As a seasoned researcher with years of experience in the crypto market, I have seen my fair share of bull runs and bear markets. The current upward trend of Solana (SOL) is certainly one to watch, especially after its impressive surge above the $150 resistance level.

currently, Solana’s price appears to be finding stability around the $140 level. There’s an indication that the price could climb higher, potentially surpassing its previous resistance at approximately $152.

-

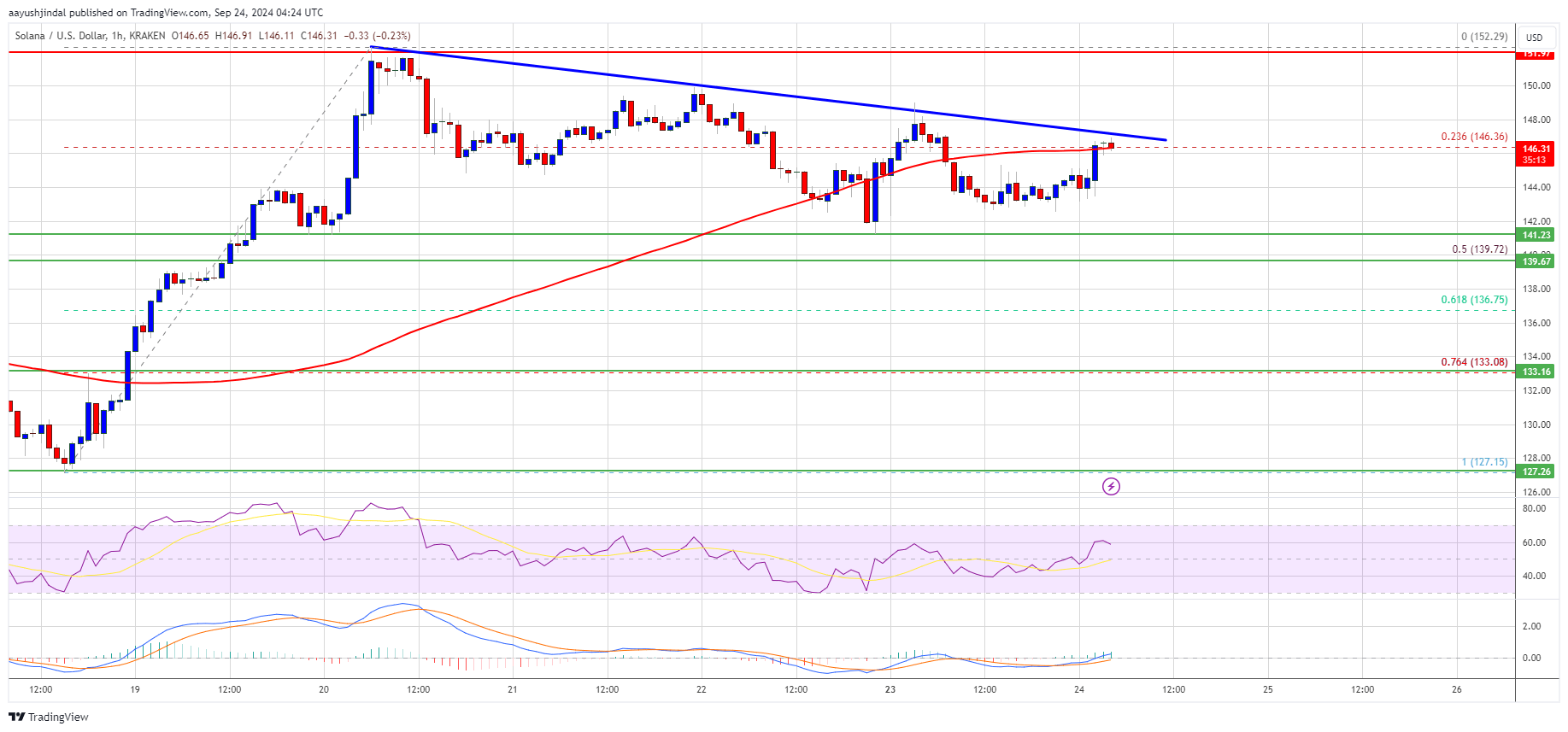

SOL price started a fresh increase from the $142 zone against the US Dollar.

The price is now trading near $1465 and the 100-hourly simple moving average.

There is a connecting bearish trend line forming with resistance at $148 on the hourly chart of the SOL/USD pair (data source from Kraken).

The pair could gain bullish momentum if it clears the $152 resistance zone.

Solana Price Eyes Fresh Surge

The price of Solana surpassed the $142 barrier, much like Bitcoin and Ethereum, and reached beyond $150. However, this upward trend was briefly interrupted by bears, who caused a peak at $152. Since then, there’s been a decline in Solana’s price.

The price dropped beneath both the $148 and $145 thresholds and fell below the 23.6% Fibonacci retracement line, which marks a significant level following the upward trend from the $127 trough to the $152 peak. Yet, it’s worth noting that the bulls exhibited notable activity around the $142 support area.

The price is stable above the 50% Fib retracement level of the upward move from the $127 swing low to the $152 high. Solana is now trading near $146 and the 100-hourly simple moving average.

On the positive side, the cost appears to be encountering resistance around $148. Additionally, a downward-sloping bearish trend line seems to be forming at the same $148 level on the hourly chart of the SOL/USD pair. The next significant resistance lies approximately at $152.

If the trade is closed above $150 and $152, it may signal a continuous upward trend. The next significant resistance can be found around $164, and further growth could potentially push the price towards $172.

Another Decline in SOL?

Should SOL not manage to surpass the $148 barrier, a potential drop may ensue. A preliminary floor might be found around $144. The primary foundation lies roughly at the $142 mark.

Dropping beneath the $142 mark could potentially push the price down towards the $134 region. Should the closing price fall below the $134 resistance level, it might lead to a short-term drop towards the $128 support.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $142 and $134.

Major Resistance Levels – $148 and $152.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-09-24 11:10