As a seasoned researcher with over two decades of experience in the financial markets, I must say that the recent surge in Bitcoin’s price to above $65,000 is nothing short of intriguing. Having witnessed several market cycles and trends, this current bull run seems to be driven by a unique confluence of factors – increased activity from whales and sharks, renewed confidence among institutional investors, and the historical pattern of Bitcoin’s price performance in September.

For the first time in about two months, Bitcoin is currently trading above the $65,000 mark. This surpasses the previous resistance level of $63,000. This significant rise has led to Bitcoin increasing by nearly 23% from its low on September 6, which was $53,400. Consequently, many Bitcoin holders are now seeing profits.

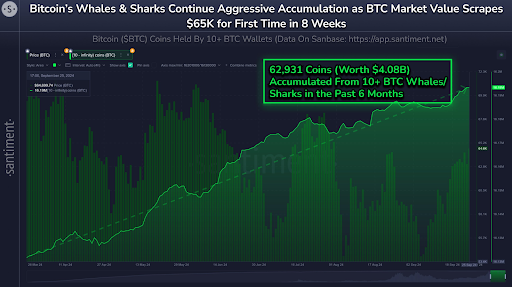

Based on Santiment’s analysis, it appears that the recent price movements are primarily driven by increased buying from large investors, such as whales and sharks. The on-chain analytics company has observed a significant trend of these big players accumulating or stockpiling the asset.

Sharks And Whales Continue To Accumulate BTC

In the global financial landscape, Bitcoin has reclaimed its prominence in investment portfolios since mid-September, with significant changes in market trends pushing it back into the spotlight. According to data from Santiment, the upward trend in Bitcoin’s price is primarily due to increased purchasing by investors. The on-chain analytics platform indicated that numerous wallets containing ten or more Bitcoins have been steadily buying additional Bitcoin over the past six months. This consistent accumulation has played a pivotal role in maintaining and boosting the price, particularly during market corrections when Bitcoin experienced downward pressure.

Significantly, over the past six months, these addresses have amassed approximately 4.08 billion dollars’ worth of BTC, and they collectively hold about 16.19 million Bitcoins. Moreover, Santiment’s data suggests that this accumulation trend has picked up pace starting around mid-September, following the Fed’s decision to lower the base interest rate. This indicates a resurgence in confidence among Bitcoin investors.

Current State Of Bitcoin

According to NewsBTC, historically, September is a significant month for Bitcoin’s price trends during the final three months of the year. Surprisingly, initially seeming to forecast a bearish trend for Bitcoin in the first fortnight, it now appears to be setting the stage for a potential price increase in Q4 of 2024.

Currently, as I’m typing this, a single Bitcoin is being traded at approximately $65,470. Over the last day, its value has increased by 2.6%. The return of institutional investors to Bitcoin trading has been noticeable since the start of the week. This trend has led to an influx of funds into spot Bitcoin investment vehicles, with such inflows being recorded for several consecutive days starting from the beginning of the week. In fact, a staggering $365.7 million in net inflows was observed in the past 24 hours alone.

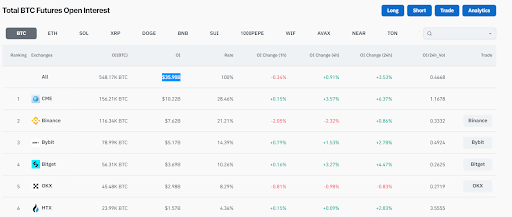

As a crypto investor, I’ve noticed a significant rise in the open interest of Bitcoin, with more investors jumping on board. According to Coinglass, the current open interest for Bitcoin stands at an impressive $35.90 billion across various exchanges, marking a 3.53% increase over the past 24 hours. This surge in open interest could potentially fuel further price growth, given the global interest in Bitcoin’s price movement.

Moving forward, Bitcoin’s price might surge past its previous peak in July ($70,162) in a bullish trend. If it does, maintaining that momentum could pave the way for Bitcoin to effortlessly reach new record highs by October.

Read More

2024-09-27 20:10