As a seasoned analyst with over two decades of experience in the financial markets, I have seen many trends come and go. However, the current surge in Bitcoin ETF investments, particularly BlackRock’s IBIT, is something that catches my attention.

In contrast to the challenging circumstances surrounding US spot Bitcoin exchange-traded funds (ETFs), the popular adage “tough times don’t last” seems to hold true. This is evidenced by the recent trend of daily inflows into ETFs, marking five consecutive days as of Wednesday.

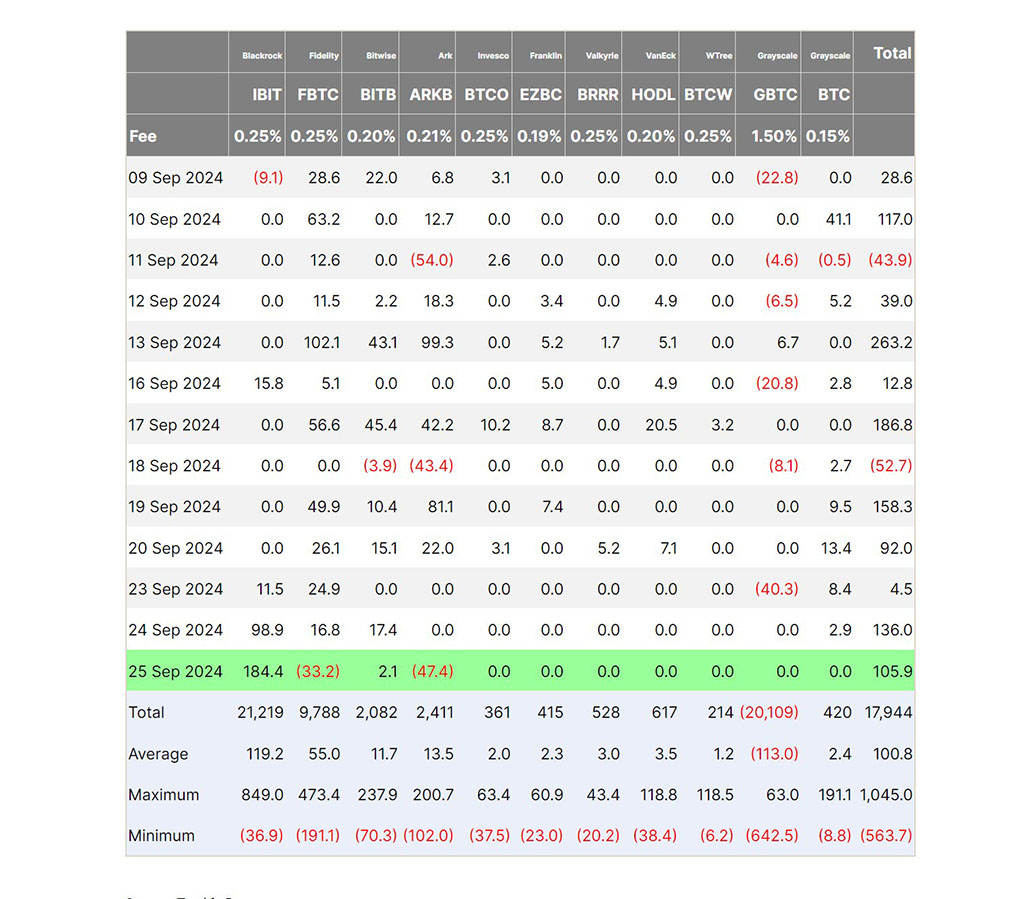

Based on figures provided by Farside Investors, it’s reported that these funds garnered a remarkable $106 million on that specific day. Notably, BlackRock’s iShares Bitcoin Trust (IBIT) appeared to be leading the market dynamics.

Source: Farside Investors

From the picture provided, it’s clear that the IBIT fund experienced a total investment of more than $184 million on that specific day, suggesting a strong inclination towards BlackRock’s investment product, as indicated by the apparent choices made by investors.

Overall, there’s been a significant increase in investor trust towards Bitcoin ETFs lately, even amidst volatile market conditions and regulatory challenges.

BlackRock Dominates, Other Bitcoin ETFs Show Mixed Results

It’s undeniable that BlackRock currently holds significant influence in this market, but for now, at least. While the IBIT fund of BlackRock remains bustling with activity and attracts growing attention from investors, other Bitcoin ETFs are not experiencing the same level of interest.

For example, on Wednesday, the Bitcoin ETF by Bitwise (BITB) saw approximately $2 million in fresh investments. This is significantly less compared to IBIT’s larger returns, but it’s important to note that BITB outperformed every other fund.

On that particular day, both Fidelity’s Bitcoin Fund (FBTC) and ARK Invest/21Shares’s Bitcoin ETF (ARKB) experienced significant withdrawals. A sum of approximately $33 million was withdrawn from Fidelity, while ARK Invest/21Shares witnessed an even larger withdrawal amounting to around $47 million.

On Wednesdays, every alternate Bitcoin ETF traded in the U.S. saw no new investments or withdrawals, a phenomenon not unique to any specific fund. Among these funds, the one that attracted the most attention was the Grayscale Bitcoin Trust, also known as GBTC.

Previously, GBTC was a dominant player in the Exchange Traded Fund (ETF) sector; however, it has since experienced a decline. Following its transformation from a trust into an ETF, investors have withdrawn more than $20 billion from the fund.

To provide some good news, the significant withdrawals seen from GBTC in the past have noticeably decreased over the last few weeks.

It seems like investors are gradually changing their investment choices, which could account for the differing performances among funds. BlackRock’s IBIT, in particular, is still attracting most of the new investments, while other ETFs are finding it challenging to match the rapid growth pace of a market that is leaning towards larger and more established funds.

This week, there was a total of $246 million in net investments flowing into U.S. Bitcoin ETFs. Therefore, it can be inferred that despite the recent fluctuations in the market, digital asset investments remain popular.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-09-26 10:42