As a seasoned crypto investor with a knack for deciphering market trends and a portfolio that has weathered multiple bull and bear cycles, I find the recent developments surrounding Ethereum intriguing. The break above $2,600 is reminiscent of the early days of Bitcoin’s surge, a sight that always stirs excitement in my crypto-heart.

In simple terms, Ethereum, which is currently the second-largest digital currency in terms of market value, hasn’t been able to surpass the $3,000 mark since early August. However, from September onwards, its price has mainly stayed below $2,600. This week, though, Ethereum investors have a reason to be optimistic as it successfully breached the $2,600 barrier for the first time since then.

With the resistance barrier now shattered, we anticipate a sustained increase in price approaching the $3,000 mark. Insights from the CryptoQuant platform suggest a possible trigger for this upward momentum. Remarkably, this analysis highlights a growing bullish tendency in Ethereum’s funding rates as a crucial catalyst.

Bullish Shift In Funding Rates

Based on an analysis by ShayanBTC at CryptoQuant, which is affiliated with ETH, there’s been a modest yet discernible upward shift in Ethereum’s 30-day moving average of funding rates. This change indicates that traders are regaining their optimism about Ethereum’s price trend, particularly following the recent reduction in interest rates by the Fed.

The funding rates for ETH (Ethereum) signify recurring payments exchanged among traders to ensure the value of continuous future contracts aligns with the current price of the cryptocurrency. When the funding rate tilts positively, it usually suggests that long positions (bets on price increase) are more prevalent, which in turn can lead to an increase in price pressure.

The analyst underscored the significance of funding rates, given the potential for a strong fourth quarter of the year. Particularly, they suggested that for Ethereum to persist in its growth and reach higher price points, the interest in the perpetual futures market needs to persistently increase over the next few weeks. A slight drop in funding rates might lead to a decrease in bullish energy.

Ethereum Staging A Return To $3,000?

The surge past $2,600 by Ethereum could be a precursor to a significant change in market attitude towards it. Previously stuck below this price point for weeks, $2,600 now appears as a crucial support level for the cryptocurrency. Remarkably, this breakout paves the way for Ethereum’s reemergence at $3,000, and funding rates are expected to play a key role in this potential development.

Currently, Ethereum is being traded at $2,610 and has risen by 8% over the last week. It’s worth noting that this growth appears more pronounced when considering its lowest point on September 6 at $2,171, representing a significant 20% increase since then.

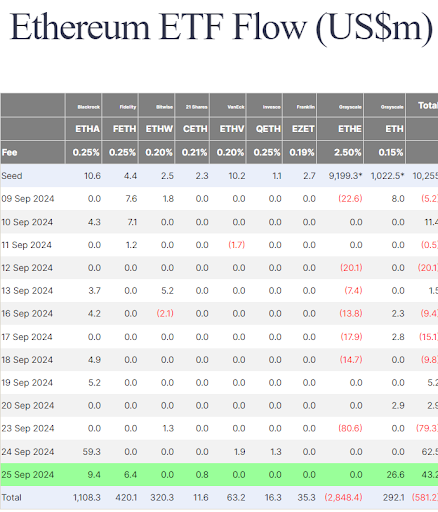

Institutional investors are increasingly showing optimism towards Ethereum, as indicated by the growth of Spot Ethereum ETFs. Initially seeing a net withdrawal of $79.3 million on Monday, these funds have since experienced inflows of approximately $62.5 million and $43.2 million on Tuesday and Wednesday respectively. These continuous investments could potentially help Ethereum surpass the $3,000 price mark and maintain it in the near future.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- POPCAT PREDICTION. POPCAT cryptocurrency

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

2024-09-27 01:34