As a seasoned analyst with over a decade of experience in the crypto market, I’ve seen my fair share of bull runs and bear markets. The current surge in SUI has certainly piqued my interest, particularly given its impressive 75% surge since mid-September.

At the moment, SUI is examining significant supply points following a remarkable 75% increase in value from local demand around $1 since mid-September. This significant price fluctuation has brought the layer-1 blockchain into sharp focus in market conversations, making it one of the most talked-about assets at present.

There’s a growing excitement among traders and investors regarding SUI, as more people are predicting that this recent surge might just be a prelude to significant increases over the next few months. The chatter about SUI has been escalating due to its robust performance, and optimistic views about its potential future growth are on the rise.

As an analyst, I’m keeping a close eye on the price movement of SUI. Some forecasts indicate that it might surge towards notably higher prices, even approaching its record highs near $2.20 in the forthcoming period. If this happens, SUI could firmly establish itself as a leading performer within the crypto market, drawing further investment as investors seek promising prospects.

As Stellar (SUI) becomes increasingly popular, there’s growing curiosity about whether it can maintain its progress and surpass significant hurdles, paving the way for a possible surge to unprecedented heights. Given the rising optimism, Stellar is an intriguing coin to monitor as investors eagerly await its next strategic step.

SUI Bullish Pattern ‘Still Playing Out’

In the last fortnight, SUI has proven itself as one of the top-yielding investments. This strong performance is largely attributed to optimism stirred by the Federal Reserve’s decision to reduce interest rates. Financial analysts and investors are closely monitoring this altcoin, hoping that its recent spike isn’t a deceptive trap but rather the start of an immense surge that could lead to a significant rally with potential for explosive growth.

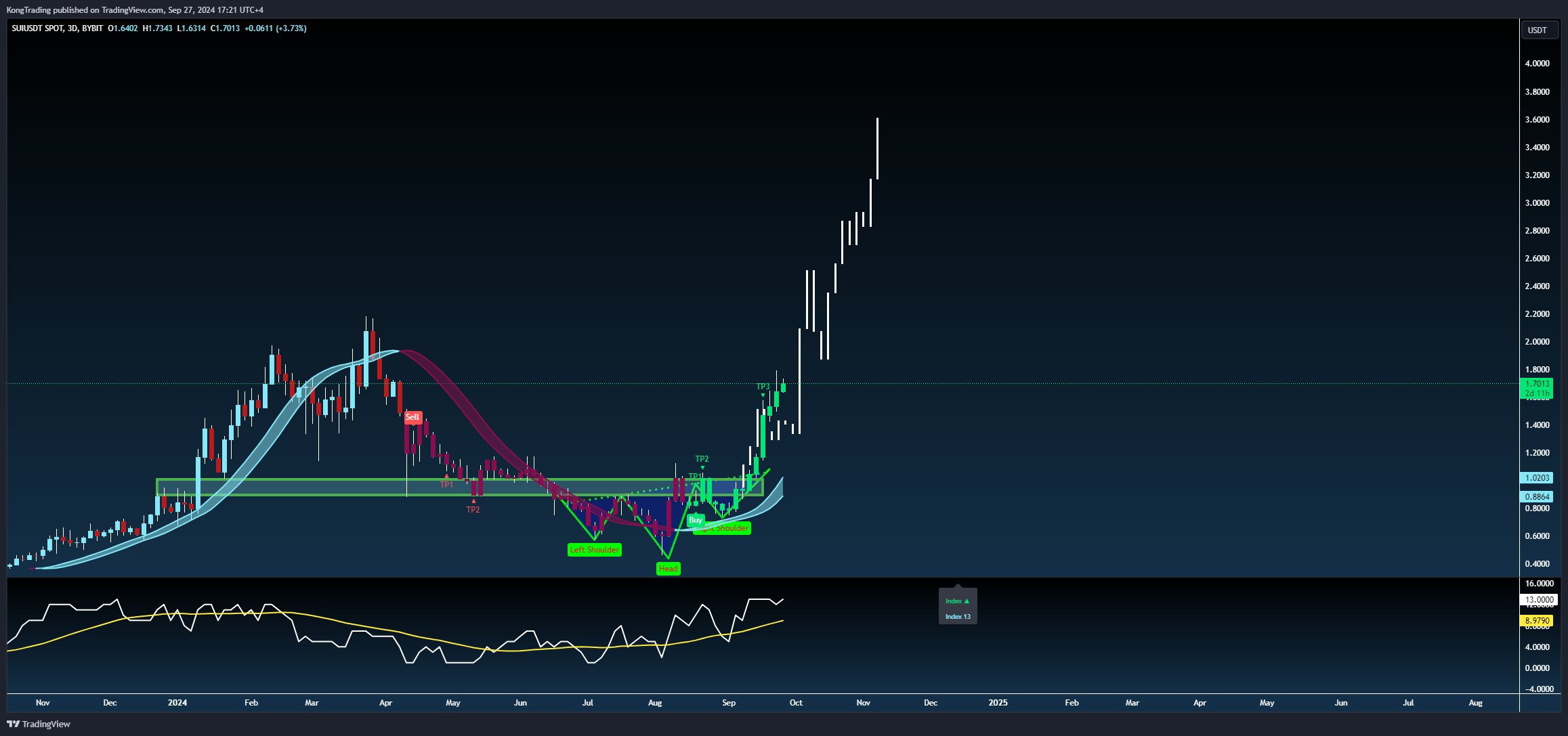

Renowned crypto trader and analyst, Kong Trading, recently shared his technical analysis on X, highlighting the potential for a significant SUI surge in the coming months. He noted that the inverted head and shoulders pattern formed in the past months is still playing out nicely and could be a powerful signal for further gains.

Based on his assessment, the crucial point to focus on appears to be around $2. If SUI successfully surpasses this barrier, it might spark a frenzy of FOMO (fear of missing out) among traders, potentially driving the price to uncharted highs.

However, Kong Trading also cautioned that SUI’s bullish momentum depends heavily on broader market conditions and macroeconomic trends. While the current setup is promising, the asset remains vulnerable to sudden shifts in sentiment or adverse market developments.

In the upcoming days, it’s vital to observe whether SUI can continue its rising trend or if it may encounter a possible downturn near its record highs. At present, interest is peaked on SUI as it maneuvers through these significant price thresholds, with investors eagerly awaiting a potential breakthrough that could reshape its market status.

Key Levels To Watch

Right now, SUI is being traded at $1.67, marking a striking 140% surge from its September low of $0.75. This substantial price increase has pushed SUI towards a key supply area where the price may encounter resistance and possibly enter a period of stabilization or consolidation. Many experts and traders are keeping a close eye on this level, as breaching it could pave the way for additional growth.

Should SUI surpass the $1.82 barrier, it paves the way for an upward surge potentially reaching its record high of $2.18. This level becomes a significant objective for buyers, as regaining it may suggest the resumption of a prolonged upward trend and draw in additional market participants. Conversely, if SUI struggles to exceed $1.80, we might witness a price decline moving towards demand zones around $1.45, a level that previously functioned as a resistance in April.

The price area of around $1.45 has become a solid point where the asset might hold steady. This could be an attractive moment for traders to join the market at a lower cost. At this juncture, SUI finds itself in a crucial position, and its future action will decide whether the ongoing surge continues to reach new peaks or if a period of stabilization is imminent.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-09-29 19:34