As a seasoned crypto investor with a decade of experience navigating the volatile digital asset market, I can confidently say that the recent inflows into Bitcoin ETFs are undoubtedly a bullish sign for the cryptocurrency industry. The institutional interest we’re witnessing is reminiscent of the dot-com boom, where traditional finance giants realized the potential of the internet and poured their resources into it.

1) Recently, Bitcoin has garnered significant media focus, not just because it surpassed $65,000 in value, but also due to the unprecedented investments flowing into Bitcoin exchange-traded funds (ETFs).

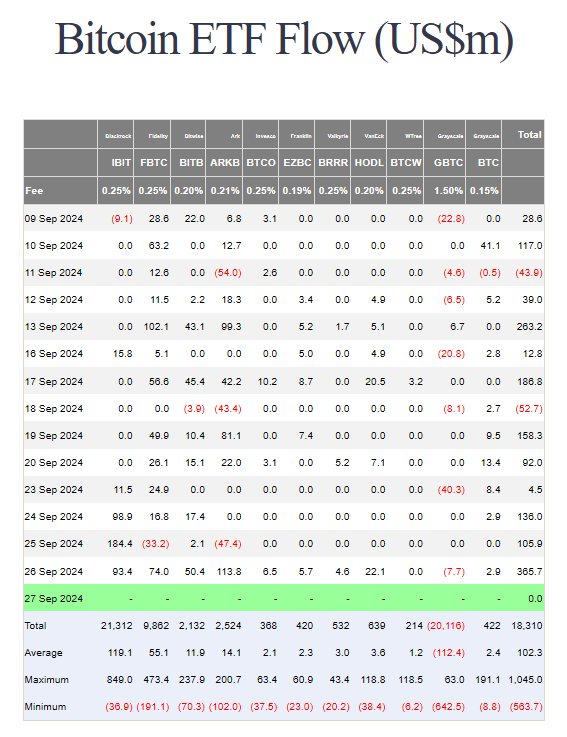

By September 26, 2024, as reported by Farside Investors, these investments in the cryptocurrency market have surged to a noteworthy $365 million, reflecting a growing institutional appetite for this sector.

Record Inflows Amid Market Optimism

On September 25, 2024, BlackRock’s Bitcoin ETF experienced its highest single-day inflow of approximately $184 million during that month.

This surge in value aligns with withdrawals from multiple Exchange-Traded Funds (ETFs), suggesting a substantial shift in perspective by institutional investors. While only $2.1 million flowed into alternative platforms like the Bitwise Bitcoin ETF, BlackRock’s performance stands out and offers encouragement amidst the market’s turbulence.

Over the last five days, a total of approximately $497 million has been flowing into U.S. Bitcoin ETFs, and one significant factor contributing to this growth is the Federal Reserve’s decision to lower interest rates by 0.5%. This action encourages investors to explore alternative investments such as Bitcoin.

For two weeks running, there has been an increase in investments into digital asset products, amounting to around $321 million. Bitcoin, specifically, has attracted most of these funds, accounting for roughly $284 million of the total.

Institutional Trust And Financial Aspects

The recent influx of funds into Bitcoin ETFs signals a broader movement where large-scale investors are increasingly treating Bitcoin as a strategic investment option. This perception is further reinforced by favorable economic conditions, such as the Federal Reserve adopting a lenient stance, which instills confidence among investors regarding potential economic security.

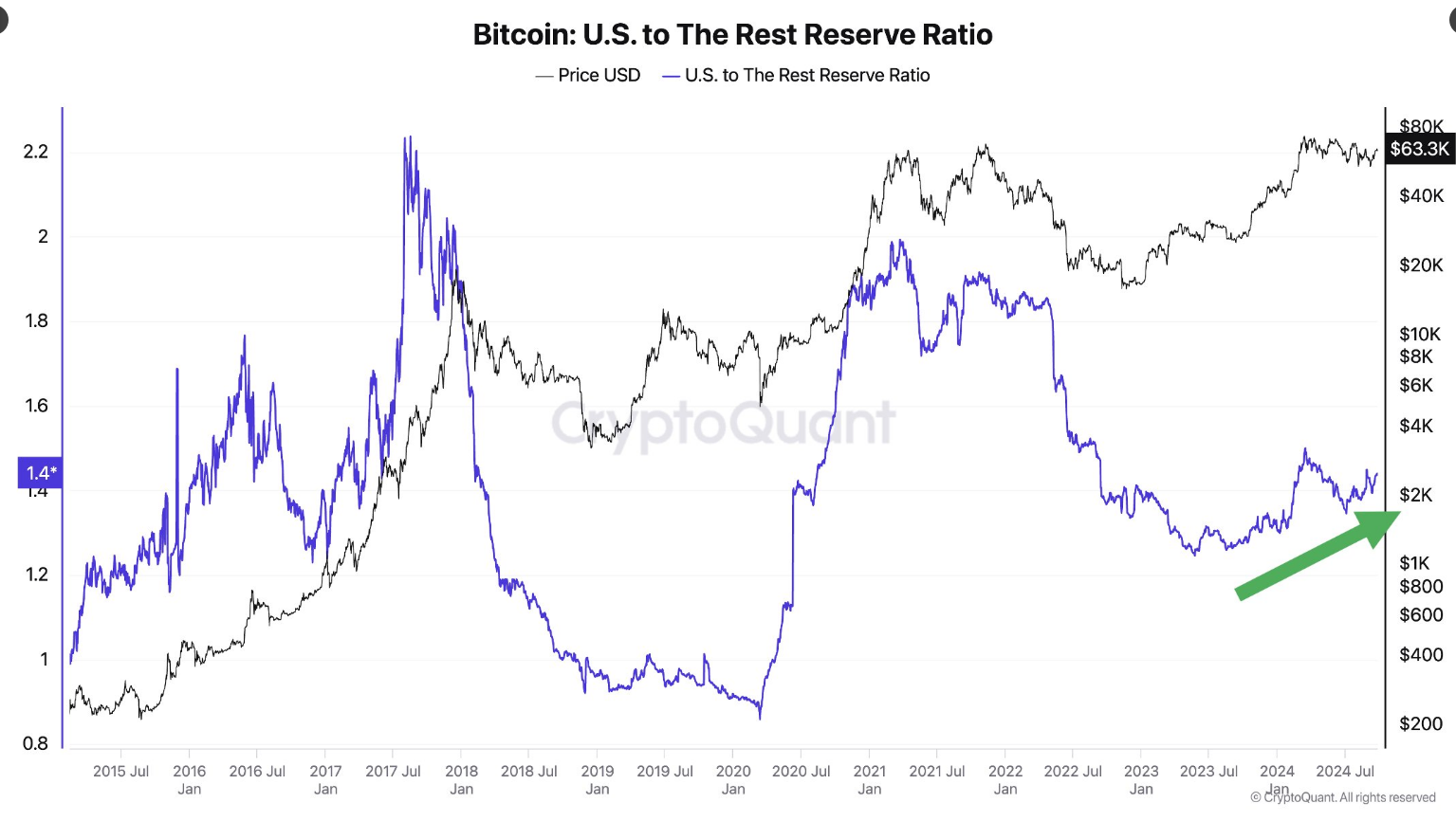

According to Ki Young Ju, the CEO of CryptoQuant, it’s crucial for the U.S. to maintain its leadership role in the crypto industry by boosting the interest and demand for exchange-traded funds (ETFs) based on Bitcoin.

The United States is seeing a resurgence in its ownership of Bitcoin. Compared to other nations, this percentage is increasing, largely due to the surge in demand for spot Bitcoin Exchange-Traded Funds (ETFs). However, only recognized entities are being considered.

— Ki Young Ju (@ki_young_ju) September 26, 2024

It’s worth mentioning that while BlackRock’s ETF is doing well, other funds like the Ark 21Shares Bitcoin ETF and Fidelity’s Wise Bitcoin Origin Fund have experienced significant outflows totaling $33.2 million and $47.4 million respectively.

The Investment Landscape For Bitcoin In The Future

Analysts closely monitor the potential impact of increasing Bitcoin inflows on future price fluctuations as its worth and demand rise steadily.

Approximately 9 out of 10 Bitcoin owners are currently making a profit thanks to the recent price spike, leading to worries that they might decide to sell their holdings in order to cash out their earnings. Historically, if a large number of these profitable investors choose to sell, it could trigger substantial price changes.

As a researcher, I’m keeping a close eye on approximately $5.8 billion in options contracts nearing their expiration date. Key resistance levels, such as the one around $66,000, will be under scrutiny. A breach above this level might ignite further positive momentum in the market.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-09-28 03:40