As a seasoned crypto investor with a decade of experience under my belt, I must say that the current surge in Tether (USDT) is truly a sight to behold. Having witnessed several bull and bear markets, I can confidently assert that this growth is not just a fleeting trend but a testament to the maturing crypto industry.

Tether (USDT), the world’s leading stablecoin and third largest digital currency by market capitalization, has solidified its position in the cryptocurrency sector and is on the verge of reaching a notable achievement. In the last week alone, there has been a substantial increase in investment into the crypto industry, with approximately $1 billion being funneled into stablecoins.

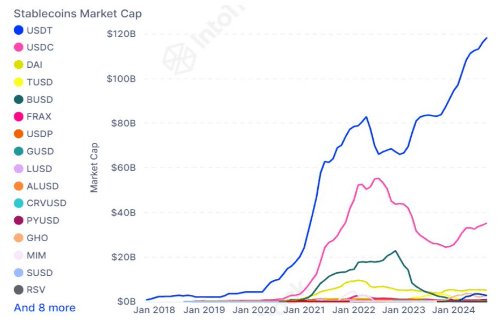

Indeed, the majority of this incoming flow has been directed towards Tether (USDT), moving it nearer to an unparalleled market capitalization figure of approximately $120 billion.

Tether (USDT) Leads The Stablecoin Market

As a crypto investor, I’ve noticed that stablecoins have emerged as one of the most innovative applications of blockchain technology. Initially used for trading other cryptocurrencies, they’re now increasingly being employed in lending platforms and transactions for goods and services. This year alone, the stablecoin market has experienced unprecedented growth, primarily fueled by a surge of investments into the crypto industry. This influx of capital has significantly boosted their adoption.

Information from IntoTheBlock indicates that the stablecoin market’s overall value was approximately $122 billion in October 2023. Since then, a surge in prices (bull run) has boosted the total market value to over $169 billion by September 2024, which is a significant increase of around 38.5%. Additionally, data reveals that the inflow has experienced a modest growth of about 1.71% compared to the previous month.

Leading the way in the stablecoin sector is Tether, holding the majority of the market capitalization. At present, Tether’s market cap hovers around $119 billion, a figure that continues to grow as more funds flow into this type of digital currency. Notably, Tether accounts for approximately 70.4% of the entire stablecoin market. USDC, the second most significant player in the stablecoin world, currently has a market cap of about $35.88 billion.

The primary cause of this expansion has been USDT’s consistent link to the U.S. dollar‘s value since its inception, which makes it a popular choice for traders who require stability during financial upheavals.

What Lies Ahead For Tether And Stablecoins?

The increase in investment towards stablecoins indicates a rising curiosity about secure digital assets, particularly amid worries over inflation and the devaluation of traditional currencies in less developed nations. Given this trend, it’s expected that Tether’s influence within the stablecoin market will continue to expand.

Just last week, the Tether Treasury minted $1 billion USDT on the Ethereum blockchain and another $100 million USDT on the Tron blockchain.

It’s worth noting that less capitalized stablecoins, including First Digital USD (FDUSD), have also been experiencing a rise in popularity due to the increased interest in stablecoins. In fact, the market cap of FDUSD has grown by 47% over the past month and now amounts to $2.94 billion.

Contributing further to this growing trend is Ripple, the organization behind XRP. Ripple has unveiled intentions to venture into the stablecoin market with its Ripple USD (RUSD) digital currency. Their aim is to link global financial entities and institutions through this new offering. Given Ripple’s strong foothold in the international banking sector, anticipation for RUSD’s growth is high following its release.

Read More

2024-09-23 12:47