As a seasoned researcher with a penchant for deciphering market trends, I find myself intrigued by the current state of Bitcoin. On one hand, we have the meteoric rise that has propelled it to levels last seen in July, a sight for sore eyes indeed. Yet, on the other, certain indicators suggest this rally might be more flash than substance.

This week, Bitcoin has been particularly popular among investors, experiencing a 4.07% increase as per CoinMarketCap’s data. At its peak, Bitcoin was trading at an impressive $66,000 – a level not seen since late July. Yet, while this price hike has continued Bitcoin’s unusual September growth, some market indicators suggest unease about the longevity of this rally.

Why Bitcoin’s Rally Is In Danger

In a Quicktake post on CryptoQuant, an analyst with username Wenry outlined several reasons Bitcoin may not sustain its current upward trend.

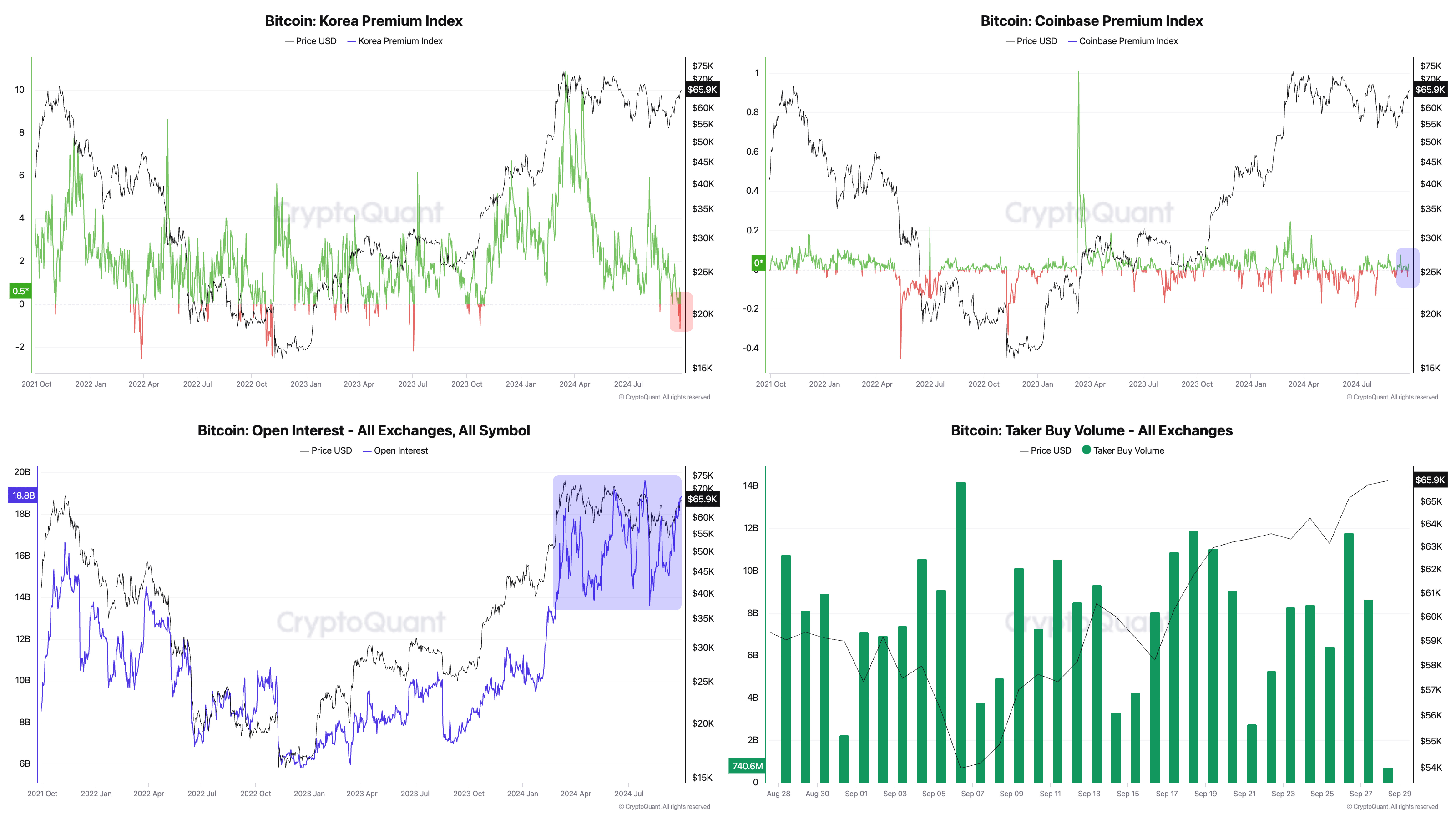

Initially, it’s pointed out by Wenry that retail investors in Korea and the US seem to be disinterested, as shown by steady Taker volume not increasing. This contrasts with past Bitcoin price surges when retail activity in these regions was significant. Consequently, it’s speculated that this recent price spike may not involve new investments but rather be influenced by a specific group of market players.

Moreover, Wenry points out that there’s a substantial amount of Open Interest in the Bitcoin market right now. However, this asset is still moving within a range-bound market, or consolidating, due to low spot volume. This combination suggests that while Bitcoin is currently experiencing a rally, it doesn’t seem to be attracting strong buying interest.

Wenry’s additional concern suggests that the recent increase in Bitcoin’s price might be primarily driven by an escalation in derivatives trading, influenced by macroeconomic factors like decreased interest rates. This crypto analyst notes that the spot market isn’t providing equal support, implying that the surge is more likely a “short-term spike” rather than a significant shift in the overall market structure.

To summarize, Wenry points out that the lack of substantial trading on the spot market, a flat Taker volume, and minimal retail involvement could potentially hinder Bitcoin’s current surge. It’s important to note that if retail investors continue to stay away from the market, Bitcoin might continue in a holding pattern or even experience a price decrease.

Bitcoin To Break All-Time High In Q4?

From another angle, well-known cryptocurrency expert Michael van de Poppe anticipates that Bitcoin will exceed its previous peak of $73,750 by the final quarter of 2024, following a trend similar to gold. Van de Poppe’s forecast appears reasonable given that Q4 is generally considered a particularly bullish time for Bitcoin. Moreover, this analyst also expects altcoins to see a price increase of up to 3-5 times during the same period.

Currently, as I’m typing this, Bitcoin is being traded at approximately $65,810. This price represents a 0.40% increase in the last 24 hours. Simultaneously, the daily trading volume has decreased by 53.16%, amounting to around $65,649.

Read More

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Gold Rate Forecast

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

2024-09-29 13:34