As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find myself intrigued by Grayscale’s latest report highlighting key trends and top performers for the upcoming quarter. The rise of decentralized AI platforms, tokenization of traditional assets, and memecoins are themes that have been on my radar for quite some time now.

Grayscale, a company that manages crypto assets, has released a detailed analysis predicting sectors expected to experience significant growth in the last quarter of the year. This optimistic outlook comes as the cryptocurrency market shows signs of recovery, with key players like Bitcoin (BTC) and numerous alternative coins reaching prices not seen for over two months.

Grayscale Highlights Key Trends In Crypto

In a report published on Thursday, Grayscale highlighted updates to its Crypto Sectors Indexes, revealing evolving patterns within the digital asset sector. Some notable trends include:

It’s worth noting that Bitcoin and the cryptocurrency market have shown exceptional growth compared to other sectors in 2024. This could be attributed to the successful introduction of spot Bitcoin exchange-traded products (ETPs) in the U.S. this year, as well as positive macroeconomic developments following the Federal Reserve’s (Fed) interest rate reduction on September 18.

This year, Ethereum has increased by 13%, but it has not kept pace with Bitcoin’s growth. However, Ethereum outperformed numerous other cryptocurrencies. To put this into perspective, Grayscale’s Crypto Sectors Market Index (CSMI) has dipped by around 1% so far this year. More specifically, the Smart Contract Platforms Crypto Sector Index, to which Ethereum belongs, has dropped about 11%. This means that Ethereum’s performance looks more favorable compared to other cryptocurrencies within its category.

Regardless of its difficulties, it’s clear that Ethereum continues to dominate the Smart Contract Platforms sector. This is evident by its significant lead in terms of application count, developer numbers, and fee income.

Top 20 Cryptocurrencies For Upcoming Quarter

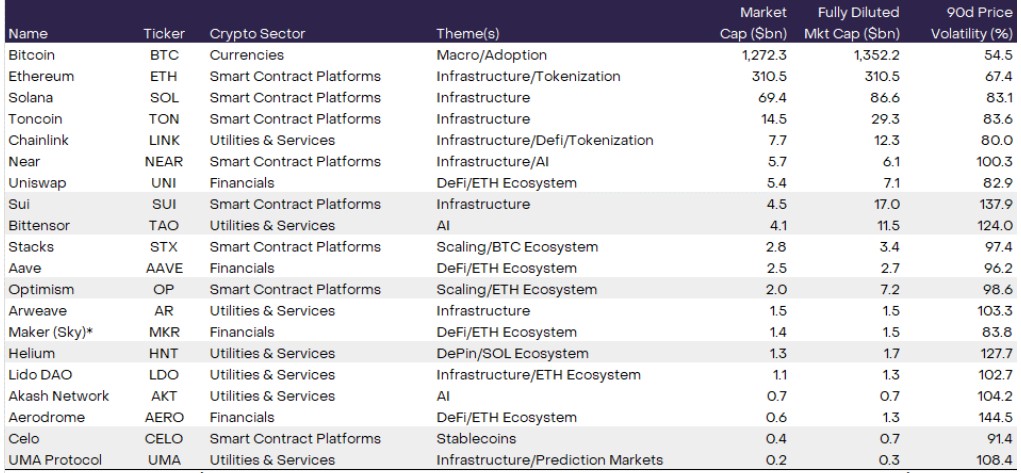

When compiling its quarterly Top 20 list of cryptocurrencies, Grayscale carefully examines numerous digital assets. This collection offers a diverse range of promising investments for the forthcoming quarter.

Notably, Sui (SUI), Bittensor (TAO), Optimism (OP), Helium (HNT), Celo (CELO) and the UMA Protocol (UMA) are notable performers as pointed out by the firm. Yet, it’s worth mentioning that Grayscale also closely monitors a broader range of assets, which include those beyond these standout picks.

Sui, a third-generation blockchain developed by ex-engineers from Meta, is causing a stir after a recent network update significantly increased its transaction speed by 80%. This improvement outperforms the capabilities of Solana.

Optimism, an Ethereum Layer 2 solution, plays a critical role in scaling the Ethereum network. It has developed a framework called the “Superchain,” which is utilized by platforms like Coinbase’s Layer 2 BASE.

Celo and UMA are taking advantage of distinct market tendencies. Specifically, Celo is concentrating on the utilization of stablecoins and payment systems in underdeveloped regions, particularly Africa, while UMA functions as a data provider for decentralized apps such as Polymarket, acting as an oracle network. Notably, Celo has now surpassed Tron in terms of stablecoin usage, whereas UMA plays this role.

Including Helium within the Top 20 indicates that Grayscale prioritizes projects led by category titans with robust, long-term revenue structures. This particular project has solidified its position as a leader in the realm of decentralized physical infrastructure networks (DePIN), expanding its network to surpass one million hotspots and yielding substantial fee earnings.

Bittensor, a platform that bridges artificial intelligence (AI) and cryptocurrency, has lately earned acclaim within Grayscale’s system, largely because of advancements in its market infrastructure. This development provides a decentralized environment where innovations in AI can thrive.

In the recent quarterly rebalancing of our portfolio, I’ve chosen to divest from several assets such as Render, Mantle, ThorChain, Pendle, Illuvium, and Raydium. Despite recognizing the potential value these projects hold, our revised Top 20 list is designed to deliver more enticing risk-adjusted returns for our investors over the coming months.

Currently, as we speak, the standout performer across all time periods in Grayscale’s top 20 list is Bittensor’s TAO token. Over the past two weeks, it has experienced a significant surge of 86%, and an impressive 841% since the start of the year. This has led to its current trading price being $536.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

2024-09-28 08:10