As a seasoned researcher with over two decades of experience in the financial markets, I find the current state of Bitcoin’s Short-Term Holder (STH) MVRV Ratio particularly intriguing. The recent surge in the STH MVRV Ratio, as displayed by the graph, is reminiscent of a rollercoaster ride, with Bitcoin’s price recovery mirroring the ups and downs.

The latest on-chain data indicates that the Bitcoin Market Value to Realized Value (MVRV) Ratio for short-term investors is undergoing a retest, which might have a substantial impact on Bitcoin’s pricing.

Bitcoin STH MVRV Ratio Is Retesting Its 155-Day MA Right Now

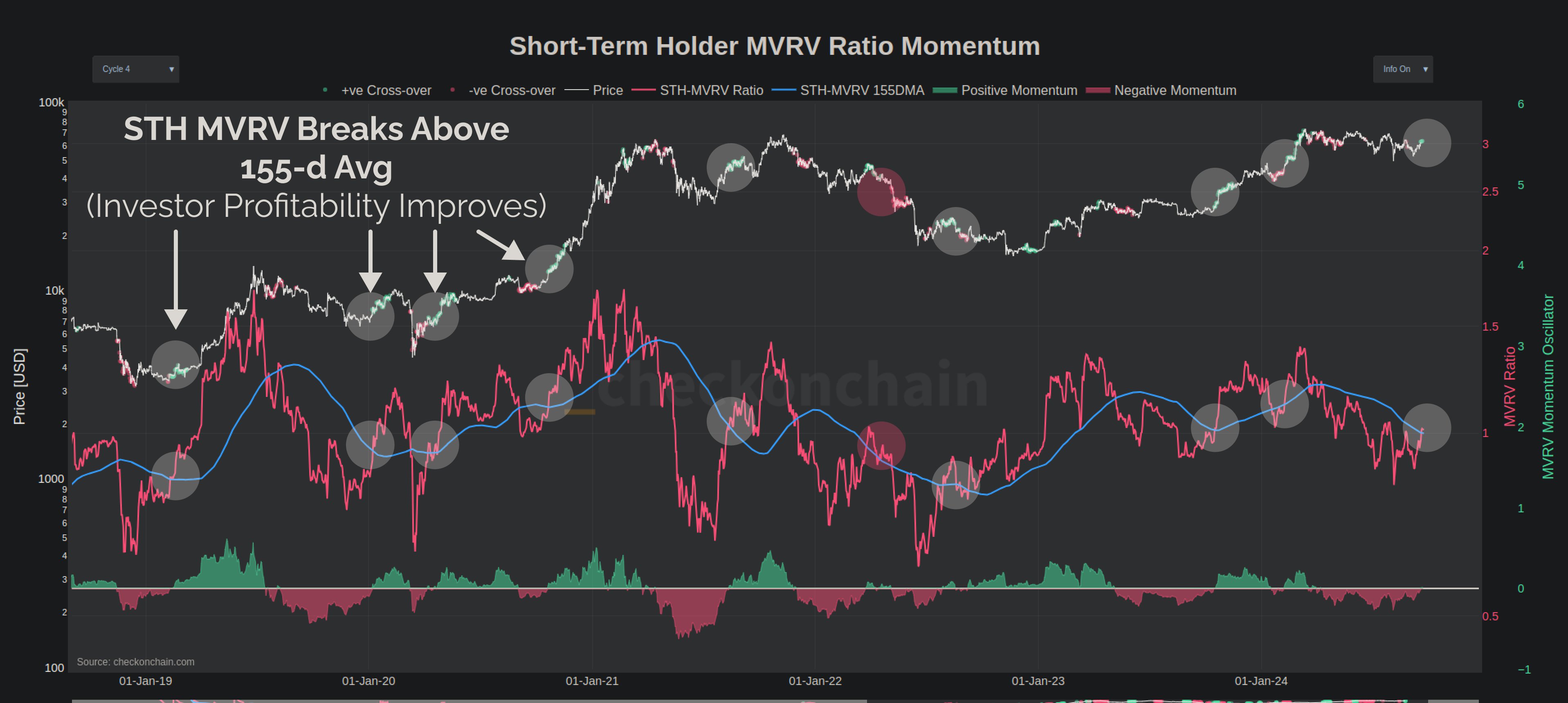

According to on-chain expert Checkmate’s latest piece on X, when the Short-Term Holder MVRV Ratio surpasses its 155-day moving average, it might signal a potential increase in Bitcoin’s price, suggesting a bullish trend.

The MVRV Ratio is a popular indicator that, in short, keeps track of how the value held by the BTC investors as a whole (that is, the market cap) compares against the value that they initially put in (the realized cap). When the value of this metric is greater than 1, it means the average address on the network can be assumed to be holding a net profit right now. On the other hand, it being under the threshold suggests the dominance of loss in the market.

In relation to our current discussion, we’re focusing on the MVRV Ratio of a particular group in the sector: the short-term holders (STHs). These are individuals who have recently purchased their assets within the past 155 days. By examining the MVRV Ratio for this group, we can gauge whether they’ve made a profit or suffered a loss over the last five months.

Now, here is a chart that shows the trend in the Bitcoin STH MVRV Ratio over the last few years:

In my analysis of the Bitcoin STH MVRV Ratio, I’ve noticed a significant rise recently, coinciding with the latest recovery rally in the cryptocurrency’s price. This spike has pushed the indicator slightly over 1, indicating that profitability has been reinstated within the cohort. However, what stands out more is its attempt to breach the 155-day moving average. As Checkmate suggests in the chart, Bitcoin tends to experience bullish momentum when the STH MVRR Ratio crosses above this particular line.

Previously, such a combination was observed in the indicator during the initial quarter of this year, which was subsequently followed by the coin reaching a fresh record peak (new all-time high).

If the STH MVRV Ratio surpasses its 155-day moving average, it could potentially trigger another bullish trend for BTC, possibly pushing prices towards a new all-time high (ATH) if we see a weekly closing price higher than the current record of $65.3k, as suggested by the analyst.

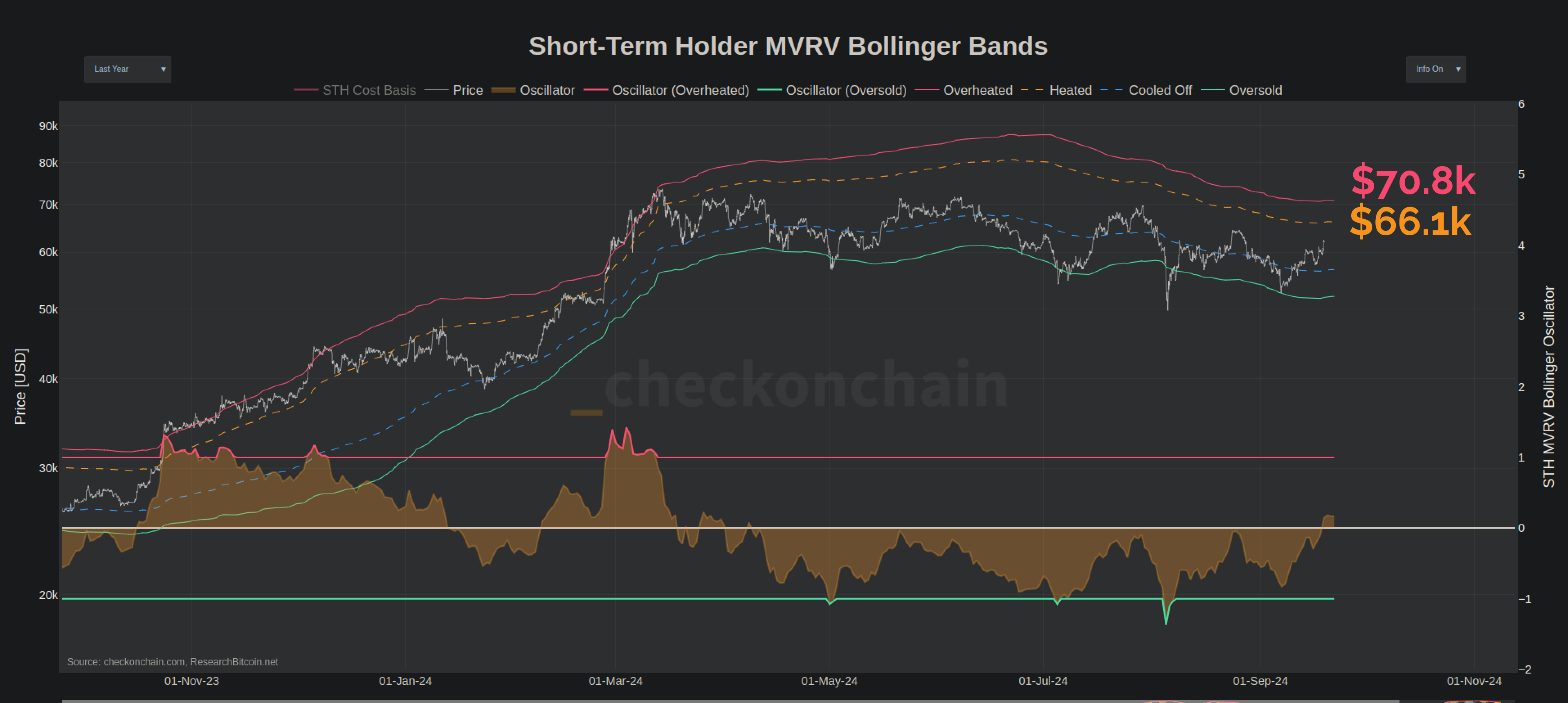

Keep in mind that as the price approaches the $66,100 to $70,800 zone, these less committed investors might decide to cash out their substantial gains. This is a potential area to be cautious about.

BTC Price

Over the course of the last seven days, I’ve observed a noteworthy surge of approximately 8% in the value of Bitcoin. This upward trend has propelled its current price to an impressive level of around $63,700.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- Fear of God Releases ESSENTIALS Summer 2025 Collection

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Gold Rate Forecast

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

2024-09-25 03:40