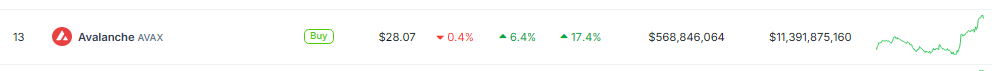

As a seasoned crypto investor with a knack for spotting undervalued gems, I’ve been closely watching Avalanche (AVAX) for quite some time now. With its impressive 17% surge over the past week and a current trading price of $28.12, it’s hard not to notice this cryptocurrency on the rise. The recent Federal Reserve’s decision to lower interest rates seems to have given AVAX a significant boost, but I believe there’s more to it than just macroeconomic factors.

Over the last seven days, Avalanche (AVAX) has experienced a surge in its value, rising by 17%. Recently, this cryptocurrency has been experiencing a series of victories. Currently, it is being traded at $28.12, marking an increase of 7% just within the past 24 hours. This sudden uptick aligns with a broader recovery in the crypto market, which seems to be influenced by a major change in the US financial system: the Federal Reserve’s choice to reduce interest rates.

On September 18th, the Federal Reserve reduced interest rates by 0.50%, setting a new range of 4.75% – 5%. This move, aimed at reducing inflation and promoting economic growth, marks the first such adjustment in four years.

Despite being expected, the market turbulence following the cut was significant in both traditional and digital currency sectors. Among them, AVAX emerged as one of the top performers. Currently, AVAX’s future price predictions remain optimistic. Given that it is currently trading at 227% below its projected value for next month, a substantial increase might be imminent.

DeFi Powerhouse In The Making

The current price increase goes beyond simply macroeconomic considerations. As it keeps increasing its total value locked (TVL), Avalanche is also making great strides in the decentralize finance (DeFi) department.

From 28.1 million AVAX in Q1 to 30.8 million AVAX in Q2, Avalanche’s TVL has climbed by 11% in recent months, data from DeFiLlama shows. The TVL across all protocols on the network as of September 18 stood at 38.63 million AVAX.

Assessing the activity and fluidity within Decentralized Finance (DeFi) networks is heavily reliant on Total Value Locked (TVL). A higher TVL often signifies that more individuals are securing their assets in DeFi systems, which could lead to improved price stability and potential long-term growth for AVAX.

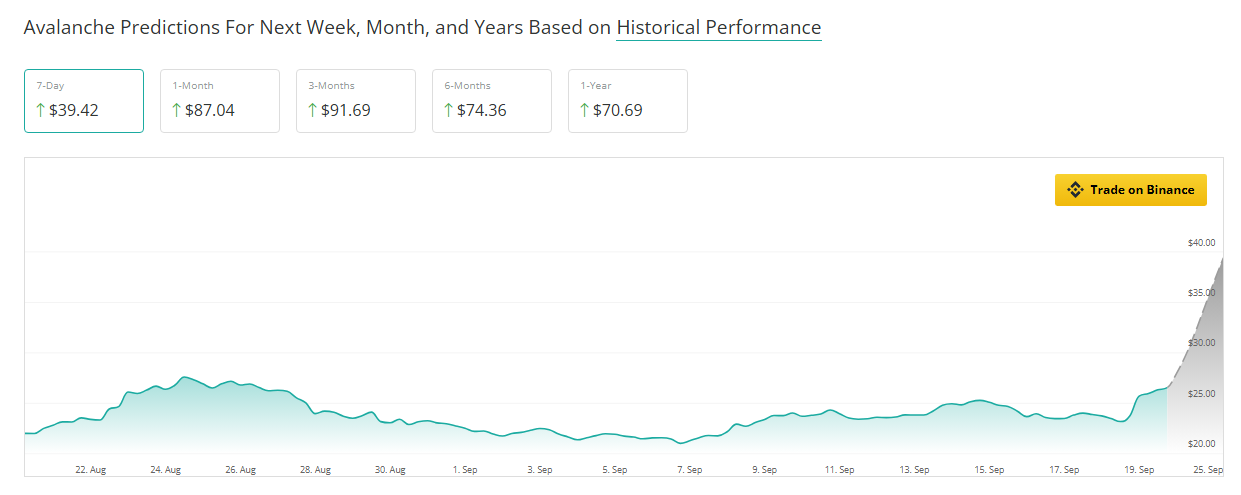

AVAX Projections: Short-Term/Long-Term

As a researcher delving into the world of cryptocurrencies, I am excited to share my analysis on Avalanche (AVAX). The technical indicators suggest a promising trajectory for this token. The substantial accumulation and escalating market sentiment are strong signs that the token could surge by approximately 245% within the next three months. Looking further ahead, analysts predict a 180.19% increase in value six months from now. Over the course of the next year, a further rise of about 166.37% is anticipated.

As Avalanche gains more popularity within its DeFi scene and the broader cryptocurrency market, these predictions point towards a promising month ahead.

Fed’s Influence

As a researcher, I’ve noticed that the recent rate decrease by the Federal Reserve has ignited a robust market momentum. However, some experts speculate that this impact might be transient. The duration of this surge remains uncertain, but historically, risk assets like cryptocurrencies tend to respond dramatically to adjustments in interest rates. Interestingly, with approximately half of AVAX holdings currently showing profits, investor sentiment appears optimistic.

All eyes are on the token’s ability to shatter important resistance levels as Avalanche gains traction in the DeFi market. Should the state of the market remain positive, AVAX may be en route to both long-term and short term growth.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2024-09-21 05:46