As a seasoned researcher with over a decade of experience in the cryptocurrency market, I find the recent surge in altcoin performance quite intriguing. The crossing of the 200-day EMA by the OTHERS index is a significant development that historically has signaled an altcoin season. However, as we all know too well in this volatile space, past performance is no guarantee of future results.

It seems like several signs indicate that altcoins might be gaining more power again, which could lead to an upcoming “altseason.” But for this to be certain, it’s important that Bitcoin‘s influence decreases even more.

Altcoin Market Cap Crosses 200-Day EMA

Cryptocurrency experts keep a close eye on several markers that show how alternative coins behave, and one vital piece of data they focus on is the 200-day exponential moving average (EMA).

Based on the provided chart, it appears that the ‘Others’ index, which monitors the market value of cryptocurrencies outside the top 10 in terms of market capitalization, has risen above both its 100-day Exponential Moving Average (EMA) and its 200-day EMA.

For beginners, the 200-day Exponential Moving Average (EMA) is a frequently employed technical tool that represents the average price of a given asset over the last 200 days, placing greater emphasis on recent prices. It helps in recognizing long-term trends; when the price exceeds the 200-day EMA, it implies the asset might be experiencing an uptrend, whereas remaining below it could indicate a possible downtrend.

Currently, the OTHERS index stands at a whopping $227.5 billion. On the other hand, both the 200-day Exponential Moving Average (EMA) and the 100-day EMA are slightly lower at $221.8 billion and $212.9 billion respectively. As per crypto analyst Caleb Franzen’s analysis, this configuration last occurred in July 2023. Remarkably, during that period, altcoins managed to establish robust support levels at these EMAs, leading them towards achieving higher peaks.

Analyst Ali Martinez hinted at the market cap of cryptocurrencies other than Bitcoin and Ethereum potentially ending a prolonged downward slope. While Martinez isn’t completely convinced we’re in for a full-fledged altcoin boom, he sees this breakout as a promising beginning.

Bitcoin Dominance Must Crash Before Altseason

As the total market value of altcoins surges beyond a prolonged slump, suggesting a potential upcoming altcoin boom, it’s crucial that Bitcoin’s dominance (BTC.D) experiences a substantial decrease from its present highs.

At present, Bitcoin’s dominance is about 57.5%. As you can see from the graph, Bitcoin’s Dominance (BTC.D) has been consistently rising since at least November 2022. According to crypto expert Yoddha, BTC.D appears ready to drop down to the mid-40s, which could trigger an altcoin season in full swing.

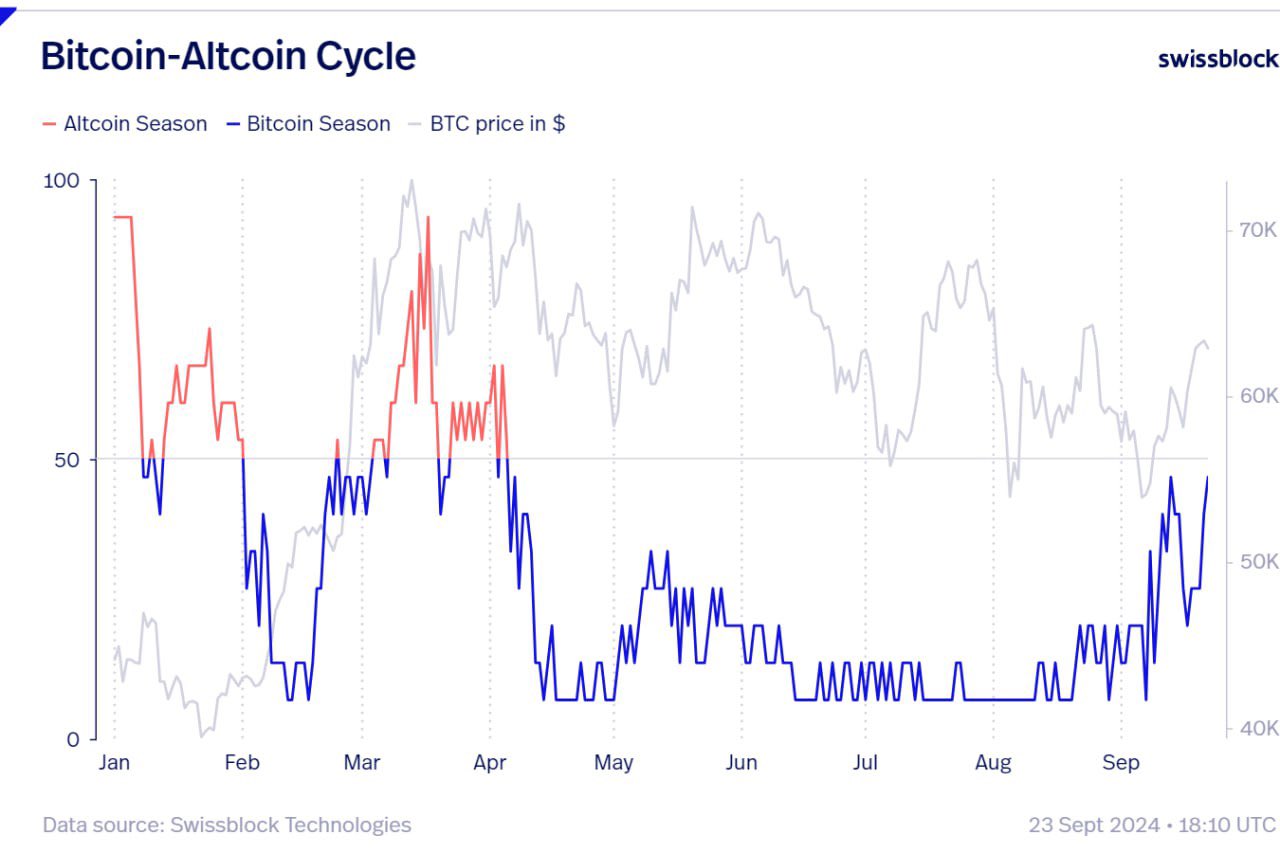

The co-founder of data platform Glassnode, known as Negentropic, commented that it appears we might be on the brink of an altcoin market surge. According to a chart from Swissblock called the Bitcoin-Altcoin Cycle, Negentropic points out that when Bitcoin surpasses its previous all-time high (ATH) and enters a period of price exploration, altcoins tend to follow suit afterward.

As a crypto investor, I’ve found that the Bitcoin-Altcoin Cycle chart illustrates the flip-flop between Bitcoin (BTC) and altcoins in terms of price movements throughout the year. When the chart shows a reading above 50, it suggests that we’re in an altcoin-driven market, where altcoins are leading the charge. Conversely, when the reading is below 50, it indicates that Bitcoin is taking the lead and dominating the market.

Even though these positive signs are present, it’s crucial for Ethereum (ETH), the leading altcoin, to regain its footing against Bitcoin (BTC) before investors start pouring money into mid-tier and smaller altcoins. As we mentioned earlier, the ETH/BTC exchange rate is at its lowest since April 2021 as of now. At the moment, Bitcoin is trading at $64,481, marking a 1.5% increase in the last 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-09-27 10:35