As a seasoned analyst with over two decades of market analysis under my belt, I have seen trends rise and fall like waves upon the shore. The latest Bitcoin surge following the Federal Reserve’s rate cut announcement is reminiscent of a bull charging headlong into battle, breaking through barriers and leaving naysayers in its wake.

Since Tuesday, Bitcoin‘s price has experienced a considerable increase, largely due to the Federal Reserve’s decision to reduce interest rates by 50 basis points. This action propelled BTC above the significant $62,000 threshold, a level that often triggers shifts in investor confidence. Now, as Bitcoin is probing this local supply, market players are keenly observing for any signs of additional price growth potential.

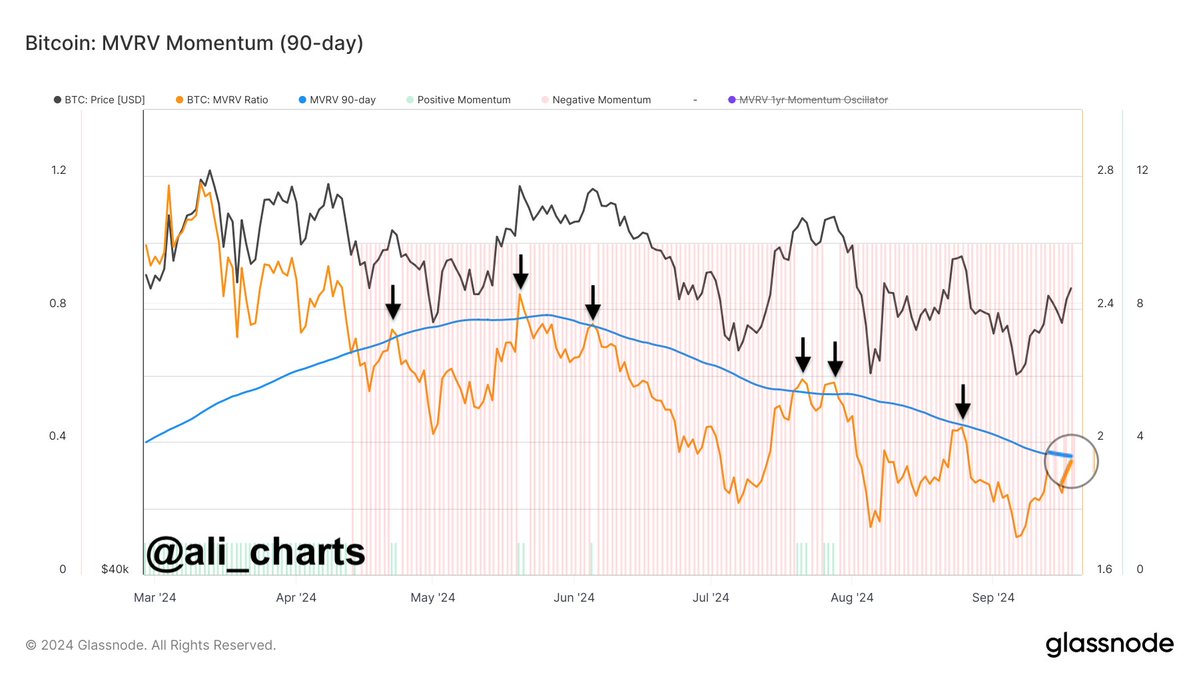

With prices climbing steadily, experts are highlighting significant data that suggests a possible change in Bitcoin’s trend following months of decreasing prices. Data from Glassnode indicates a shift in trends, implying that Bitcoin could be moving into a bullish phase again. This renewed interest has caught the eye of both individual and institutional investors who are now assessing whether Bitcoin’s growth will sustain or if it might encounter resistance at higher price levels.

In the upcoming period, it’s crucial to see whether Bitcoin can maintain its current uptrend and definitively exit its past pessimistic trend.

Bitcoin Signals A Bullish Return

In recent days, the mood among Bitcoin investors has changed drastically from apprehensive to enthusiastic. The Federal Reserve’s rate cut announcement on Wednesday triggered a 8% surge in Bitcoin, breaching significant barriers and probing local resistance. This swift market action has ignited fresh optimism across the cryptocurrency sector, offering investors renewed hope for a turnaround after prolonged bearish trends in pricing.

Crypto expert Ali Martinez offers insightful analysis on X, emphasizing crucial data from Glassnode that hints at a major change in Bitcoin’s pricing pattern. More specifically, he underscores the Market Value to Realized Value (MVRV) ratio, which measures the gap between Bitcoin’s current market price and its inherent worth.

In simpler terms, the MVRM ratio (Market Value to Realized Value), which had been decreasing since April, is now on an uptick, suggesting that Bitcoin might be gaining back its power. Ali points out that this MVRM ratio is crucial for determining market momentum, and this recent increase suggests a possible move towards optimistic conditions.

The analyst goes on to clarify that if the MVRV (Market Value to Realized Value) ratio manages to surpass its 90-day moving average, it would suggest a more robust bullish prediction for Bitcoin. With the recent steep price increase and rising interest indicated by current market activity, this situation appears to be growing in probability. As such, investors are becoming increasingly attentive, as Bitcoin’s upcoming movements could potentially initiate a new period of growth.

Technical Levels To Watch

Currently, Bitcoin (BTC) stands at approximately $63,024, surging following consecutive days of upward price trends since it touched local bottoms. Lately, its value has breached the daily 200 exponential moving average (EMA) at $59,350 and is now attempting to cross the significant daily 200 moving average (MA) at around $63,954.

Each day, the 200 Moving Average functions as a crucial long-term marker, indicating the general robustness of the market. Should Bitcoin manage to regain this level as a foundation, it is anticipated to spark a substantial price increase, thereby strengthening the optimistic perspective on its future trends.

If bitcoin continues its upward trend, it could potentially reach a significant point near the current level, possibly pushing further up to $65,000 – a price not seen since late August. But if Bitcoin can’t sustain itself above $60,000 in the near future, we might witness a pullback to less active buying zones. Whether it manages to stay above crucial support areas will shape the next stage of its price movement.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2024-09-21 19:16