quick profits. Rather, it’s about consistently positioning yourself correctly within the market, allowing you to ride the waves without stress, minimizing losses, and feeling fulfilled in the journey itself. In time, with patience and perseverance, you will reach your financial goals.

At press time, BTC traded at $64,622.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-09-30 11:46