As a seasoned researcher with over a decade of experience in the cryptocurrency market, I must admit that the recent developments surrounding Stacks (STX) have piqued my interest. The token’s impressive 18% surge since last week is a testament to the growing investor sentiment and the potential this platform holds.

Stacks (STX) has regained and built up its momentum over two weeks after a bloody September start. Since then, the token has garnered much-deserved attention as developments on the platform mount up. According to CoinGecko, STX surged over 18% since last week, representing a strong flip in investor sentiment.

This week, stacks are getting louder with each new partnership revealed, potentially ushering in a new era for these platforms. Given the buzz surrounding the prospective Bitcoin economy associated with Stacks, investors and traders could be in store for quite a bit of growth in the near future.

New Developments Fuel STX Growth

According to a recent post by the Stacks’ official account, Hermetica.fi – a stablecoin provider within the Stacks ecosystem – has launched USDh, a unique “Bitcoin-backed, yield-bearing” synthetic dollar available on the retail market. This new stablecoin is being heavily promoted by Hermetica, offering a high time-limited staking Annual Percentage Rate (APR) of 25%.

Stacks’ leading Bitcoin L2 ecosystem continues to grow

Congratulations to @HermeticaFi for the official launch of their USDh stablecoin on Stacks.

To honor the occasion, Hermetica is providing an incentive for those who act quickly – a reward pool for early adopters. For more details, check the information provided below.

— stacks.btc (@Stacks) September 25, 2024

Potential institutional investors could soon join the Stacks platform, as Anchorage Digital – an institution-focused digital wallet provider – has declared their support for Stacks. This move allows the platform to reach out to larger entities, potentially boosting its future growth and development. The integration of institutional investors is expected to accelerate the platform’s advancement.

After completing the last phase of the Nakamoto upgrade, many SX users have shared their thoughts on the advantages this network update brings. In summary, it’s clear that the Nakamoto upgrade will enhance user experience substantially, while simultaneously granting developers access to approximately $1 trillion in Bitcoin liquidity through sBTC, a one-to-one Bitcoin-backed asset within Stacks. Additionally, sBTC is being integrated with Solana and Aptos for faster distribution and broader adoption.

Investors Should Watch Stacks On These Levels

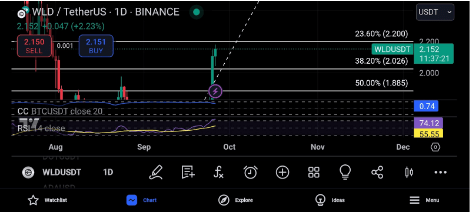

As an analyst, I observe that STX continues its positive trend, overcoming any immediate chances of a reversal by surpassing the $2.02 mark in the short term. This price surge certainly benefits the bulls substantially; however, this success could be fleeting as the bullish momentum seems to wane, making it challenging for them to sustain the upward trajectory.

In simpler terms, the Relative Strength Index (RSI) of the token indicates that the bulls might encounter resistance near $2.2 over the short term, which could allow the bears to regain some strength equivalent to the current bullish momentum. This temporary shift will likely keep the token’s price steady for a while, providing the bulls with an opportunity and space to strategize for further upward movements in the medium term.

If STX maintains its existing support of $2.02, we could witness an uptrend in the near future, assuming the market’s current correction transitions into a bullish phase. Conversely, if the bulls are unable to sustain this level for a mid-term trend, the bears might drag the token down to around $1.885 or potentially even lower if they gain sufficient strength.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- All Elemental Progenitors in Warframe

- How to get all Archon Shards – Warframe

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- What Happened to Kyle Pitts? NFL Injury Update

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-09-27 12:04