As a seasoned analyst with over two decades of experience in the financial markets, I find myself constantly intrigued by the dynamic nature of cryptocurrencies. The recent performance of Ether outpacing Bitcoin, despite a largely stagnant broader market, is a testament to the resilience and potential of this digital asset class.

Ether (ETH) has surpassed Bitcoin (BTC) in daily gains, possibly due to the conclusion of two significant crypto events: Token 2049 and Solana’s Breakpoint, which took place in Singapore on September 22, 2024. While both cryptocurrencies saw minor growth spurts, the overall market remained relatively stable, reflecting ongoing apprehension.

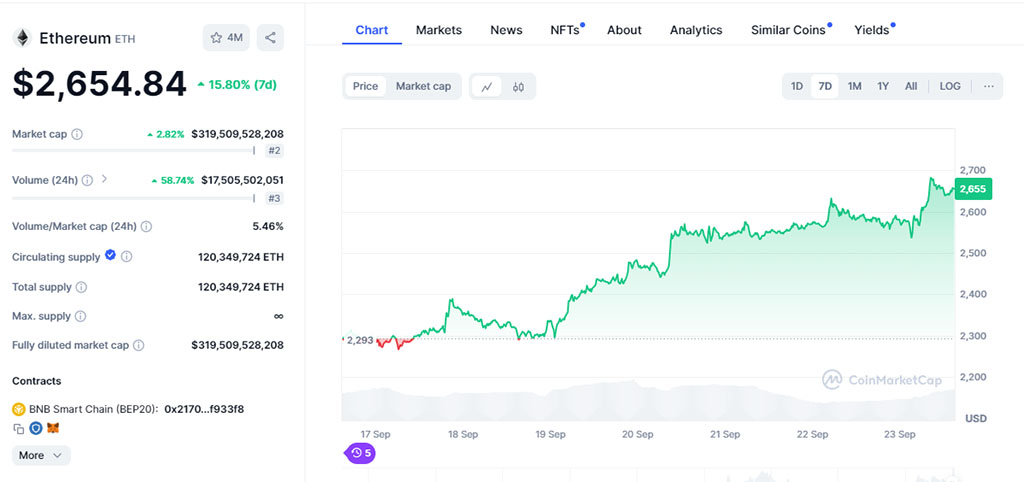

Source: CoinMarketCap

In the past day, Ethereum experienced a 3.10% increase, reaching beyond $2,650, while Bitcoin saw a 1.46% rise to $63,630, according to CoinMarketCap. Worth noting is that Ether has seen a substantial surge of 15.80% in the last week, indicating a strong recovery from its downward trend over the past month. On September 6th, it touched an impressive $21,700 mark, but then declined by more than 18% as of September 23.

Liquidations Surge as Rate Cut Speculation Grows

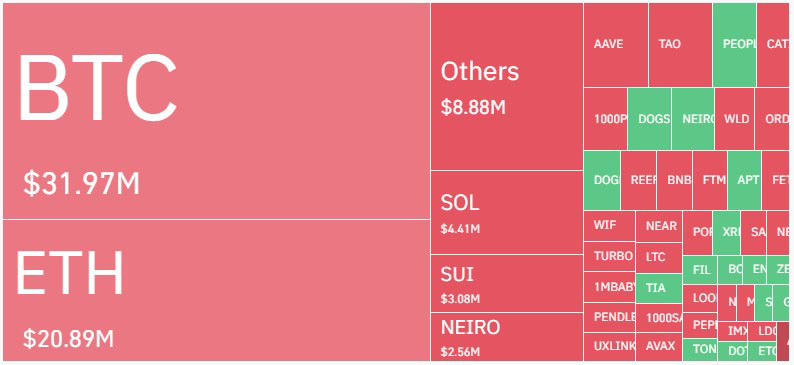

Over the final 12 hours before September 23rd, data from CoinGlass showed more short positions being closed than long ones. Specifically, there were $64.89 million in short liquidations compared to $31.61 million in long liquidations. This suggests a turbulent trading period, possibly influenced by the 50 basis point (bps) interest rate reduction from last week, which seems to have spurred heightened trading activity.

Source: CoinGlass

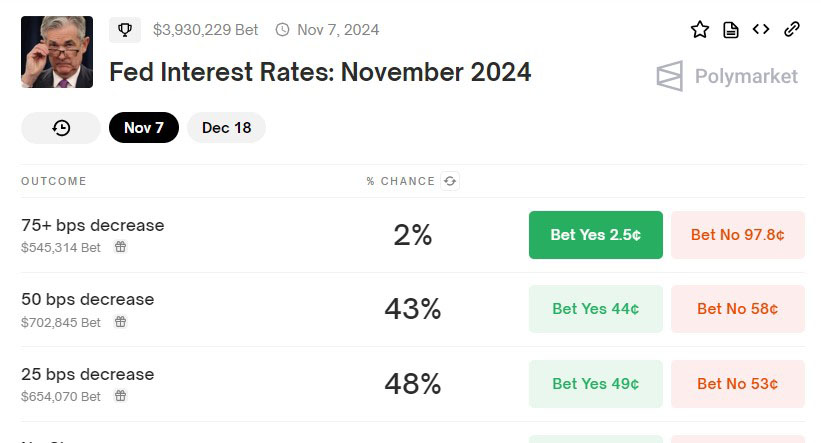

There’s a lot of discussion among market players about the possibility of another interest rate decrease. According to Polymarket, opinions are divided: around 43% think the cut could be 0.5 percentage points, while approximately 48% believe it might only be 0.25 percentage points.

Source: Polymarket

The cryptocurrency Solana (SOL), prominent at the Breakpoint conference post-Token 2049, held steady around $145, despite no significant price fluctuations within the last 24 hours. Excitement was palpable, especially with announcements like Jump Crypto’s validator becoming operational. However, Solana has yet to experience the price surge that followed Ethereum’s rise.

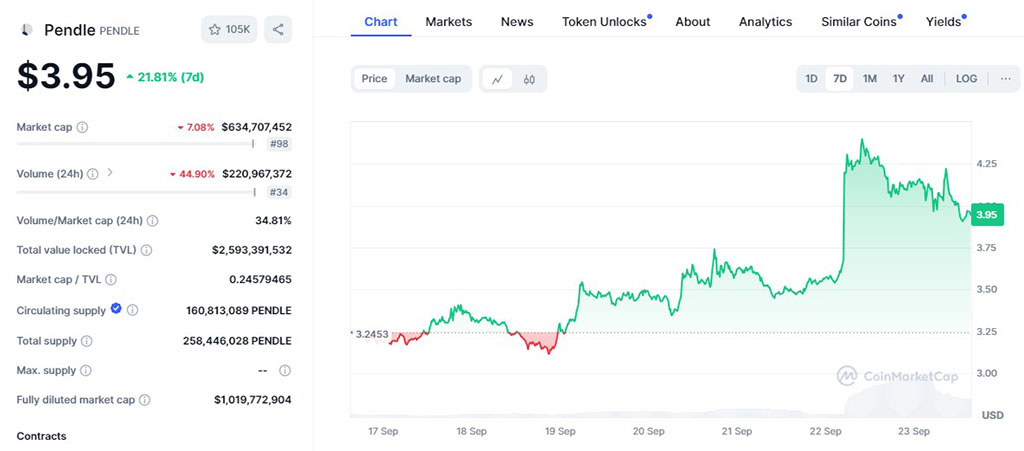

Crypto Trading Remains Cautious Post Rate Cut

As a crypto investor, I’ve noticed a significant drop of around 6.25% in the value of my Pendle holdings. This seems to be due to traders becoming more cautious following news that Arthur Hayes’ Maelstrom fund has decided to reduce its holdings. Hayes hinted at this move being made to create more liquidity for a “special situation,” but specifics are still shrouded in mystery. However, despite this temporary setback, Pendle has managed to rally and increase its value by 21.81% over the past week.

Source: CoinMarketCap

Unlike other coins, MOTHER, a meme-based token endorsed by Iggy Azalea, saw a 4% increase after she announced her intention to establish an online casino called Motherland. While the value of the meme coin has generally remained consistent, it encounters hurdles when trying to get listed on significant exchanges because of the regulatory complexities associated with gambling businesses.

In essence, the crypto market is experiencing a calm period, showing slight increases in Bitcoin and Ether without any major changes in investor sentiment. With ongoing interest rate adjustments impacting the market and initiatives like Solana and Pendle gearing up for new advancements, traders are adopting a cautious stance amidst this slow-moving phase.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- POPCAT PREDICTION. POPCAT cryptocurrency

2024-09-23 16:13